The Most Popular Group Health Insurance Program Is…(not what you would expect)

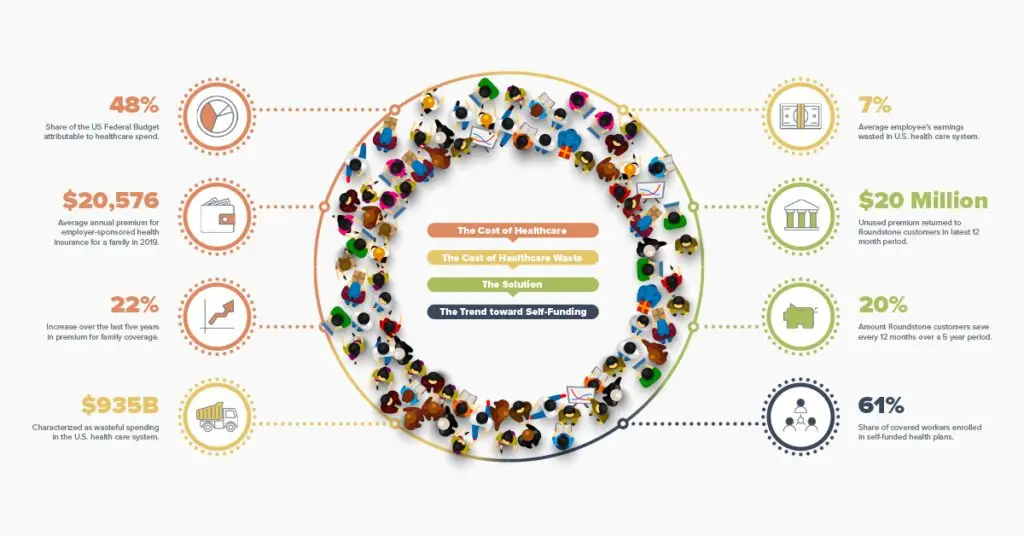

61% of covered workers are now participating in self-funded plans, including 50% of firms with 200-999 employees.

Why is self-funding the trend?

Simply put: It saves you money. Health insurance premiums continue to rise, information as to why is limited and you may feel like you do not have any choice or control. Roundstone understands the challenge, and has gathered some key information so you can start to think about your healthcare as an opportunity to reduce waste and realize significant savings over the long term.

The Cost of Healthcare

The average premium for family coverage has increased 22% over the last five years and 54% over the last ten years, significantly outpacing workers’ wages or inflation. According to “KFF 2019 Employer Health Benefits Survey”, the average annual premium for group health insurance plans for a family in 2019 was $20,576. $7,188 was the average for an individual.

Let’s look at these healthcare spending costs in terms of “waste”. Accordingly to the Journal of American Medicine, approximately 25% of spending in the U.S. health care system can be characterized as waste. That’s between $760 billion and $935 billion annually. Research projects that a significant reduction in the cost of health benefits is achievable through transparency and a focused effort to reduce “waste.” All told, about 7% of the average employee’s earnings go toward waste in the healthcare system, based on aggregated case studies in a recent report from Johns Hopkins University.

So why Self-Funding?

The traditional insurance model simply does not help employers optimize their plan. Self-funding through Roundstone empowers employers with transparency and control. It allows them to improve their selections each year, and ultimately leads to even greater long-term savings. Self-funding means the employer pays for only claims incurred and not a set premium that often exceeds actual costs. Self-funded health plans enable an employer to take control of their spend through transparency in claims data to help identify health benefit cost savings opportunities. The advantage of actively managing spend to employ cost containment strategies far outweighs the risk. Plus, employees are provided a quality level of care typically at a lower cost—promoting the attraction and retention of top talent. Self-funding is growing in popularity and increasingly recognized as the most efficient funding method available for health care benefits for companies of all sizes.

The majority of Roundstone customers save 20% in costs over five years. That means they save enough money in their first 5 years to fully pay for an additional year of coverage.

Self-funding saves money and the proof is in the numbers. That’s why self-funding is on the rise, with 61% of covered workers now enrolled in self-funded plans!