Highlights

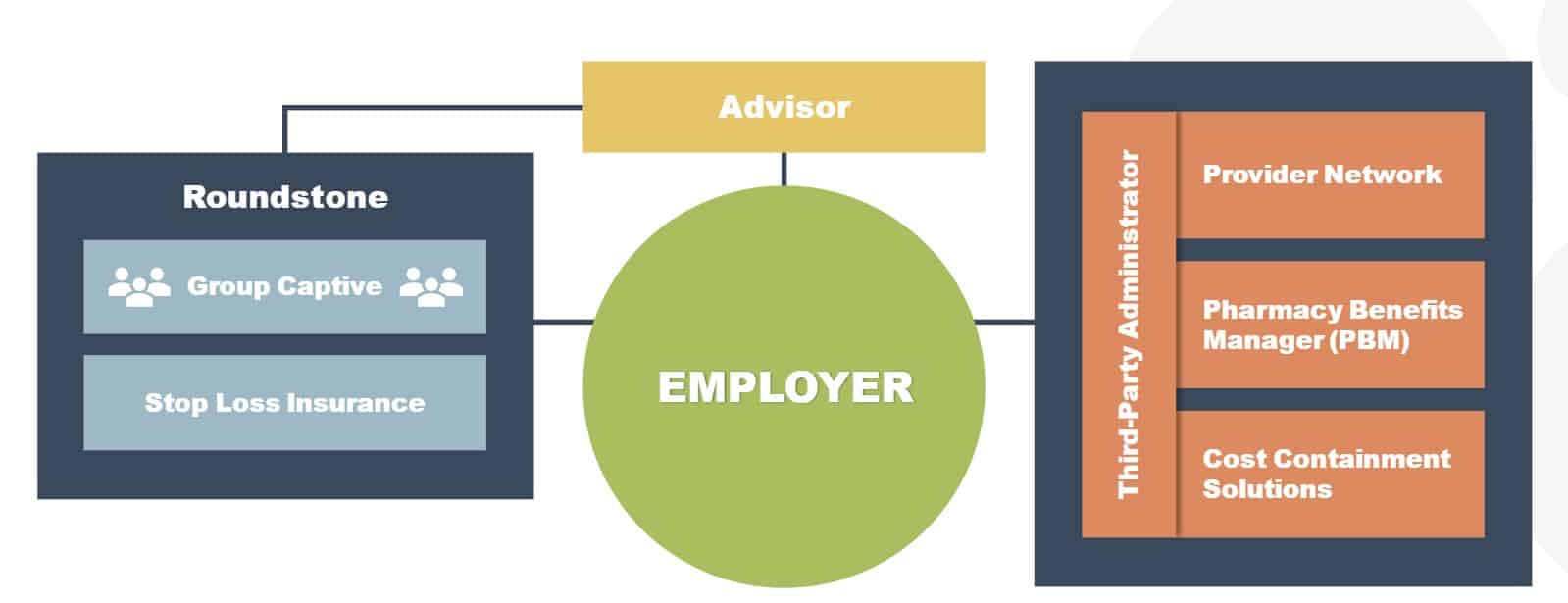

- Self-funded health plans are managed by a Third-Party Administrator (TPA) along with your benefits advisor and other key players, including the Stop-Loss Insurance Carrier and Pharmacy Benefit Manager (PBM).

- Every employer who self-insures receives seamless support from these organizations to implement and administer the plan, manage and pay claims, optimize plan utilization, and analyze and contain costs.

- With a self-funded plan, you also have transparent data access, allowing you to understand how your plan is performing and identify areas for cost savings.

- Roundstone’s team and partnerships with all solution providers ensure you have the resources and guidance you need for a great member experience.

Self-funded health plans, or self-insured plans, are an alternative to traditional employer-sponsored health insurance.

Self-funding means the employer retains control and responsibility for employees’ healthcare benefits. And the captive model means that the employer becomes part of a shared risk healthcare community. It’s a great option for businesses with 20-1000 employees because as part of the captive community, they can purchase health benefits like a much bigger company.

In the group captive model, you only pay for what you use. Most costs (85%) are variable, so you have a lot more control over benefit design and cost saving measures. This is important because you can save money from your own claims account if it’s unused, plus you can save money from the captive pool if the captive runs well. Each captive participant receives a distribution back pro rata at the end of the year.

Last year, we distributed $24.4 million back to participant companies in the captive. Everyone likes getting a check instead of a big increase. As you can see, the captive acts as a protective layer and removes volatility from the equation. Even if you have a bad year, which everyone does at one time or another, the captive can still perform well and you will benefit from that stability.

Self-funded employee benefits plans give employers more control over healthcare costs and greater flexibility in designing benefit packages. Understanding the components and players involved in self-funded plans lets you make accurate decisions regarding plan design and cost management strategies for maximum benefits optimization.

We discussed this topic during a recent webinar with a panel of experts who offered their insights on how self-funding works and how all the pieces fit together. It was a great episode, and you can watch it on-demand at any time.

Who’s Who in a Self-Funded Health Plan

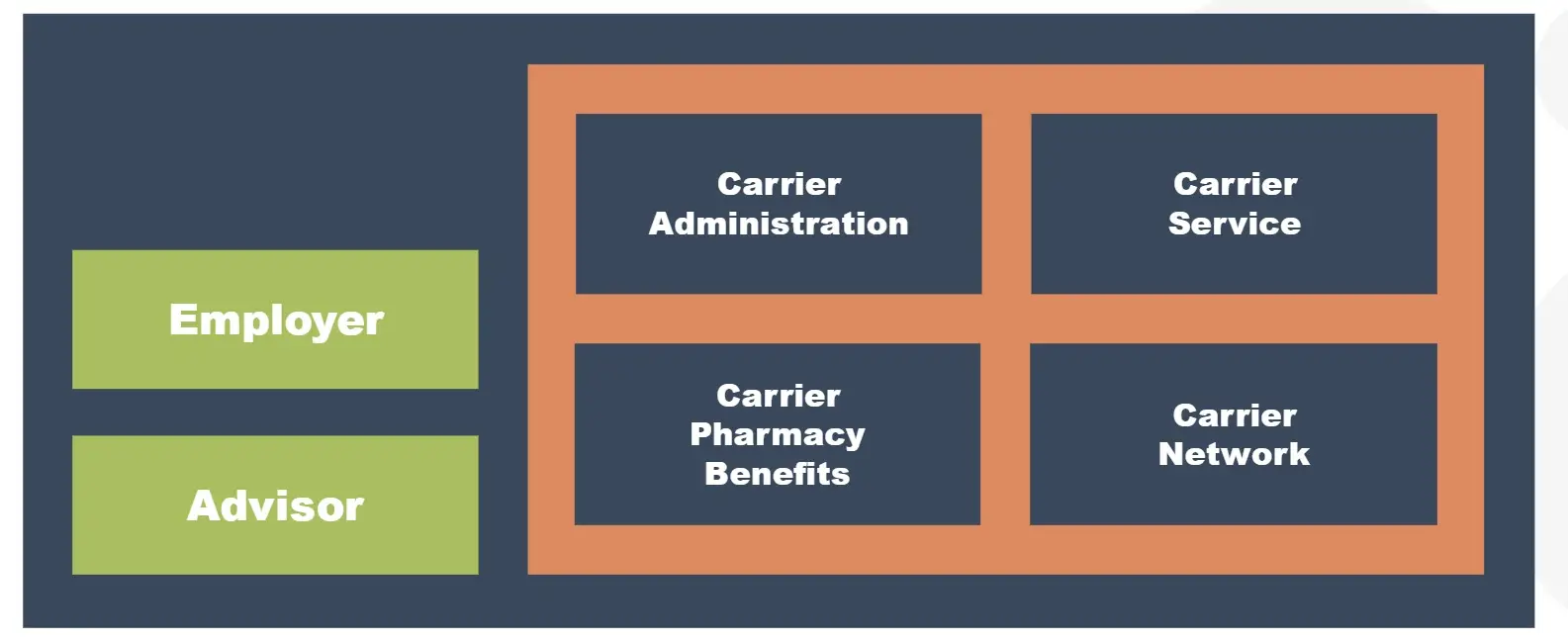

Fully insured plans rely on carriers like the BUCAs (Blue Cross Blue Shield, United Healthcare, Cigna, Aetna) to handle all aspects of the plan. While these plans provide predictability in terms of a fixed monthly premium, they lack data transparency and offer little ability to control costs or enjoy flexibility in plan design.

Self-funding, on the other hand, is an employer-centric solution. Everyone involved is there and aligned around the best interests of that employer: Benefits Advisor, Roundstone, Third Party Administrators (TPAs), and Pharmacy Benefit Managers (PBMs), providing more control and customization options.

Without transparent data access, fully insured plans can hinder long-term cost control and access to quality care. Self-insurance addresses these limitations by focusing on employers’ needs and collaborating with solution providers.

The Advisor’s Role in Designing Your Self-Funded Plan

Choosing the right advisor is crucial when implementing self-funded health plans. An effective advisor exhibits traits like collaboration, advocacy, and a long-term perspective.

They work closely with employers, understanding their unique employee needs and financial goals. A dependable advisor advocates for cost control and the delivery of quality care, ensuring employers get the best of both worlds.

By challenging the existing norms and status quo, advisors set themselves apart. They bring innovative solutions to the table, leveraging their expertise to navigate complex healthcare landscapes, improve outcomes, and prioritize employee well-being.

Finding a trusted advisor who can guide you toward optimal health plan choices can help you save money and help you design a plan that fits your company’s budget and benefit needs.

Roundstone’s Role in Self-Funded Health Insurance Plans

Roundstone underwrites and manages the risk and provides the stop-loss insurance for catastrophic coverage for employers self-funding in our group captive.

Roundstone is different from other stop-loss carriers in that we manage the group captive and we provide employer-centric customer service throughout. It’s important to note that Roundstone provides personalized service and attention for advisors, too. We help to ensure success and are always aligned with the employer’s best interests. This is our North Star.

The Roundstone Captive enables companies to self-insure safely. With its three-tiered model, you pay for healthcare costs up to a specific deductible, you share some costs above that deductible across a pool of hundreds of other employers in the captive, and finally, you shift costs to a stop-loss carrier to cover catastrophic claims. Stop-loss insurance safeguards employers from catastrophic claims and unexpected medical expenses, mitigating the risk associated with self-funded plans for SMBs.

The captive, with its thousands of lives, acts as an additional protective layer that absorbs risk, reduces stop-loss fixed costs, and gives smaller companies the advantages of self-insuring like the Fortune 500s.

Roundstone thoroughly vets and selects best-in-class solution providers to ensure quality services for employers and their employees. This includes engaging with experienced advisors, TPAs, and PBMs who offer expertise in claims processing, network selection, cost containment strategies, and customer service.

Our support team, including client managers, relationship managers, nurses, cost containment consultants, customer service, and claims teams, assist employers in the cost optimization of their health plans. Bringing all the components together, we offer a turnkey solution for small to midsize businesses like yours, ensuring smooth operations and optimal outcomes.

A wealth of information, our Roundstone University can be extremely helpful in explaining the best practices to utilize your self-funded health insurance plan to deliver optimal savings and the best care for your employees. The self-guided courses will walk you through the basics of self-funding, how to choose a TPA to help implement the plan, and how to budget and save for your plan.

The Vital Role of TPAs and PBMs

TPAs and PBMs are essential components of self-funded plans. TPAs manage and administer your plan benefits, while a PBM helps you manage prescription drug benefits, potentially lowering your pharmacy costs.

Third Party Administrators — TPAs

TPAs act as the face of your health insurance plan to employees. They are the primary point of contact for addressing queries, clarifying policy details, and assisting with claims processing.

The TPA’s role is to deliver an efficient plan document as well as closely review claims for accuracy and plan compliance. The TPA’s priorities and goals should be suitably aligned with the employer’s objective of providing affordable, high-quality healthcare for employees.

A TPA’s professionalism and responsiveness impact employees’ overall satisfaction with their health insurance coverage. Choosing a TPA with a fast response time and excellent customer service is necessary for a successful self-funded plan.

You should also consider geographical factors and network selection when choosing a TPA. A TPA with a wide network of healthcare providers can ensure employees have convenient access to quality healthcare services, regardless of location. This geographical coverage is crucial in providing comprehensive healthcare benefits to employees.

Pharmacy Benefit Managers — PBMs

Pharmacy Benefit Managers specialize in managing prescription drug benefits, negotiating contracts with pharmacies, and ensuring cost-effective medication options for employees. TPAs collaborate with PBMs to incorporate prescription drug coverage into the health insurance plan. A good PBM will pay close attention to specialty drugs and manage them closely to help save costs.

When selecting a PBM for your self-funded insurance plan, look for a pass-through or transparent structure. Review your PBM’s contract carefully to ensure favorable terms and conditions, such as rebates or low fees that enable cost mitigation of pharmacy expenses. Also, choose a PBM with a network of pharmacies that offer your employees convenient access to easily obtain their prescriptions.

Traditional PBMs under fully insured plans are notorious for charging exorbitant fees and “ingredient cost spread” — adding additional costs on top of the medication that aren’t disclosed to the employer. For example, you might be charged $200 for 30 Adderalls when they only cost the PBM $150.

Many drug manufacturers will offer rebates on certain high-cost medications. Traditional PBMs under fully insured plans will simply pocket these savings, rather than giving them back to the employer.

The traditional PBM payment model of ingredient cost spread encourages them to push both higher-cost drugs and a higher volume of drugs, which isn’t usually in the best interest of the patient.

Roundstone instead recommends that PBMs earn their services through a flat, agreed-upon fee, such as $6 per prescription, rather than an unknown percentage.

To learn more, download our free eBook, Strategies to Contain the Rising Costs of Pharmacy.

The Power of Data and Cost Containment to Self-Insured Plans

With a self-funded plan, you have transparent access to your claims data. This data transparency allows you to analyze patterns and plan utilization to enact cost containment strategies and take full advantage of the savings potential of self-insurance. You can leverage claims data to inform your customized plan design. This involves using healthcare utilization data to shape self-funded health insurance plans that best suit your employees’ needs.

For example, if your data analysis shows a high demand for mental health services, you can adjust your self-funded plan to provide comprehensive behavioral health coverage.

Analyzing trends and developing cost containment strategies helps companies identify ways to manage expenses. This may include negotiating lower rates with healthcare providers or implementing employee well-being programs to prevent costly chronic conditions.

Digital health tools can be another efficient and effective way to encourage employees to get the treatment and care they need in a cost-effective manner. Digital doctor appointments can be both beneficial and efficient for primary, mental health, and musculoskeletal (MSK) needs.

At Roundstone, strategic relationship managers act as extensions of the HR team. We work closely with employers and other healthcare partners to ensure smooth plan administration and effective communication and implement cost containment solutions or annual renewals.

Making data-based adjustments throughout the underwriting year allows you to address emerging issues before they cost you big money. For instance, if your employees make extensive use of emergency departments, you can adjust your coverage to incentivize use of less-costly options, such as primary care.

Meet Your Self-Funded Health Plan Support Team at Roundstone

Self-insured health plans have several benefits for small and medium-sized businesses, such as using claims data for plan design and implementing cost containment strategies to lower plan costs. With Roundstone’s helpful strategic relationship managers, advisors, and TPA and PBM partners, you can build a customized self-funded plan that meets your company’s unique healthcare insurance needs.

Roundstone prioritizes a policy of alignment to the employer’s best interests. Our primary goal is to provide affordable, high-quality healthcare for your employees.

Explore self-funded health plan options with Roundstone to unlock the advantages for your business. Watch the Who’s Who webinar, or read the other blogs in our Three Easy Pieces series, “How to Budget for a Self-Funded Health Plan” and “Self-Funding 101: How Self-Funded Health Insurance Works.”

Reach out to a Roundstone Advisor or our customer care team today to learn how self-funded insurance can save you thousands on healthcare costs.