Highlights

- Small to midsize businesses are increasingly adopting self-funded insurance.

- Many smaller companies think they are too small to afford self-funded insurance.

- Smaller companies can achieve affordable risk predictability with as few as 25 employees through group captives.

- Self-funded insurance gives employers control over costs and greater access to data.

- Group captive insurance mitigates the risks associated with self-funding for businesses.

Health insurance does more than cover medical bills — it’s a powerful tool for attracting and retaining top talent.

Yet, rising healthcare costs challenge small and midsize businesses that want to offer competitive benefits without straining their budgets. While large corporations have long benefited from self-funded insurance, many smaller companies think this cost-saving option remains out of reach.

Group medical captives change that equation, making self-funded plans accessible to companies with as few as 25 employees. Self-funded insurance through a group captive helps both employers and employees win with better benefits at lower costs.

Traditional Employer-Sponsored Health Insurance Is Becoming Unsustainable for Small Companies

Healthcare benefits present one of the biggest challenges for small and midsize businesses. In a nutshell, 88 percent of employers1 still prioritize health-related benefits, partially because 65 percent of employees2 turn down offers from companies that don’t offer them.

Traditionally, smaller companies rely on fully funded plans and pay fixed premiums regardless of claims. But with average single premiums rising 6 percent3 and family premiums soaring 7 percent in 2024, these costs can quickly strain a company’s resources. Many SMBs are seeking more cost-effective alternatives.

Self-Funded Insurance vs. Fully Funded Plans: What’s the Difference?

If your business provides company health benefits, you’re probably familiar with the standard fully funded insurance model: Select a plan annually, pay fixed premiums and let the insurer handle claims.

While this approach offers convenience and predictable costs, it also has its drawbacks, such as:

- Higher premiums tied to your employees’ risk profile

- Limited options for customizing benefits

- Little visibility into what you spend premiums on

- Frustration over limited control of covered services

So, what sets self-funded insurance apart? Rather than paying fixed premiums to an insurance company, employers allocate funds to cover employee claims as they occur.

This hands-on approach gives businesses greater control over their healthcare spending and allows them to customize benefits to meet their team’s needs better.

| Traditional Plans | Self-Funded Group Captive |

| 100% fixed costs | 15% fixed costs |

| No data access | Full claims transparency through CSI Dashboard |

| No premium returns | 100% premium returns |

| Limited plan options | Complete customization |

| No cost containment | Multiple saving strategies |

| Annual premium increases | The Roundstone Guarantee |

| No claims data | Real-time analytics |

| Standard networks only | Choice of providers and networks |

Key features of self-funded insurance include:

- Customizable benefits tailored to your team’s needs

- Greater visibility into spending

- Reduced costs compared to fully funded options

- Risk-sharing opportunities for smaller businesses

Is Self-Insurance Only an Option for Large Companies?

Not anymore. For years, self-funded insurance was a privilege reserved for large corporations with the financial resources to cover employee health claims.

Large businesses could absorb unpredictable claim costs and set aside reserves, while smaller companies typically weren’t able to access the same flexibility and cost control.

Small and midsized companies can now access self-funding through group medical captives, which join like-sized SMBs together to pool resources and offset risk. Roundstone’s Group Medical Captive covers over 170,000 lives, enabling companies with just 25 employees to achieve the same risk protection as Fortune 500 corporations.

By 2024, 63 percent of covered workers4 are part of a self-funded solution, and 20 percent of small businesses offer self-funded health insurance plans.

Among firms with 3 to 199 employees, participation has risen from 13 percent in 1999, showing steady and promising growth for smaller employers seeking smarter healthcare solutions.

Thank you for taking the quiz!

How Do Group Medical Captives Help Smaller Companies Manage Risk?

Smaller businesses often face big challenges when managing the risks of self-funded insurance. What if claims unexpectedly spike? How do you keep costs under control without sacrificing coverage?

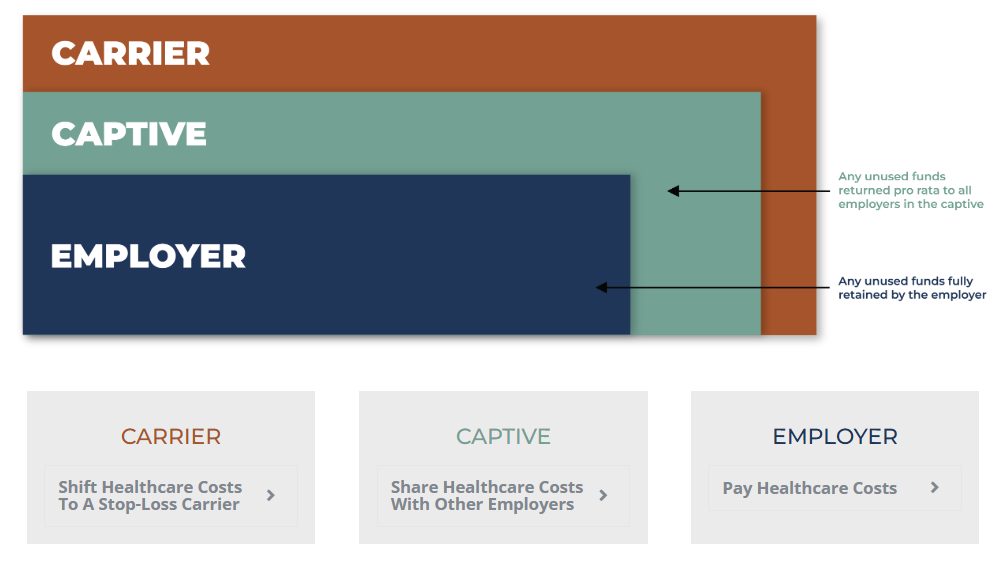

Group medical captives overcome these challenges by allowing multiple employers to share resources and healthcare claim expenses. To add even more protection, they include stop-loss insurance, which caps financial exposure in case of costly claims.

Here’s how it all comes together:

- Employer responsibility. Each employer self-insures a portion of claims, such as $25,000 per member per policy period.

- Stop-loss coverage. The captive group’s stop-loss fund pays claims exceeding $25,000, protecting individual businesses from excessive expenses.

- Catastrophic claims. For claims over $500,000, reinsurance covers the costs to shield the group from the financial impact of major medical events.

The three-layer structure shields employers from the full financial burden of high claims. Group captives boost purchasing power and reduce administrative costs, enabling businesses with as few as 25 employees to offer competitive healthcare plans while keeping expenses in check.

What Are the Benefits of Self-Funded Insurance With a Group Captive Solution?

A self-funded company health plan gives employers greater control over costs and coverage. With features like risk-sharing and refunds on unused premiums, a Roundstone group captive plan provides these advantages:

| Benefit Type | What It Means | Key Features |

| Fixed vs. Variable Costs | Combines fixed costs (around 15%) with variable costs for better control and savings. |

|

| Return of Unspent Premiums | Returns unused premiums at year-end with no future contract required. |

|

| Flexible Plan Design | Build custom plans that fit your workforce’s needs and your budget. |

|

| Claims Data Transparency | Full access to claims data through Roundstone’s CSI Dashboard helps you track spending and improve plan performance. |

|

| Cost Containment Opportunities | Use data insights to reduce costs and improve efficiency. |

|

As part of a self-funded plan, group captives empower you to provide affordable healthcare benefits that are customized to fit your team’s needs.

For example, you can offer impactful benefits like the following with Roundstone’s self-funded plans, which balance cost savings with broader coverage options.

- Comprehensive coverage. Provide mental health resources like therapy, wellness programs focused on fitness and nutrition, and preventative care such as annual check-ups, screenings and vaccinations.

- Improved access to care. Expand care options by including telehealth services and direct primary care (DPC) programs to make healthcare more accessible with flexible solutions that fit busy schedules.

- Wellness-focused options. Support health management with well-being programs like fitness challenges, nutrition counseling and stress-reduction workshops.

- Lower employee costs. Help employees manage expenses with reduced premiums, zero deductibles plans and out-of-pocket costs. Make healthcare more affordable without sacrificing quality or coverage.

Experience the Benefits of Self-Funded Insurance

Roundstone is an innovative employee health benefits company. We help small and midsize businesses offer competitive benefits at a lower cost by self-funding health insurance through our group medical captive. The Roundstone Captive enables companies to self-insure safely by pooling hundreds of employers together to share risk and save money.

With easy onboarding and personalized support every step of the way, the Captive offers control, flexibility and transparency and returns all savings back to employers, where they belong. We believe in always aligning with the employers’ best interests and remain committed to our mission—quality, affordable healthcare and a better life for all.

If you’re ready to see increased savings on your company’s employee health insurance, consider switching to self-funded insurance with a group medical captive.

Speak to a Roundstone advisor today to learn how self-funding can help you cut costs and improve employee benefits.

References