The movie opens on a gorgeous Utah mountain cliffside. The camera pans in on Tom Cruise, free-soloing up the side of a rock with his bare hands, thousands of feet in the air. He hangs off a cliff ledge like he’s crunching pull-ups at Planet Fitness, eagles soaring in the panoramic – no ropes, wires, or parachute.

Opening credits rolling, Tom Cruise heaves himself up to the top of the mountainside as a helicopter materializes out of nowhere, a calypso soundtrack keeping the beat. A tuxedoed government secret agent torpedoes a message into the ground.

Inside is a $100,000 check – Tom Cruise’s refund of unused spend in his Roundstone Group Medical Captive from his self-funded insurance plan. It’s accompanied by a note, should he choose to accept it:

“Believe it or not – for the fifth year in a row, you have saved money on your employee health benefits. Here’s your refund check. Bank it, spend it, take the Rain Man to Vegas. It’s yours to enjoy.”

Think Mission Impossible is a stretch for a blog on self-funded health insurance? Try this piece of movie trivia on for size, courtesy of the IMDB: “Tom Cruise lied to the movie’s insurance agents, saying that he would be letting the stunt crew handle all the major action setpieces. In reality, Cruise did about 95% of his own stunts.”

Talk about jumping the couch.

Mission Possible is the theme for Roundstone’s Group Medical Captive this May 18 to 19 in Chicago. We believe affordable, quality health insurance should be a reality for everyone, not just the Tom Cruises of the world. Finally, self-funded insurance is a viable option even for small businesses.

You’re invited. Register here.

Self-Funded Insurance on the Group Medical Captive Model: Affordable Employee Health Coverage

We’re psyched. And you should be too. Because your business can truly save using self-funded health insurance on the Group Medical Captive model.

Founded in 2005, Roundstone’s Group Medical Captive was the first of its kind and revolutionized the healthcare space by making self-funded insurance an affordable and viable option for small to midsize companies – not just Fortune 500 brands.

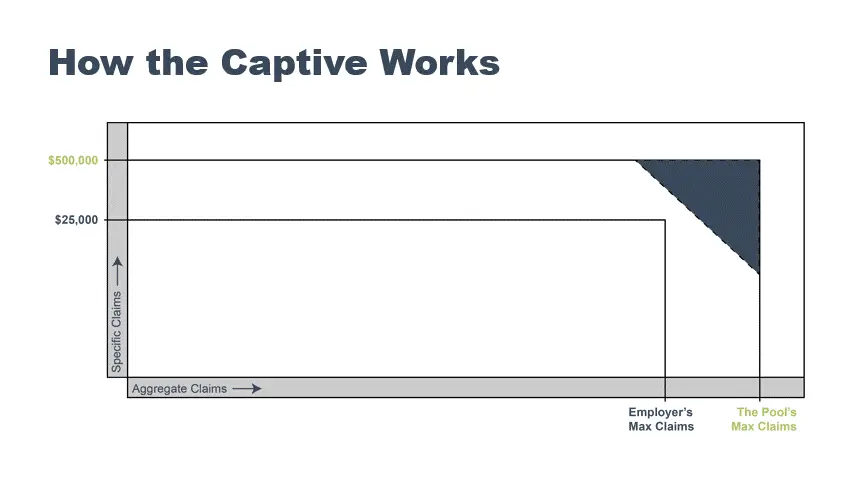

Companies only pay for what they deserve to pay, which is what they use. They pay their claims out of pocket, up to a certain deductible they choose. Then payment becomes the responsibility of the stop loss insurer and its reinsurer the Group Medical Captive – a consolidation of companies like your own who pool their resources to be able to afford self-funded insurance. This way, they enjoy the privileges only large corporations could previously access.

Claims over $500,000 are paid by stop-loss insurance, which allows the company to avoid catastrophic risk.

Companies only pay for the insurance they use – what their employees need. Outside of the stop-loss insurance, the rest gets refunded back. In 2022, Roundstone distributed $24.4M unspent captive premium pro rata.

Roundstone’s Medical Captive Forum: Explore the Benefits and Savings of Self-funded Insurance

Roundstone’s Medical Captive Forum (MCF) brings employers and benefits advisors together to learn more about self-funding best practices and trends. It’s designed to be educational. We’ll explore a variety of issues in the current health benefits landscape. Learn how to best save money through self-funded insurance using the Group Medical Captive model and improve care quality for your employees.

Since 2015, we’ve hosted the event in Cleveland. This year, we decided to freshen things up a bit with a trip to Chicago. This city is absolutely beautiful in May. See your reflection in the “Bean” in Millennium Park. Stroll the Chicago River and check out the famous Marina City Towers. And join us for an epic event dedicated to helping employers provide better healthcare benefits to employees – MCF 2023.

The MCF agenda has been locked and loaded. Here are a few of the agenda highlights:

Voices of Self-Funded Employers – Insights, Tips, and Lessons Learned

- Featuring perspectives from employers including The Cleveland Orchestra

Your Mission to Make Each Moment Matter

- Inspirational keynote with best-selling author and speaker Jon Petz

The Benefits of Good Benefits – How self-funding impacts employee satisfaction?

- A conversation from the HR perspective, with two seasoned HR leaders who will share first-hand experiences of being self-funded.

Breakout Sessions:

- Captive Financial Management: Where Does the Money Go?

- Claims Processing: How the Captive Stewards Your Healthcare Costs

- Plan Design: Picking the Best Bundle

- How the Captive Works: Self-Funding 101

Chicago Jazz Orchestra at the Welcome Reception

- Be-bop deluxe!

We designed the agenda so you can experience everything MCF has to offer and still be home for dinner Friday night. Or extend your trip and have an awesome weekend in Chicago – it’s up to you.

Learn more about the benefits of self-funded insurance using Roundstone’s Group Captive Model. In fact, two-thirds of our customers save enough in their first four years with us to pay the claims for their entire fifth year. And 100% are guaranteed to save money, full stop.

Secure your spot at Roundstone’s MCF.