In that iconic scene in the Matrix, Morpheus offers Keanu Reeves the Red pill or Blue pill. The Red pill reveals things as they actually are; the Blue lets you drift back to the sleep of unawareness.

“The Matrix. It is the world that has been pulled over your eyes to blind you from the truth,” Morpheus tells Keanu.

Writing these self-funded insurance blogs kind of makes us feel like Morpheus sometimes.

But instead of offering readers a Red pill unveiling a hideous armageddon nightmare, we get to teach readers how to save money on health benefits and provide employees better care quality through self-funded health insurance.

That’s a reality the insurance companies don’t want you to know. They’d rather you take the Blue pill and drift back to the sleep of unawareness, totally oblivious to the fact that you have a choice that actually costs less yet delivers higher quality care.

We’ll tell you the truth: the traditional health insurance industry is a bit of a racket. They make outrageous profits through misaligned incentives – and you pay through the nose as a result.

Fortunately, there’s a solution that’s more affordable and actually provides better care – self-funded insurance under the group medical captive model.

Let’s explain the value of self-funded insurance and how self-insurance can help small businesses save big on insurance costs when compared to fully insured.

Why Most Employees in Large Firms are Self-Insured

Take a ride on the subway. Believe it or not, many of the people on your commute are insured under self-funded health plans, but they probably don’t know it. (Because when you have self-insurance, your employees often aren’t even aware. They still have similar medical cards, similar processes, similar portals as their old plans. They still get the same level of integrated support. But self-insured plans cost less and provide better care quality.)

Among large firms, 82% of workers are covered by self-insurance. That makes sense because it’s cheaper. You only pay for the insurance you need – the insurance you deserve.

But what about small to mid-size companies? Until recently, they couldn’t afford the risk of self-funding their health plans. If something catastrophic would happen to one or more of their members, they couldn’t afford the hit.

Roundstone’s Group Medical Captive model changes all that. Launched in 2005 and the first of its kind, our Group Medical Captive allows smaller companies to pool their resources to dilute their risk. Today our Group Medical Captives protect over 120,000 lives, or belly buttons as we like to call them.

Companies with only 25 employees can now enjoy the same risk predictability as Fortune 500 brands. And that’s great news because they can now self-fund like Fortune 500s.

And no, Roundstone clients don’t have to have the same insurance plans as other companies in the captive. The beauty of self-funding health benefits under the group captive model is each plan can be tailored to your employees’ unique needs. You can choose your own TPA as well as your own advisor. You’re not forced into the one-size-fits-all approach of fully insured. The end result is a plan that better meets your needs and provides higher quality care.

And that’s something the insurance companies don’t want you to know. They’re banking on the possibility you’ll go back to sleep. To them, misalignment is a cash machine.

How Self-Insurance Works on a Group Medical Captive Model

Unlike fully-funded insurance plans, 85% of self-insurance costs are variable – you have control over them and can save money as a result.

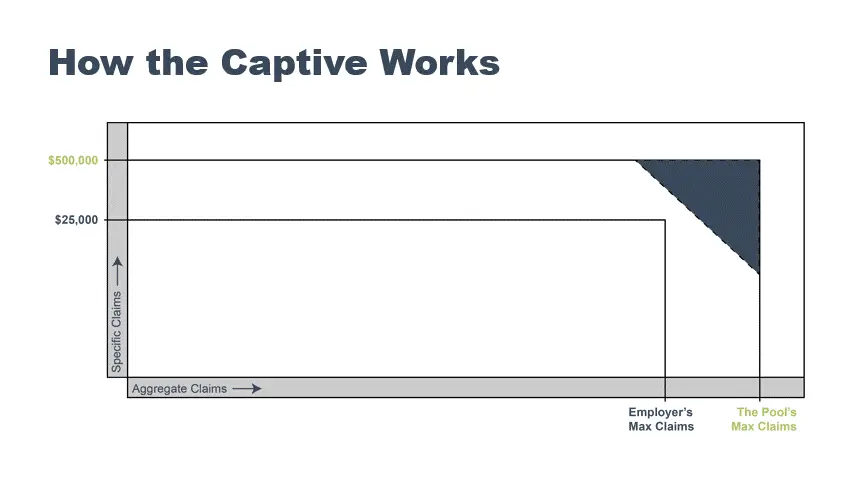

The first pool of money – in blue – is your claims fund. This is the fund you use to directly cover costs up to a specified deductible, typically $10,000 to $25,000 per employee, and a specified amount of aggregate costs. This fund will be 65% of the total costs of the self-funded insurance plan.

Any costs beyond that deductible are paid from the Group Medical Captive – in green – up to $500,000. This is the fund you pay into collectively along with other members of the captive. By sharing this pool, you collectively offset the risk – essentially gaining the risk predictability of a company with a hundred thousand employees, even if you only have 25 employees on your payroll. Suddenly you’re a mom-and-pop shop with the risk predictability muscle of General Motors.

Roundstones’ Group Medical Captive is 25% of the total costs of the self-funded insurance plan.

Whatever isn’t spent in the Group Medical Captive gets refunded back to you, pro rata, in the form of a check. The refund is based on how well the group does, not necessarily your company specifically.

In 2022, Roundstone distributed $24.4M unspent captive premium pro rata. Every year, we write checks in the 10s of thousands of dollars back to clients as refunds on the captive. They can spend it, bank it, or save it for next year’s insurance costs – the choice is theirs.

That’s why insurance companies want you to take that Blue pill – they don’t want you to know you can actually get back the money you don’t spend on your insurance premiums. They’d rather bank that money as profit. That’s how the nation’s largest insurers are able to rake in billions of dollars in record profits as the country stands on the brink of a recession.

Come to MCF 2023 and Explore the Benefits and Savings of Self-Funded Insurance

There is a solution to expensive, out-of-control insurance premiums. By self-insuring under Roundstone’s Group Medical Captive model, you’re guaranteed to save money. Two-thirds of our customers save enough in their first four years with us to pay the claims for their entire fifth year. And 100% save money, full stop.

If you’re ready to wake up to the realities of self-funded insurance, you need to attend Roundstone’s Medical Captive Forum (MCF).

Held this May 18 to 19 in Chicago, MCF brings employers and benefits advisors together to learn more about self-funding best practices and trends. It’s designed to be educational. We’ll explore a variety of issues in the current health benefits landscape. Learn how to best save money through self-funded insurance using the Group Medical Captive model and improve care quality for your employees.

If the system isn’t working for you, why aren’t you doing anything about it? Attend MCF, and learn more about the benefits of self-funded insurance using Roundstone’s Group Captive Model.

Secure your spot at Roundstone’s MCF.