- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

Find this article helpful? Share it with others.

A group captive health insurance plan allows small to midsize businesses to band together, pool risk, and save money—while maintaining control over plan design, vendors, and claims data.

Self-Funding 101: What Is a Captive?

Health insurance shouldn’t feel like a black box with ever-rising costs and no clear explanation. Yet for many small- to midsize-businesses (SMBs), that’s exactly what fully insured plans have become—expensive, rigid, and impossible to navigate.

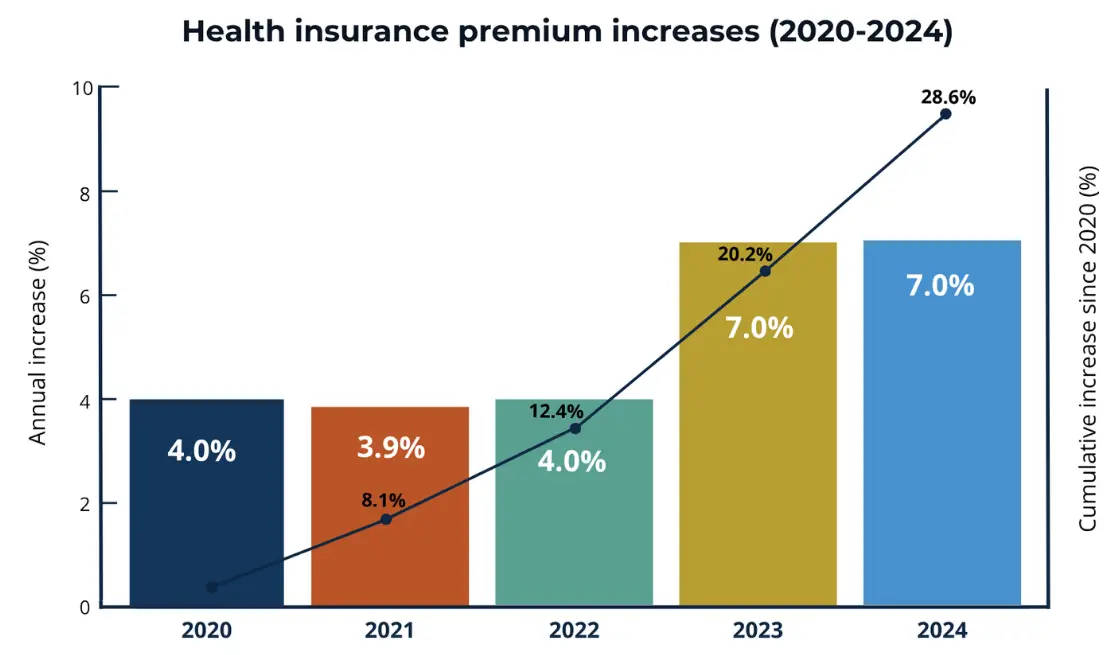

With premiums jumping 7% in 2023 and another 7% in 2024, employers are fed up with writing blank checks for benefits their teams can’t afford to use.

Group captives offer a better way forward. By giving employers control over plan design, transparency into claims data, and a share in the savings, captives are redefining what affordable, high-quality healthcare looks like and who can access it.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

Self-Funded vs. Fully Insured Health Plans: What’s the Difference?

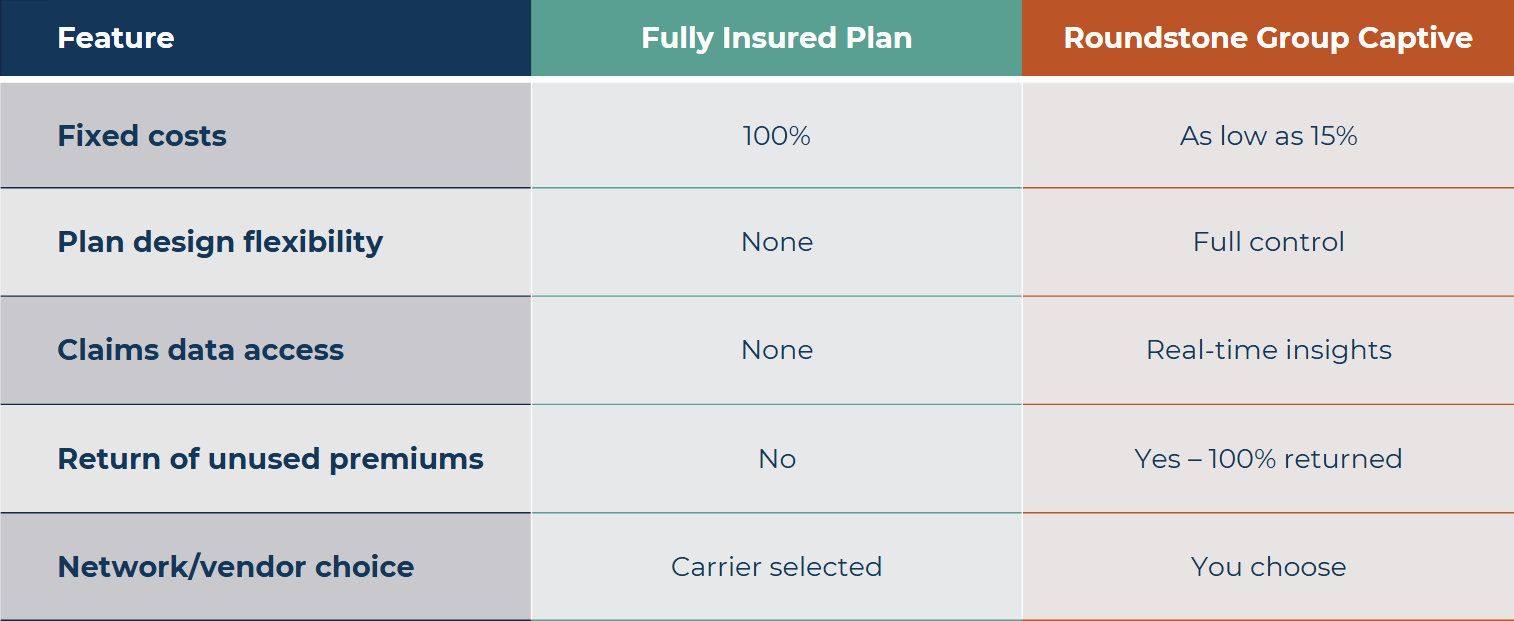

Understanding how group captives compare to traditional insurance is key. In a fully insured plan, you pay fixed monthly premiums to a carrier, regardless of how much your employees use their benefits.

You have no say in network choice, limited cost control, and no access to your own claims data.

With a self-funded insurance plan in a group captive, you pay for what you use, gain full data transparency, and get to customize your plan to fit your employees’ needs. Plus, you share risk with like-minded employers safely, predictably, and with stop-loss coverage that protects you from large claims.

For small- to mid-sized employers, a group captive health insurance plan is a scalable, proven way to self-fund, making it one of the most effective options for small businesses seeking long-term savings and control.

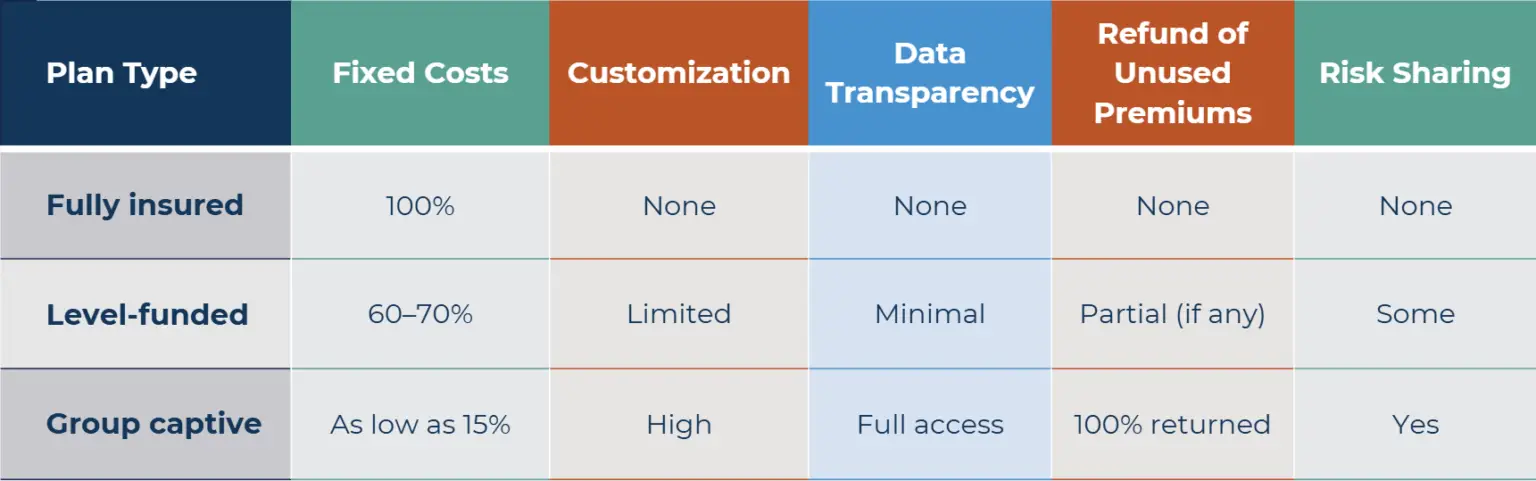

Group Captive vs. Level-Funded vs. Fully Insured: What’s the Difference?

Employers often compare group captives to level-funded and fully insured plans when exploring better ways to manage healthcare costs. Here’s how they stack up:

Group captives offer the most transparency, control, and long-term savings for small businesses seeking a better alternative to rising insurance costs.

Top 5 Benefits of a Group Captive Health Insurance Plan

A group captive plan delivers five core advantages that fully insured plans simply can’t match. Here are the top 5 benefits of medical stop-loss captives for SMBs looking to lower healthcare costs and increase plan control.

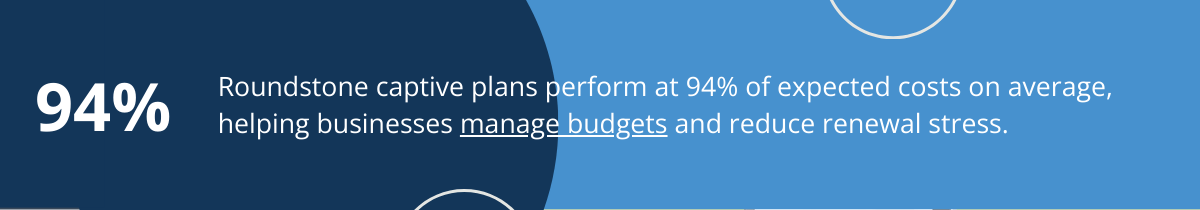

1. Lower fixed costs. Roundstone captive plans have fixed costs as low as 15%, compared to 100% in traditional fully insured plans.

2. Customizable plan design. Choose your own third-party administrator (TPA), pharmacy benefits manager (PBM), provider network, and wellness programs.

3. Control. Data transparency through Roundstone Reporting gives you access to your claims data to make informed cost-containment decisions.

4) Return of unused premiums. One hundred percent of unspent stop-loss premiums go back to you, pro rata.

5) Risk sharing, not risk taking. Pool risk safely with hundreds of like-sized employers, minimizing volatility while maximizing savings.

Is self-funding right for your company? Find out in our 30-second quiz.

Thank you for taking the quiz!

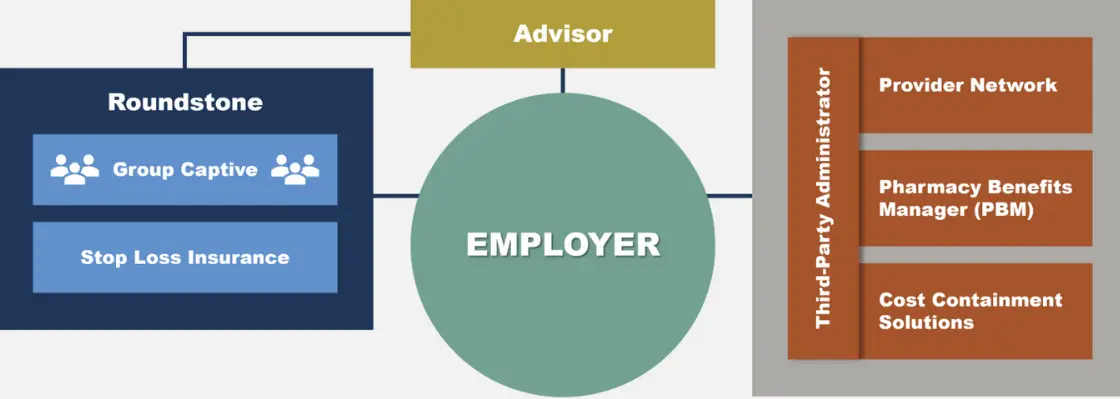

How Group Captive Health Plans Work for Employers

In the Roundstone group captive model, your business stays in control. You select your own trusted vendors—like a TPA and PBM—and your advisor helps you optimize the plan design. Roundstone manages all captive administration, underwriting, and stop-loss behind the scenes.

Who’s Who in a Self-funded Group Captive

Claims flow through your TPA, while you receive detailed reports via Roundstone Reporting—so you can make informed decisions throughout the year.

You get all the benefits of self-funding—without the administrative burden.

Learn more about how group captives work.

How to Help Employees Understand Self-Funded Captive Plans

When rolling out a self-funded plan, your employees need to understand how the change impacts them. The good news? It’s usually for the better—lower out-of-pocket costs, more provider flexibility, and more transparency in care decisions.

Here’s how to ease the transition:

- Simplify the message. Emphasize lower copays and deductibles, not funding structures.

- Encourage cost-conscious care. Explain the benefits of telehealth, direct primary care, and generic medications.

- Provide accessible communication. Use webinars, emails, and short videos.

- Create a feedback loop. Make it easy for employees to ask questions and get support.

- Partner smartly. Your advisor and Roundstone will help ensure a smooth rollout and ongoing employee education.

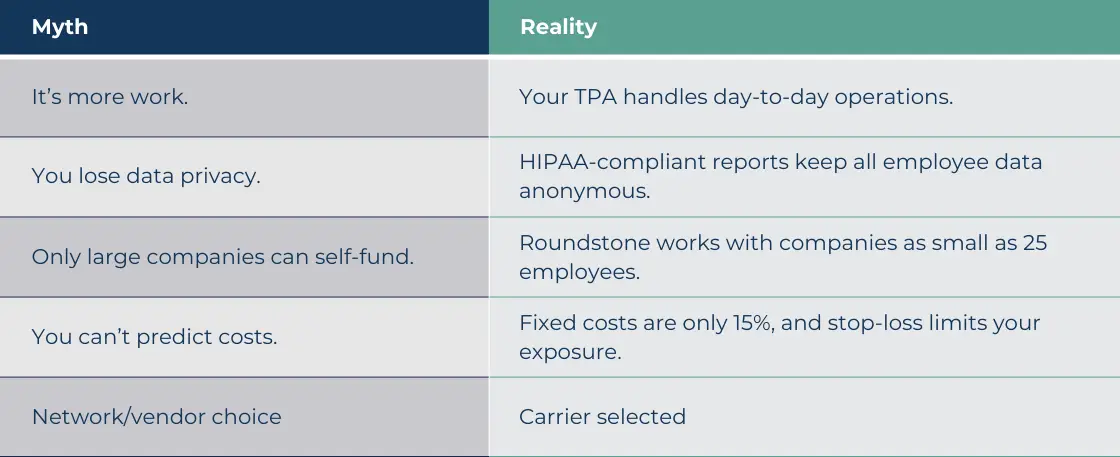

Top Misconceptions About Self-Funded Health Insurance

Despite the growing popularity of group captives, several common misconceptions still give employers pause. Clearing up these myths can help decision-makers move forward with clarity and confidence.

Explore more in our guide to overcoming objections to self-funding.

Why Roundstone’s Group Captive is the Best Self-Funded Solution

Roundstone pioneered the medical stop-loss captive model in 2005. We’re not a newcomer or a VC-backed startup. We’re a family-owned company with a 20-year track record of helping employers like you take control of their healthcare spend.

- $91.8 million returned in unused premiums

- In-house underwriting and claims adjudication for faster service

- Real-time transparency with Roundstone Reporting

- Flexible plan design that puts employers in the driver’s seat

- Easy onboarding and seamless renewals with dedicated advisor support

Unlike many captives, we also offer:

- Guaranteed renewals and low collateral requirements

- Cash distributions—not credits or fees

- Personalized support from an entire team of experts, including Partner Solutions and your Regional Practice Leader

Employers like you are saving tens of thousands per year and giving their teams access to better care—with lower deductibles and copays, and fewer out-of-pocket surprises. With Roundstone, you don’t just get a health plan. You get a long-term strategy—and a partner who makes sure it pays off.

Still have questions? See our FAQ below for answers to the most common questions we hear from potential customers.

Ready to stop overpaying for healthcare? Speak with a Roundstone advisor today and discover how a group captive plan can deliver cost savings, control, and better care for your employees—while showing you how to lower employer health insurance costs year after year.

Frequently Asked Questions

A group captive health insurance plan is a member-owned insurance model where multiple small- to mid-size employers pool premiums into a shared fund. This entity self-funds core healthcare claims and purchases stop-loss reinsurance for large losses. The result: lower fixed costs, shared risk, plan design, and access to claims transparency.

Employers contribute to a captive fund covering predictable losses. Catastrophic claims exceed the captive retention and are covered through stop-loss insurance. That structure caps individual financial exposure while spreading risk across the group for greater predictability

Yes. Any unused stop-loss premium funds and investment income generated by the captive are returned to members via pro-rata distributions, typically after each policy year

Not significantly. Well‑structured captives use licensed policies and stop‑loss insurance. Employers assume only the predictable layer of claims. Risk is capped and regulated so individual exposures remain limited.

An independent actuary calculates expected loss based on each member’s historical data, demographics, and risk profile. Premiums then include administrative fees, captive pooling, and reinsurance costs.

Group captives are ideal for SMBs with 25 to roughly 500–1,000 employees, especially those committed to proactive risk management, cost savings, and choosing their vendors.

Not exactly. A captive leverages a group structure for self-funding but includes a licensed insurance entity and a reinsurance layer. Unlike traditional self-funding done by large corporations, captives offer shared scale and stop-loss protection.

Initial hurdles include upfront costs for collateral, selecting an appropriate captive domicile, compliance complexities, and commitment to data transparency among members.

Yes. Group captives typically allow employers to retain their advisors, TPAs, PBMs, and networks. The captive model is flexible—members choose preferred vendors and cost-containment partners.

Members receive regular, HIPAA‑compliant access to aggregated claims data and benchmark reports, enabling proactive utilization review, cost-containment programs, and plan optimization.

Not when done through a group captive. Captives use stop-loss insurance to cap exposure and pool risk across hundreds of employers. This gives small businesses a safe way to self-fund, with fixed costs as low as 15% and full access to claims data for proactive management.

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025