Highlights

- Making the switch to self-funded health insurance can mean better benefits for your employees and significantly reduced healthcare costs for your company.

- A self-funded group captive plan can help you cut premium costs and minimize risk by pooling resources with other like-size companies.

- To see if a self-insured group captive plan is right for you, assess your current plan, employee needs, and your business’s budget.

- Once you decide to change plan models, talk with your leadership team, communicate with employees, and select a trustworthy provider.

- Switching to self-funded group captive coverage with Roundstone is straightforward, with in-house underwriting and outstanding customer support at every step.

Healthcare costs in the U.S. continue to skyrocket, outpacing the country’s per capita growth rate. Healthcare is now a top business expense, second only to payroll. Between 2020 and 2022, health expenditures grew by 3.4% on average, making it hard for small businesses to offer cost-effective employee health coverage. Small to midsize businesses — not to mention their employees — cannot afford to sustain much more.

Thanks to pioneering providers like Roundstone, self-funded health insurance for small businesses has emerged as an affordable solution. When you switch to self-funded insurance from a fully insured plan, you gain more control over your healthcare expenses, allowing you to design a plan that fits your company’s needs and budget.

You also only pay for what you need — the healthcare you actually use. You pay what you deserve. Unlike a traditional, fully insured plan, you keep any unused healthcare spend. Finally, you can get off the merry-go-round of escalating premiums and no control over your plan.

Learn more about self-funded vs. fully insured plans, what to consider to see if this model is right for you, and how to switch to a self-funded plan to start saving money for your small to medium-sized business (SMB).

What Is Group Captive Insurance?

In group captive insurance, also known as a stop-loss captive, like-sized businesses collectively pool their resources to level risk in order to safely and confidently self-fund their healthcare, an option formerly reserved for large corporations with significant financial resources.

This model enables small and medium-sized businesses to enjoy the same self-funding benefits — such as direct control over policies, coverages, and claims processing — as Fortune 500 companies. By pooling their resources, these businesses can access a level of insurance management and cost efficiency that was once beyond their reach.

On average, a company that self-funds will save 20% over a traditional fully insured plan. Those savings can substantially accrue over time.

Benefits of Self-Funding for Employers

A self-funded plan offers several benefits over traditional insurance, including customization, cost control, and potential premium refunds.

Here’s a breakdown of self-funding advantages for SMBs.

- Cost control. With self-funding, you only pay for actual healthcare claims, avoiding the fixed premiums of traditional plans. This can lead to substantial savings, especially in years with low healthcare usage.

- Customization. Self-funded plans allow you to design coverage that fits your specific workforce needs. Whether adding wellness programs or focusing on chronic disease management, you have the flexibility to prioritize, optimizing affordability as well as care quality.

- Refund of unused premiums. Any unused spend is returned to you as a cash refund at the end of the year. This is a significant financial benefit you don’t get with traditional insurance, where unused premiums remain in the pockets of the insurance carrier as profit. With self-funded insurance, you only pay for the insurance you actually use.

- Cost containment opportunities. With self-funding, you can implement cost containment strategies like wellness initiatives, preventive care programs, and negotiated pricing with healthcare providers, further driving down expenses and improving the affordability of your benefits.

- Data transparency. Self-funded plans provide detailed data on healthcare spending, allowing you the flexibility to identify trends and make data-driven decisions to control costs more effectively. This can increase both your savings as well as the quality of your plan.

Is Self-Funding Right for Your Company?

If you’re questioning “Is self-funding right for my company?,” there are several steps you can take to determine its potential benefits for your business. Before making the switch, evaluate your current plan and explore the financial implications of a self-funded stop-loss captive.

Evaluating Your Current Plan

To determine if self-funding is the right fit for your company, evaluate the effectiveness and cost-efficiency of your existing setup. Begin by analyzing metrics and Key Performance Indicators (KPIs) to understand how effectively your current plan meets your employees’ healthcare needs and financial goals.

Consider the following KPIs:

- Claims history. Begin by scrutinizing your past claims data. Identify areas that indicate overspending or inadequate coverage. For instance, if you notice high expenses for prescription medications, switching to a self-funded plan could help you work with a pass-through Pharmacy Benefits Manager (PBM) to negotiate better prescription drug prices.

- Premium trends. Analyze historical premium data. If your premiums align with the national 22% increase over the last few years, assess whether your current plan offers enough value for the cost or if an alternative option could provide improved savings. Ask yourself if your business would be able to sustain doubling your health insurance expense in the next 5 years, as would be the case with the market’s current trend trajectory. If not, it may be time to consider a more affordable option like a self-funded stop-loss captive.

- Workforce satisfaction. To gauge employee satisfaction, conduct surveys or hold discussions. If employees express frustration with your plan’s limited choice of healthcare providers, you could benefit from self-insurance through a more flexible network or coverage.

- Cost fluctuations. Investigate if your plan has experienced unpredictable cost swings. For instance, you discover an unexpected surge in high-cost urgent care claims caused budget disruptions. This indicates you could benefit from a self-funded plan that prioritizes lower-cost services, like primary care, to cut healthcare expenses.

- Coverage flexibility. Evaluate how well your plan allows customization based on workforce needs. For example, if your employees are dealing with mental health or dependent care issues, a self-funded plan could allow for behavioral health or telemedicine options for more flexible, accessible coverage.

Financial Implications

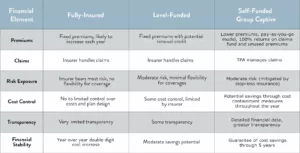

Transitioning to self-funded health insurance requires a clear understanding of the financial implications. Below is a comparison of the financial details between traditional and level-funded plans and a self-insured group captive model:

How to Make the Switch to Self-Insurance

Switching to a self-funded stop loss captive to benefit from self-funded insurance cost savings for your company involves preparing your team, analyzing your finances, and communicating with employees.

Take the following steps as you begin transitioning to self-insurance.

Consult All Stakeholders

Begin by engaging with essential stakeholders in your organization. Include key decision-makers such as executives, human resources managers, and your finance department. This approach allows you to gather different viewpoints and establish objectives and expectations for transitioning to a group captive plan.

Perform a Cost-Benefit Analysis

Before committing to the change, conduct an in-depth cost-benefit analysis. This will help your team comprehend the possible financial considerations of moving to a self-funded group captive plan. Assess the pros and cons, considering premium expenses, claims history, and anticipated savings.

Select a Stop-Loss Captive Provider

Choose a stop-loss captive provider for your new insurance plan with specific criteria in mind. Seek a reputable provider with years of experience in the self-funding industry and a network of advisors you can work with to develop a tailored healthcare plan.

Consider their vendor partnerships, cost containment opportunities, data transparency tools, and customer service to ensure you have a supportive provider.

Employee Communication

Develop a well-thought-out communication strategy to introduce your employees to the impending insurance change, including emails, flyers, posters, or meetings.

Clearly explain the new plan’s benefits and address their concerns or questions. Open and transparent communication can ease the transition and boost employee confidence and satisfaction in their benefits plan. This can improve morale as well as employee retention.

Implementation

Once all the groundwork is in place, outline a comprehensive plan for implementing the new insurance program. This is where your TPA comes in. They’ll do all the heavy lifting of implementing your plan to ensure a smooth and streamlined implementation.

Read this blog for tips on how to best work with your TPA for optimal results.

Monitoring and Adjustment

Once you’ve switched to a self-funded group captive insurance plan, establish an effective process for ongoing evaluation and necessary adjustments. Fortunately, the provider of your self-funded insurance plan has data specialists who can help you every step of the way. This ensures that your plan aligns with your company’s changing needs and goals.

You can achieve this with the following:

- Regular data analysis. Continuously monitor claims data, premiums, and other relevant metrics. Analyze this information to identify trends, cost drivers, and areas for potential improvement. Your stop-loss provider will also be analyzing your data, identifying trends, and making cost savings recommendations to improve the savings of your plan.

- Quarterly reviews. Conduct quarterly plan reviews with your group captive provider to assess performance, discuss challenges, and explore opportunities for cost savings.

- Employee feedback. Maintain open communication with your employees. Urge them to share their healthcare experiences, which can guide modifications to the plan.

- Cost-control measures. Implement cost-control measures as needed, such as adjusting deductibles, copayments, or network options to optimize plan performance.

Case Study

Considering making the switch to self-funded insurance? Take inspiration from A New Start Clinics, which faced healthcare challenges like skyrocketing premiums and a lack of data transparency. CEO Tim Dukes found a solution with Roundstone Insurance’s self-funded group medical captive plan.

Through Roundstone, A New Start was able to design a plan around its unique setup, offering a Direct Primary Care program on-site. The plan included a $0 co-pay to encourage employees to use this service and boost the quality of care.

The outcomes were remarkable: Employees benefited from improved care at reduced costs, including no copay for primary care, lower prescription charges, and higher usage. Dukes expressed his delight with his self-funded plan, saying, “This is the first year where I’ve felt like we’ve managed it well and stayed within our budget, and I’m tickled about that. It’s great news to take to my partners. I’m amazed at the success we’ve had.”

This example demonstrates how a strategic change in healthcare options can result in enhanced benefits and substantial cost reductions for your organization.

Switching to a Self-Funded Group Captive With Roundstone

ROUNDSTONE is an innovative employee health benefits company. We help small and midsize organizations offer competitive benefits at a lower cost by self-funding health insurance through our group medical captive. The Roundstone Captive enables companies to self-insure safely by pooling hundreds of employers together to share risk and save money.

With easy onboarding and personalized support every step of the way, the self-funded stop-loss captive offers control, flexibility, transparency, and returns all savings back to employers where they belong. We believe in always aligning with the employers’ best interests and remain committed to our mission — quality, affordable healthcare and a better life for all.

When you choose Roundstone, switching to group captive insurance is easy. We’ve designed a seamless onboarding process to ensure uninterrupted coverage, and our flexible underwriting creates a customized, cost-effective plan that could let you keep your current benefits at a lower cost.

We prioritize simplicity for your employees with user-friendly navigation tools and a secure dashboard for easy benefit access. Our CSI Team helps identify cost-saving opportunities and facilitates their implementation, using our CSI Dashboard to monitor and prevent unnecessary healthcare expenses.

Our self-funded group captive is also designed to minimize the risks involved with switching from a fully insured carrier. We protect you from high-cost and catastrophic claims with stop-loss coverage. We also help ease the administrative burden of a self-funded plan through your chosen TPA, who will handle most of the administrative tasks for you.

Roundstone also equips you with the tools and unwavering support for daily cost containment. This is why we’ve been able to give back $72 million in premiums since 2003. This demonstrates our commitment to the Roundstone guarantee — we promise you’ll see cost-saving refunds within five years of joining our group captive, or we’ll make up the difference.

In fact, two-thirds of Roundstone customers save enough in their first four years to entirely pay for their fifth year of claims.

Join Roundstone Today for Cost-Effective Self-Funded Health Insurance

If you are ready to implement affordable health insurance at your SMB, switch to Roundstone today. We’ve been in the group captive business for over 20 years, helping offer a better life for all through plans prioritizing cost-effectiveness and customized care.

Speak to our team today to learn how to make the transition and give your employees the insurance benefits they deserve — higher-quality care at a lower cost.