- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

Self-Funded Health Insurance: The Complete Guide to Taking Control of Your Healthcare Costs

- Roundstone Team

- 10 Minute Read

- Employers

Find this article helpful? Share it with others.

Healthcare costs have become an overwhelming burden for businesses. As the second-largest expense after payroll, employee health benefits consume an ever-growing portion of company budgets.

Traditional insurance operates like a black box. You pay premiums, watch rates raise annually, and have zero visibility into where your money goes. The insurance carrier keeps unused funds as profit while you prepare for next year’s inevitable rate increase.

What Is Self-Funded Health Insurance?

With self-funded health insurance, your company pays for employee healthcare claims directly, rather than paying premiums to an insurance carrier. You keep what you don’t spend.

Understanding the Basics

Instead of purchasing a fully insured plan from a carrier like Blue Cross or Aetna, you establish a fund to pay claims as they occur. This fundamental shift puts you in control of costs while eliminating insurance company profits from the equation.

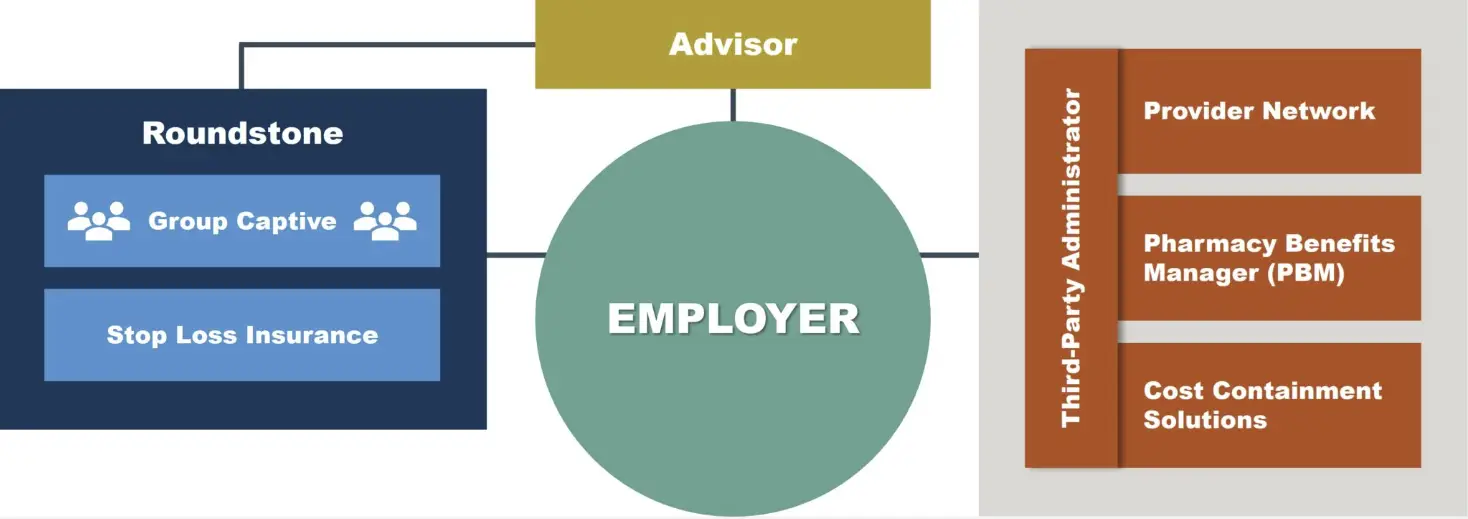

The mechanics are straightforward. You work with a third-party administrator (TPA) to process claims and manage the plan, while stop-loss insurance protects against catastrophic claims above specific thresholds.

You design the exact benefits your employees need, implement cost containment strategies based on real data, and receive any funds not spent on claims.

Learn how to plan ahead. Read How to Budget for a Self-funded Plan.

Key Components of Self-Funding

Every self-funded plan includes several essential elements working together:

Claims fund The account you establish to pay employee medical expenses as they occur.

Stop-loss insurance Protection against unexpectedly high claims that could threaten financial stability.

Third-Party Administrator (TPA) Your operational partner who processes claims and manages day-to-day plan administration.

Pharmacy Benefit Manager (PBM) The specialist who negotiates prescription drug pricing and controls pharmacy costs.

Plan document The official description of covered benefits, exclusions, and employee responsibilities.

Provider network The doctors, hospitals, and facilities where employees receive discounted care.

Self-Funding vs Traditional Fully Funded Insurance

For decades, small to midsize businesses have accepted annual premium increases as an inevitable cost of doing business. Understanding the fundamental difference between traditional insurance and self-funding could save your company thousands—even millions—over time.

The Traditional Insurance Trap

With fully insured plans, you’re essentially renting your health insurance. Every month, you send premium payments to an insurance carrier, and that money is gone forever—whether your employees use $10,000 or $100,000 in healthcare services.

Here’s what happens to your premiums in a traditional plan:

Annual increases of 10-20% are standard.

You have no control over plan design or cost-containment strategies.

The insurance carrier wins either way. In good years when claims are low, they pocket the difference. In bad years, they simply raise your premiums at renewal.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

To learn more about the way fully funded insurance carriers keep you in the dark, download the free ebook What Your Fully Insured Carrier Doesn’t Want You to Know.

The Self-Funded Advantage

For decades, only Fortune 500 companies could self-fund safely due to their size and resources. Smaller companies faced too much risk from unpredictable claims. The group captive model changed everything by allowing businesses to pool resources and share risk, making self-funding accessible to companies with as few as 25 employees.

With self-funding, instead of paying fixed premiums to a carrier, you pay for healthcare claims as they occur. Think of it as paying for healthcare directly rather than overpaying for insurance.

Consider a 100-employee company spending the industry average of $16,464 per employee annually. That’s $1.6 million in healthcare costs. With Roundstone’s self-funded solution averaging $12,385 per employee, the same company would save over $400,000 per year—money that goes straight to your bottom line.

Self-Funding vs. Level Funding

If you’ve researched alternatives to fully insured plans, you’ve probably come across level funding. Many insurance companies market level-funded plans as a safer way to “dip a toe” into self-funding.

But the truth is, level funding often keeps employers stuck with the same limitations as traditional insurance, just packaged differently.

Level funding is basically “self-funding lite.” Here’s how it works: Instead of paying one fixed premium to a carrier, you pay a set monthly amount that covers claims funding, admin fees, and stop-loss insurance.

If claims run lower than expected, you may get a portion of the surplus back, but the carrier keeps most of it.

Here are the key differences:

Level funding means limited control. You still rely on the insurance company’s network, plan design restrictions, and vendor choices.

You get a fraction of your unused funds back. Carriers typically keep 50–75% of surplus dollars as profit.

You lack true transparency. Most level-funded arrangements offer partial claims visibility, so you can’t make fully informed cost-containment decisions.

In contrast, true self-funding within a group captive means you:

Design your plan your way—full flexibility to choose your TPA, PBM, and provider network.

Keep 100% of unused funds—every dollar not spent on claims stays with you, not the carrier.

Gain complete claims data transparency, so you can spot trends and take action to contain costs.

Leverage group risk pooling to stabilize costs and limit risk — with stop-loss protection and captive surplus returns.

Bottom line: Level funding looks like self-funding on the surface, but the real savings and control come from fully committing to a group medical captive. That’s how you break free from the traditional insurance cycle for good.

Why Doesn't Everyone Self-Fund?

If self-funding is so advantageous, why do many small businesses stick with traditional insurance? The answer is simple: risk.

Pure self-funding can be volatile. One catastrophic claim, a premature birth, an organ transplant, or a cancer diagnosis, could devastate a small company’s finances. While large corporations have the cash reserves to weather these storms, smaller businesses need protection.

This challenge led to an innovative solution that gives small and midsize businesses the best of both worlds: the savings and control of self-funding with the stability and protection of traditional insurance. That solution is group medical captives.

How Does a Group Medical Captive Work?

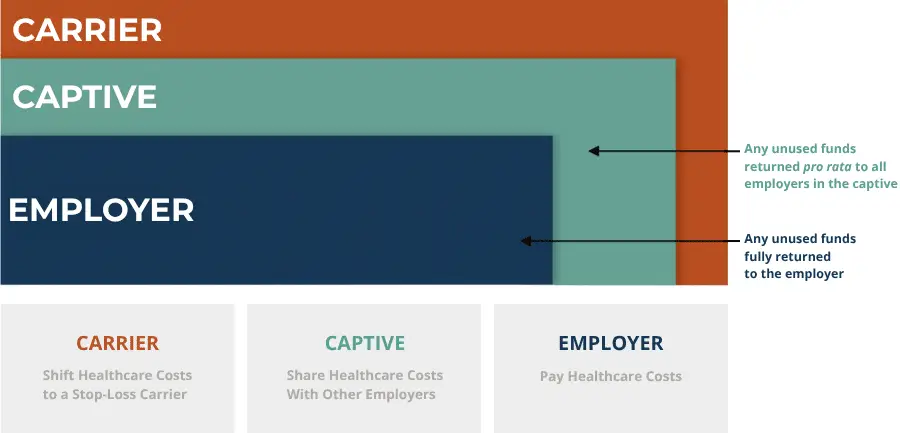

A group captive program pools 100s of similar-sized businesses together to share risk, making self-funding more predictable. The group captive structure provides three layers of financial protection that eliminate the risk traditionally associated with self-funding:

Layer 1: Direct payment (65% of costs): Employer. You pay claims up to your specific deductible, typically $25,000-$50,000 per employee. This gives you skin in the game and incentive to manage costs.

Layer 2: Shared risk pool (25% of costs): Captive. Claims between your deductible and $500,000 are shared across all captive members. This spreads medium-sized risks across hundreds of employers.

Layer 3: Stop-loss coverage (10% of costs): Carrier. Commercial reinsurance covers catastrophic claims above $500,000, protecting against worst-case scenarios.

Self-funded health insurance through a group captive changes everything. Instead of paying premiums to an insurance company, you pay for actual healthcare usage.

How Risk Pooling Works

Risk pooling means a single employee’s cancer diagnosis or premature birth won’t devastate your budget. The captive absorbs these medium-to-large claims across all members, while stop-loss insurance handles true catastrophes.

What Is Stop-Loss Insurance and Why Do I Need It?

Stop-loss insurance protects your company from unexpectedly high medical claims by covering costs above predetermined limits, typically starting at $25,000-$50,000 per employee.

Two Types of Protection

Stop-loss insurance provides a critical safety net through two distinct coverage types.

Specific stop-loss coverage. Protects against individual high-cost claims by covering expenses above your chosen deductible per employee, typically $25,000 to $75,000.

Aggregate stop-loss coverage. Protects against higher-than-expected total claims by covering costs when your plan exceeds 125% of projected annual expenses.

Making It All Work: Your Third Party Administrator (TPA)

,Stop-loss insurance protects you from catastrophic claims, but who actually processes those claims, sends out ID cards, answers employee questions, and makes sure providers get paid on time?

That’s where your TPA comes in — the operational engine that makes self-funding work seamlessly.

Operational Components of a Self-Funded Captive Program

What Is a TPA and What Is Their Role In My Self-Funded Plan?

A third-party administrator (TPA) handles all day-to-day operations of your health plan, from processing claims to member services, so you can focus on running your business.

Core TPA Responsibilities

Your TPA serves as the operational backbone of your self-funded plan. They handle:

Claims processing. Your TPA processes medical claims, verifies coverage, negotiates provider payments, and delivers detailed spending analytics that reveal cost-saving opportunities.

Member services. Employees receive support through call centers, online portals, and ID card services with 24/7 access to benefits information, keeping your HR team free from daily benefits administration.

Plan administration. Your TPA creates plan documents, ensures compliance with ERISA and ACA regulations, manages enrollment changes, administers COBRA, and handles all government reporting so you can focus on your business.

Choosing the Right TPA Partner

Not all TPAs are created equal. Look for these differentiators:

Captive experience: Specialization in group captive administration.

Technology platform: Modern systems for claims processing and reporting.

Service metrics: Published standards for call times and claims turnaround.

Fee transparency. Clear per-employee-per-month pricing without hidden charges.

Integration capability. Seamless connectivity with stop-loss carriers and networks.

The Bywater Advantage

Roundstone’s in-house TPA, Bywater, was built specifically for captive administration:

No setup fees. Bywater charges no setup fees, even for groups under 50 employees.

99% claims accuracy. Claims are processed with 99% accuracy within our 14-day processing standard.

Transparent pricing. Bywater charges flat per-employee-per-month (PEPM) fees with no percentage-based charges.

Integrated operations. Bywater coordinates directly with Roundstone's captive management for seamless operations.

Dedicated service team. You work with consistent contacts who know your plan and your company's needs.

What Are Pharmacy Benefit Managers and How Do They Control Drug Costs?

While your TPA manages medical claims and plan administration, prescription drugs require specialized expertise through a Pharmacy Benefit Manager (PBM). Your PBM negotiates prescription drug prices, manages formularies, and processes pharmacy claims to control one of healthcare’s fastest-growing expenses.

What PBMs Do for Self-Funded Plans

Pharmacy Benefit Managers serve as the behind-the-scenes force controlling prescription drug costs, which typically represent 15-25% of total healthcare spending.

Here’s how they deliver value:

Price negotiation: PBMs secure discounts from drug manufacturers and pharmacies, often achieving 20-40% savings.

Formulary design: PBMs create preferred drug lists that guide employees toward cost-effective medications while maintaining quality.

Clinical programs: Advanced PBMs offer specialty drug management, prior authorization protocols, and step therapy programs that ensure appropriate medication use.

Rebate management: Unlike traditional insurance where carriers keep manufacturer rebates, self-funded plans retain 100% of these rebates.

Transparency Matters

Traditional PBM contracts often include hidden fees and spread pricing that benefit the PBM at your expense. Roundstone partners with transparent PBMs that pass through all savings and provide clear reporting on your pharmacy spend, ensuring every rebate dollar returns to your plan.

To learn more about PBMs and how they save you money, download the free ebook Strategies to Contain the Rising Cost of Pharmacy.

Self Funding and Benefits Advisors

Your benefits advisor serves as your strategic partner and guide throughout the self-funding journey. They help evaluate whether self-funding fits your company, assist with vendor selection, and provide ongoing support for plan optimization.

An experienced advisor who understands self-funding will help you navigate TPA selection, network choices, and stop-loss options while ensuring your plan design aligns with your budget and employee needs.

What Is Roundstone's Preferred Bundle?

Roundstone’s preferred bundle combines the Bywater TPA, Cigna network, and select pharmacy benefit managers to deliver optimal results. Groups using this strategic combination average $10,810 per employee annually – that’s $1,700 less than standard arrangements and 34% below industry benchmarks.

This integrated approach streamlines administration, maximizes pharmacy rebates, and provides data-driven cost optimization while maintaining gold-level coverage quality.

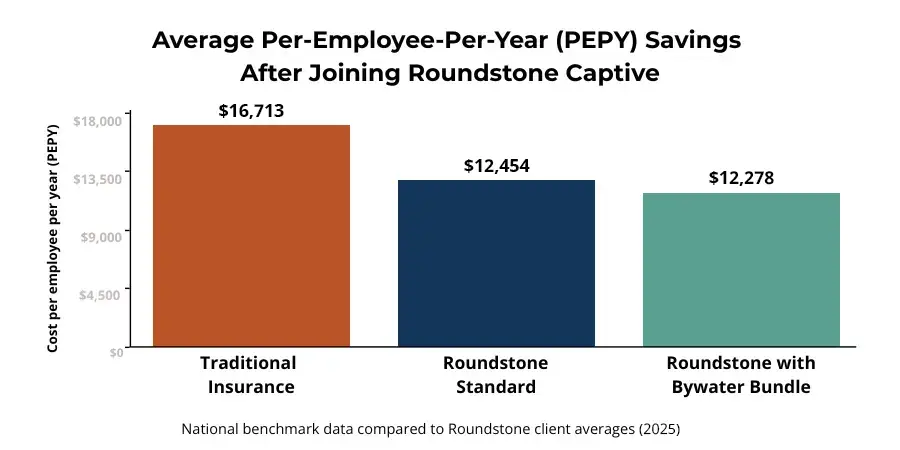

Breaking Down the Numbers

Recent data from the 2023 Mercer National Survey of Employer-Sponsored Health Plans shows the average employer with 50-499 employees spends $16,464 per employee per year (PEPY) on healthcare.

Roundstone’s internal performance data tells a different story:

Industry average: $16,713 per employee per year (PEPY)

Roundstone standard plans: $12,454 PEPY

Roundstone preferred bundle: $12,278 PEPY

Where Savings Come From

Self-funded savings come from multiple sources:

No insurance company profit margins. Traditional carriers build 15-20% profit into premiums.

Lower administrative costs. Transparent TPA fees versus hidden carrier charges.

Smarter spending. Data visibility enables targeted cost containment strategies.

Pharmacy rebates retained. You keep manufacturer rebates instead of the carrier.

Investment returns. Unused claims funds can be invested until needed.

The Roundstone Guarantee

We stand behind our promise: If you don’t save money within your first five years in the Roundstone group captive, we’ll make up the difference.

Two-thirds of our clients save enough in four years to pay for their fifth year of claims in full, and 100% keep the money they don’t spend.

Can I Customize My Self-Funded Health Plan?

Unlike one-size-fits-all traditional insurance, self-funding gives you complete control, with the flexibility to design benefits that match your employees’ needs and your budget. You’ll also get access to claims data so you can make informed cost containment decisions.

Plan Design Options

Self-funding puts you in control of every aspect of your health plan:

Financial parameters. Set deductibles, copayments, out-of-pocket maximums, and coinsurance levels that balance employee protection with plan sustainability and encourage smart healthcare utilization.

Coverage decisions. Customize what's covered, from 100% preventive care and expanded mental health benefits to alternative medicine options and prescription drug formularies that meet your employees' specific needs.

Network selection. Choose from national networks like Cigna or UnitedHealthcare, regional options with better local discounts, narrow high-performance networks, or negotiate direct contracts with health systems.

Strategic Design Approaches

Smart plan design goes beyond picking numbers. Self-funding lets you create incentives that guide employees to cost-effective care while improving their health outcomes.

Common strategies include steering employees to primary care with lower copays, eliminating costs for generic medications and preventive care, and offering free telemedicine visits.

You can also integrate advanced cost containment solutions like centers of excellence for major procedures and care navigation services.

Data Transparency Lets You Refine Your Design

When you self-fund, your claims data belongs to you. With Roundstone Reporting, you’ll see exactly where employees seek care, identify cost drivers, and track pharmacy utilization patterns.

This transparency lets you make annual refinements based on actual usage to create a continuous improvement cycle that enhances benefits while reducing costs.

Common Misconceptions About Self-Funded Insurance

The five biggest myths about self-funding are easily debunked by data from thousands of successful small and midsize businesses.

Myth 1: "Self-Funding Is Too Risky for Small Companies"

The myth: Only large corporations can handle the financial uncertainty of self-funding.

The reality: Group captives make self-funding as predictable as traditional insurance through:

Risk pooling across hundreds of employers

Stop-loss protection at multiple levels

Specific claim advance funding for cash flow protection

Twenty years of proven performance through all economic cycles

The proof: Over 1,000 companies with 25-1,000 employees successfully self-fund through Roundstone, with a 90% retention rate.

Myth 2: "It Costs More Than Traditional Insurance"

The myth: Self-funding leads to higher costs when claims spike.

The reality: Roundstone members consistently outperform traditional insurance:

Average savings of 24-34% versus industry benchmarks

Maximum exposure capped by stop-loss insurance

100% of unused funds returned to employers

The Roundstone Guarantee ensures savings within five years

The proof: Since 2003, Roundstone has returned $91.8 million in unused premiums to members.

Myth 3: "It's Too Complicated to Manage"

The myth: Self-funding requires extensive HR resources and expertise.

The reality: Your TPA handles all complex administration:

Claims processing identical to traditional insurance

Customer service for employee questions

Compliance with all regulations

Monthly reporting simplified through dashboards

The proof: HR’s role remains similar to traditional insurance—communication, enrollment support, and strategic planning.

Myth 4: "Level-Funding Is a Better Alternative"

The myth: Level-funded plans offer self-funding benefits with more predictability.

The reality: Level-funding is “self-funding lite” with significant drawbacks, including limited plan design and vendor choices. Level funding is often more expensive than true self-funding, as carriers keep 50-75% of the surplus.

The proof: Roundstone returns 100% of surplus, offers complete flexibility, and costs less than level-funded alternatives.

Myth 5: "We Could Get Dropped or Non-Renewed"

The myth: Poor claims experience leads to cancellation.

The reality: Roundstone guarantees renewals with no “adverse selection” exits. As a commitment to long-term partnerships, renewal proposals are provided to all members, and we offer support for high-cost situations through care management.

The proof: Unlike traditional carriers or other captives, Roundstone has never forced a group to leave due to claims.

Why Choose Roundstone for Self-Funded Insurance?

Rising healthcare costs and unpredictable renewals shouldn’t be the norm. Roundstone gives small and midsize businesses the power to take control with self-funded group captive insurance that saves money, restores transparency, and delivers real long-term value.

Since 2005, Roundstone has transformed self-funded health insurance by making it accessible to smaller employers through a unique group medical captive. This proven approach helps businesses share risk and unlock the same level of cost control large corporations have enjoyed for decades, but without taking on unmanageable risk alone.

Get Unmatched Transparency

Roundstone believes you deserve to know exactly how your healthcare dollars are spent, and how to make them work harder for you. We make full data access simple and actionable.

Here’s what that means for your business:

See the data. Our Roundstone Reporting tool puts detailed claims information right at your fingertips.

Spot opportunities. You can pinpoint trends, high-cost drivers, and places to cut waste.

Act on insights. With clear visibility, you can make confident changes and keep improving over time.

Experience Real, Measurable Savings

With Roundstone, you don’t just hope to save; you see it, year after year. And we stand behind it.

Here’s how you benefit financially:

Get money back. We’ve returned more than $91.8 million in unused premiums to our members.

Save more each year. Many employers save up to 20% annually compared to fully insured plans.

Support You Can Count On

Switching to self-funding is a big move, but you won’t do it alone. We make it manageable and successful, with real people guiding you every step of the way.

Here’s what you can expect:

In-house experts. Our underwriting and claims teams handle the details with speed and accuracy.

Partner solutions. We help you identify savings, connect with trusted vendors, and manage costs.

Relationship managers. From onboarding to renewal, your dedicated team keeps your plan running smoothly.

Better Benefits, Lower Cost

Choosing Roundstone means offering competitive, customizable benefits that help you attract and keep top talent—while you control your costs and invest in what matters most: your people and your business.

Join the hundreds of employers nationwide who trust Roundstone to deliver affordable, high-quality healthcare—and take back control of your health insurance costs today.

The choice is yours: Keep paying rising premiums to traditional carriers who profit from your surplus, or take control with a partner who only wins when you do.

Still have questions? Read our FAQ below for answers to the most common questions we hear about self-funding.

Ready to see what a self-funded group captive program can do for your bottom line? Contact a Roundstone Regional Practice leader today to discuss your specific situation. We’ll review your current plan, explain your options, and show you exactly how self-funding could work for your company.

Frequently Asked Questions About Self-Funding

A: With traditional insurance, you pay fixed premiums whether you use services or not, and the carrier keeps any surplus as profit. With self-funding, you pay only for actual healthcare usage and keep 100% of the savings. You also gain complete transparency into claims data and full control over plan design.

A: A group captive is a form of self-insurance where multiple employers pool resources to share risk. This makes self-funding affordable and predictable for companies with 25-1,000 employees by spreading risk across hundreds of businesses. Each member maintains their own plan design while benefiting from the group’s collective buying power.

A: Yes, through group captives. By pooling with other businesses and purchasing stop-loss insurance, companies with as few as 25 employees can self-fund as safely as Fortune 500 companies. The captive structure provides three layers of protection against unexpectedly high claims.

A: Stop-loss insurance limits your financial risk by covering claims above certain thresholds. Specific stop-loss covers individual high-cost claims (like cancer treatment) above your deductible, typically $25,000-$75,000. Aggregate stop-loss protects against higher-than-expected total claims, usually kicking in at 125% of projected costs.

A: A third-party administrator (TPA) manages your health plan operations including claims processing, member services, ID cards, provider networks, and regulatory compliance—everything an insurance carrier would handle internally. They process claims within 14 days, answer employee questions, and provide detailed reporting on your plan’s performance.

A: The preferred bundle includes Bywater (Roundstone’s in-house TPA), Cigna network access, and select pharmacy benefit managers (True Rx, Serve You Rx, or Cigna). This combination delivers the lowest costs—$10,810 PEPY versus $16,464 industry average—while maintaining gold-level coverage quality.

A: No, you’re free to choose any qualified TPA, network, and PBM. However, groups using our preferred bundle (Bywater + Cigna + select PBMs) average $1,700 less per employee per year compared to other arrangements. Your advisor can help you evaluate which approach works best for your situation.

A: PEPY (Per Employee Per Year) is the total annual healthcare cost divided by enrolled employees. It’s the key metric for comparing healthcare costs across different plans and company sizes. Lower PEPY means better cost efficiency. Roundstone’s average PEPY is $10,810-$12,385 versus the industry average of $16,464.

A: Roundstone members save 24-34% compared to traditional insurance. The average employer saves $4,079-$5,654 per employee annually. Many save enough in four years to fund their entire fifth year. A 100-employee company typically saves $400,000-$565,000 per year.

A: In Roundstone’s model, 100% of unused claims funds are returned to employers in cash approximately 6-7 months after the plan year ends. Traditional insurance keeps these funds as profit. Since 2003, Roundstone has returned $91.8 million to members.

A: If you don’t save money within your first 5 years in the captive, Roundstone will pay you the difference in cash. This guarantee reflects confidence in the model based on 20 years of proven results. It’s the only guarantee of its kind in the industry.

A: Implementation typically takes 30-45 days, similar to changing traditional carriers. This includes finalizing plan design, setting up administrative systems, creating employee communications, and conducting enrollment. The process is well-defined with your TPA and advisor guiding each step.

A: No. Your TPA handles all complex administration including claims processing, compliance, and reporting. HR’s role remains similar to traditional insurance: supporting employees, managing enrollment, and working with your benefits advisor on strategy. The main difference is you have data to make informed decisions.

A: Most likely, yes. Roundstone works with major national networks (Cigna, Aetna, UnitedHealthcare) and many regional networks. During implementation, we verify that your employees’ key providers remain in-network. You can also change networks annually if needed, unlike with traditional insurance.

A: Stop-loss insurance protects against high-cost claims, and the captive pools medium-sized risks across all members. Additionally, Roundstone provides care management resources to help control costs for complex conditions. Unlike traditional insurance, you won’t face huge renewal increases—just appropriate stop-loss adjustments.

A: Many employers see immediate monthly cash flow improvements since you only pay for actual claims plus fixed costs. Surplus accumulates throughout the year if claims run favorably. First-year distributions typically occur 6-7 months after your plan year ends, with ongoing savings continuing each year.

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025