Highlights

Roundstone’s group medical captive program provides small to midsize businesses with a cost-effective, self-funded health insurance solution that offers transparency, control and savings.- Roundstone pioneered the group medical captive model in 2005. This innovation allows employers to pool resources and share risk.

- Unlike traditional fully insured plans, a well-managed group medical captive allows flexibility in choosing plan design and vendors.

- Self-funding with a group captive program gives employers greater transparency, control, and long-term stability compared to fully insured and other self-funded options.

- Roundstone delivers unmatched customer service, shares data-driven insights and provides expert guidance to help businesses lower healthcare costs while maintaining high-quality benefits.

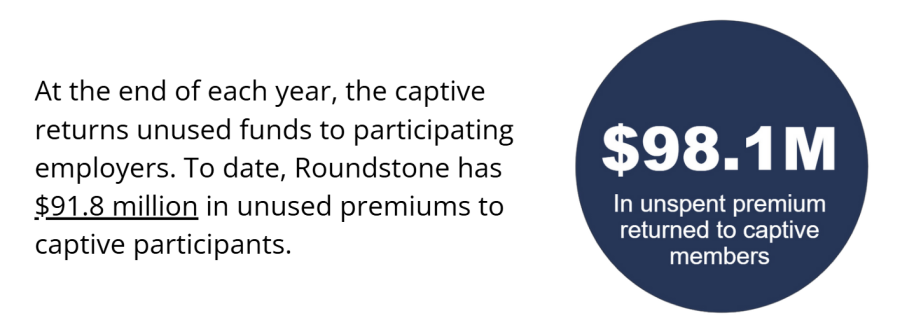

- Roundstone continues to experience strong growth, returning $91.8 million in unused premiums to members.

If your company is enrolled in a traditional, fully insured health insurance plan, your plan is costing you more than you think.

Fully insured plans are not designed for small businesses, which means you end up paying more without getting the plan your employees need. This model boosts the profitability of the big insurance carriers while putting your company and staff at a disadvantage.

Self-funded health insurance plans are different. More than 90 percent of larger companies have used them for years, but smaller companies haven’t had the resources to do the same.

What Is a Group Medical Captive Program?

Group captive insurance plans offer a way for small businesses to take advantage of self-funding by banding together to manage risk while lowering costs. They can finally ditch the fully insured insurance carriers in favor of a more manageable and transparent self-funded solution.

Self-funded health insurance comes with potentially high claim volatility, so small and midsize companies have traditionally been unable to embrace this option.

How a Group Medical Captive Reduces Risk

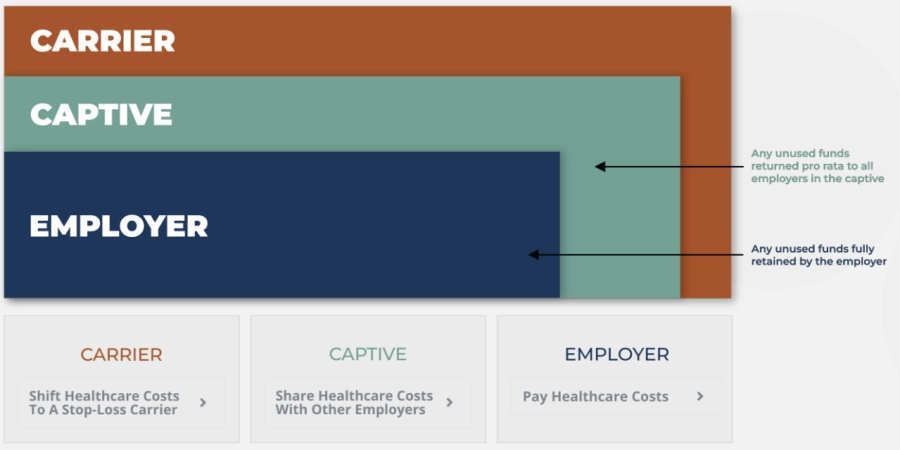

A group medical captive solves this problem by allowing employers to band together and share risk, giving them the same scale and financial stability as a larger company.

Here’s how it works:

- Employers pool a portion of their premiums to a collective fund within the captive.

- Each business benefits from economies of scale, leading to lower costs and better plan stability.

- Employers pay less individually if they have fewer claims.

- The captive program as a whole benefits when the group performs well, reducing volatility and stabilizing costs.

Why Group Captives Are a Cost-Efficient Solution

Unlike fully insured plans, which involve fixed, non-refundable premiums, a self-funded insurance plan through a group medical captive is more cost-efficient:

- Lower premiums. Employers only pay for actual claims, not inflated estimates.

- Return of unused funds. If claims are lower than expected, unspent premiums are returned to participants instead of being kept as profit by an insurance carrier.

- No hidden fees. Captives offer transparent cost containment strategies, ensuring employers have full visibility into where their healthcare dollars go.

By joining a group captive, small and midsize businesses gain greater financial stability, reduced healthcare costs, and the ability to control their plan design—without passing increasing expenses onto employees.

How Captive Insurance Programs Work

A captive self-funded insurance plan aims to reduce overall health insurance costs by shifting from fixed to variable costs. With fully insured small business health insurance plans, companies pay fixed costs for premiums each year.

This means that they pay the full cost, regardless of whether their employees are submitting claims equal to or less than the premium.

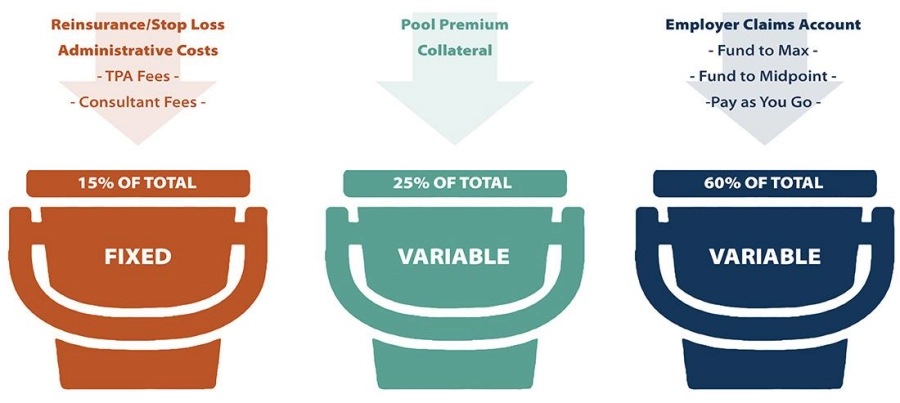

A group medical captive, however, lets the employer keep unused funds from year to year. Fixed costs are only 15 percent, and the rest is variable. So, if a company’s costs are substantially lower than expected, captive insurance gives you the potential of savings from the bucket of variable costs (85 percent).

Three Key Components of a Group Medical Captive

Instead of paying fixed premiums to an insurance carrier, employers in a group captive program take a three-tiered approach to managing costs.

This structure helps businesses maintain financial stability, gain greater control over their healthcare expenses, and benefit from cost savings that would otherwise go to traditional insurers.

Below are the three key components that make a group captive an effective alternative to fully insured plans.

- Self-funded claims (employer responsibility)

- Employers pay for their employees’ healthcare claims as they occur rather than paying fixed premiums to an insurance carrier.

- Each employer is responsible for at least $10,000 per employee per year before shared risk coverage applies.

- Shared risk (captive pool)

- Employers contribute premiums to a shared fund that covers claims between their deductible and $500,000.

- Premiums are set based on company demographics and risk assessment.

- If there is money left over at the end of the year, the captive returns unused funds to participating employers. To date, Roundstone has $91.8 million in unused premiums to captive participants.

- Transferred risk (stop-loss carrier)

- Stop-loss insurance protects businesses from high-cost medical expenses by covering claims above $500,000.

- This coverage spreads the risk of large claims across all members, reducing financial volatility.

- Employers never pay more than their maximum agreed amount, ensuring cost predictability.

This structure allows small and midsize businesses to self-fund safely, gain cost savings, and maintain financial stability while managing healthcare expenses effectively.

Group captive insurance works best for midsize companies between 25 and 500 employees.

Group Captives Offer Freedom of Choice

One of the advantages of group captives is that they allow member companies to control several aspects of their plans. One of the choices members can make is the people they choose to work with.

Those people can include:

Third-Party Administrators

A third-party administrator (TPA) is in charge of the plan’s day-to-day operations, including filing claims, reporting losses and reviewing performance through quality control and internal audits.

It’s important to hire a TPA who meets your company’s data and claims needs while working to lower your costs. When looking to hire a TPA, consider the following:

- The TPA’s claim system

- Is the TPA collecting the information your company needs?

- Does it include basic policy information or any specialized medical coding your business uses?

- Does it use billing software or estimating programs to help lower your costs?

- Reports

- What types of reporting does the TPA offer?

- Will they run loss reports?

- How frequently does the TPA produce reports?

- How are reports distributed?

- Can they produce customized reports for your company?

- Quality control

- Does the TPA do internal reviews of their practices and performance?

- Do they review claim files for compliance with their practices?

- How do they ensure files are handled correctly and consistently?

- Do they conduct an internal audit yearly?

- Is the audit report available for your company to examine?

Your company’s service contract with your TPA should outline all provisions and clearly explain costs.

Pharmacy Benefits Managers (PBMs)

A pharmacy benefits manager (PBM) administers all prescription drug benefits. We call them a self-funded plan’s secret weapon.

On behalf of the captive, PBMs work with:

A good PBM can significantly reduce prescription drug costs and improve overall cost containment in a self-funded or group captive plan.

Why PBMs Matter in a Group Captive Program

Fully insured plans typically lock PBMs to large carriers, but self-funded group captive insurance gives employers the flexibility to choose their PBM.

For you, this means:

- More cost transparency

- Lower prescription drug costs

- Greater control over pharmacy benefits

Types of Pharmacy Benefit Management Services

Employers in a group medical captive can choose from three main types of PBMs:

1. Traditional PBMs

- Keep any savings as profit instead of passing them to the employer

- Are tied to your health insurance carrier, limiting flexibility

- Provide little to no transparency into how they generate revenue

2. Transparent PBMs

- Provide clear contracts and transparent pricing structures

- Show employers exactly where their money is going

- Have restricted ability to mark up drug prices unfairly

3. Pass-Through PBMs (The Most Employer-Friendly Option)

- Only collect revenue through administrative fees—no hidden markups

- Pass manufacturer rebates and discounts directly to your company

- Make it easier to budget prescription costs with predictable pricing

A pass-through PBM ensures that savings go where they belong—back to your company rather than in the pockets of the PBM as additional profit.

How PBMs Help Reduce Healthcare Costs

A PBM plays a crucial role in cost containment for self-funded employers by:

- Negotiating drug prices to secure lower-cost generics and specialty medications

- Offering discount programs and manufacturer coupons to reduce employee costs

- Providing home delivery services to increase convenience and compliance

- Implementing clinical programs like step therapy and prior authorizations.

The Link Between PBMs, Employee Health, and Cost Savings

In addition to reducing employer costs, a well-structured PBM strategy improves employee health outcomes by:

- Lowering out-of-pocket costs, ensuring employees can afford necessary medications

- Increasing medication adherence, leading to fewer complications and hospital visits

- Reducing long-term healthcare costs, as employees stay healthier and require less intensive care

When they choose the right PBM, employers in a self-funded group captive can cut prescription drug costs while making sure employees receive the medications they need without unnecessary financial burden.

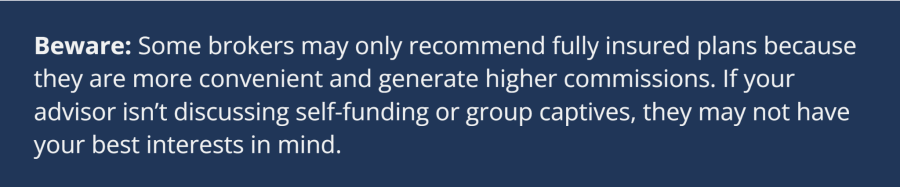

Employee Benefit Advisors

An employee benefit advisor (or broker) is a professional who helps businesses navigate their health insurance options. They play a critical role in making sure your plan design is the best fit for your company by:

- Evaluating different health insurance models

- Comparing self-funded, fully insured, and group captive plans

- Providing expert recommendations tailored to your business needs

A self-funded group captive requires specialized expertise, so working with the right advisor is essential to maximizing cost savings and plan flexibility.

The Importance of a Strong Advisor Relationship

Your insurance benefits advisor is your primary guide when it comes to one of your biggest line-item business expenses—health insurance.

A successful advisor relationship should be built on:

- Open communication. Your advisor should provide clear, transparent insights into cost and coverage options.

- Trust. They should prioritize your business’s needs, not just their commission.

- Strategic guidance. A knowledgeable advisor helps you manage risk, optimize costs, and maximize plan benefits.

What to Look for in an Employee Benefits Advisor

Not all employee benefit advisors take a consultative, data-driven approach.

The best benefits advisors stand out by:

- Offering differentiated solutions, rather than pushing one-size-fits-all plans

- Understanding the advantages of self-funding and group medical captives

- Providing customized recommendations based on your company’s goals and claims data

- Avoiding the “easy option” of defaulting to a fully insured plan without assessing alternatives

Your Employee Benefit Advisor as an Industry Insider

A knowledgeable employee benefit advisor can provide strategic insights that help you control costs and improve plan performance. To get the most out of your advisor relationship:

- Prepare questions ahead of advisor update meetings.

- Ask for data-driven recommendations, not just standard renewals.

- Discuss cost-containment strategies that go beyond traditional insurance models.

We’ve compiled a list of questions to help you have more productive discussions with your advisor.

Need Help Finding the Right Advisor?

Roundstone works with a network of trusted advisors who are knowledgeable about self-funding and group captive insurance.

- We have strong relationships with agents in every state.

- Our advisors understand your area’s specific regulations and business needs.

- We can help connect you with a broker who aligns with your cost-containment and plan customization goals.

If you need an expert advisor to guide you through the self-funded transition, contact us today for a recommendation.

Benefits of Group Medical Captive Insurance

Transitioning to a new type of health insurance can be intimidating and complex.

The BUCAAs (Blue Cross and Blue Shield, UnitedHealth Group, Cigna, Aetna, and Anthem) bank on the client’s dependence on not understanding their health insurance options to keep them on the fully insured “merry-go-round” with rate increases almost every year.

Here’s how group captive insurance is different.

Improved Transparency

Trying to get information out of a fully insured insurance carrier about where your money goes and what services your employees access is challenging. With group medical captives, you control the policy, which only serves your interests and unique business needs.

This gives you access to more data, such as urgent care utilization, high drug costs, and other key areas of impact that help drive down unnecessary costs

Greater Control

In a fully insured insurance model, the insurance company controls everything, from how much you pay to what is covered in your plan and who your providers are.

If something changes within your company, other than adding or losing employers, there’s nothing you can do to address it until the start of a new plan year.

Group captive insurance allows you to design a plan that is right for your business and for your employees. You are not locked into a one-size fits all plan with benefits that you won’t use.

You have control over what your plan covers, ensuring your policies serve all employees and staff members.

Increased Stability

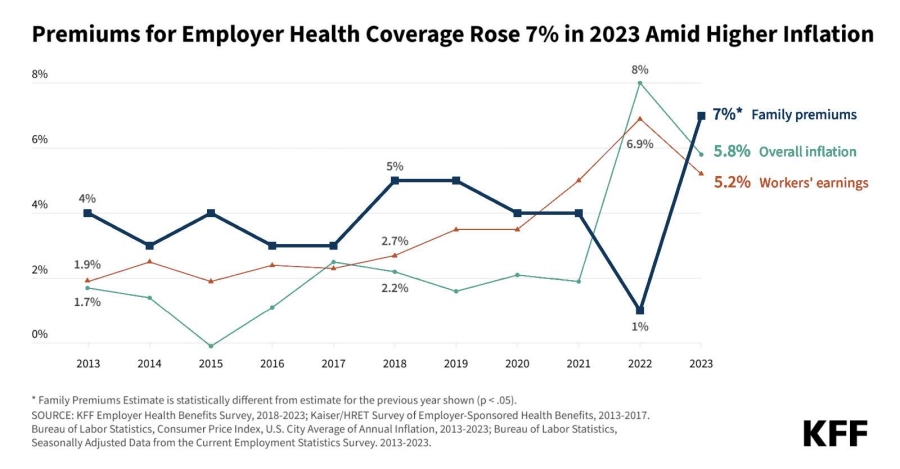

With fully insured policies, annual premium increases are inevitable and often unpredictable. A recent Kaiser Family Foundation survey found that insurance premiums have risen 47 percent over the last decade, much faster than inflation and employee wages.

With group medical captive insurance, you control how much money you spend on healthcare, which means you can plan accordingly, ensuring greater financial health for your business and your employees. Plus, since you only pay for claims as they occur, you can significantly improve cash flow.

Reduced Costs

With the fully insured model, you pay monthly premiums to insurance companies, and 100 percent of those premiums are fixed. If your employees don’t generate that amount in claims, the insurance company gets to keep the difference as profit in compensation for taking on the risk.

In a group medical captive insurance program, the guiding philosophy is to help employees become smarter healthcare consumers. Because only a small percentage of your cost is fixed, the rest of your money is paid out as your employees file claims, which means that any “profit” at the end of the plan year stays in your pockets.

And with plenty of cost-containment solutions in place—including data analytics as well as wellness and concierge programs—you can reduce costs in a number of ways that are seamless to implement and create a positive experience for employees.

Risk-Sharing

Risk-sharing is the key to making group medical captives feasible for smaller businesses. When you band with other small to midsize businesses in a group captive, you share the risk of volatile claims over a larger pool of members.

This allows small businesses to provide the same level of health insurance as Fortune 500 corporations.

Better Profit Potential

A good group medical captive plan can do more than help save money; it can become profitable. Our group captive plans return excess funds paid into your premiums so you can reinvest them wherever you want.

Why Roundstone is the Best Option for Your Group Medical Captive Insurance

We know you have many options for your health insurance, but as the originator of the group medical captive model, at Roundstone, we know what we’re doing. Our focus on customer relationships, level of choice, full disclosure, and cost savings sets us apart from our competitors.

Built to Serve Small to Midsize Businesses

Small and midsize businesses face different challenges from those of larger companies, especially when it comes to health insurance. Roundstone was founded in 2003 as a small business determined to help other small businesses thrive and enjoy the same advantages of larger companies in recruiting and retaining top talent.

While we’ve been fortunate to be featured as an Inc. 5000 fastest-growing company for six years in a row and are now considered a midsize company, we haven’t forgotten our roots.

From starting out as a small business, we understand the challenges of balancing comprehensive healthcare with the financial needs of your business, so we work tirelessly to advocate for you and your unique needs.

We’re so confident our captive program saves money, we use it ourselves. Read the Roundstone Case Study.

We Believe in Data Transparency

At Roundstone, we’re passionate about full disclosure, unlike fully insured insurance carriers.

With Roundstone group medical captive insurance, your data is your own. You will have complete access to all data on how your employees are using their healthcare benefits through our CSI (Cost Saving Investigators) team.

With the CSI Dashboard, you will be able to see exactly where you need to expand or tighten coverage based on the needs of your employees. Our CSI Team works with you to interpret your data and identify cost-containment opportunities.

Roundstone makes this data available while still upholding HIPAA statutes, so your employees’ personal health information remains private.

We Have a Top-Notch Support Team

Health insurance is a complicated topic, and we know that it can feel overwhelming. That’s why Roundstone offers best-in-class customer service to our group captive members.

In addition to our CSI Team, we have Relationship Managers working for you who are always available for questions and constantly working to get you the best coverage at the lowest price.

When you work with Roundstone, you are never on your own. We employ an impressive team of insurance experts so you don’t have to.

Gain Freedom and Support with Roundstone Captive Insurance

At Roundstone, we believe that health insurance should work for you—not the other way around. That’s why we give employers the flexibility, transparency, and support they need to take control of their healthcare spend.

Unlike traditional insurance carriers that lock you into rigid plans, we help you build a benefits package that fits your business, saves you money, and keeps employees happy.

Tailored Plans for Every Business

No two businesses are the same, so why settle for a one-size-fits-all health plan? With Roundstone’s group captive, you have the power to customize every aspect of your benefits strategy.

Whether you need a specific provider network, cost-containment tools, or a wellness initiative, we work with you to design a plan that meets your unique needs.

Full Control Over Your Healthcare Plan

Traditional insurers limit your options, forcing you to pay for services you may never use.

With Roundstone, you call the shots:

- Choose your Third-Party Administrator (TPA) and Pharmacy Benefits Manager (PBM) to align with your company’s goals.

- Access and analyze claims data to track spending, identify trends, and make informed decisions.

- Adjust your plan as needed to ensure cost efficiency and employee satisfaction.

Cost-Saving Strategies That Work

Healthcare costs shouldn’t be a mystery. With transparent data and proactive management, you can reduce expenses without sacrificing quality care.

- Eliminate unnecessary spending on high-cost specialty drugs while ensuring employees get the medications they need.

- Introduce wellness programs that keep your workforce healthier, reducing long-term claims and boosting productivity.

- Take advantage of cost-containment strategies that proactively manage healthcare utilization.

Innovative, Hands-On Support

Navigating self-funding doesn’t have to be complicated. Roundstone provides personalized support at every step, so you never feel like you’re managing your plan alone.

- We help implement and optimize your health benefits strategy to maximize savings.

- Our expert team and CSI Dashboard provide real-time insights into claims and spending.

- We work alongside you to continuously refine your plan, ensuring it evolves with your business.

With Roundstone, you’re in control—without the headaches.

Roundstone Has a Proven Track Record of Saving Companies Money

With a fully insured insurance carrier, 100 percent of your costs are fixed, meaning you can’t control your spending, and the big insurance carriers keep the money you don’t use each year as profit, regardless of how much or how little your employees’ claims cost that year.

At Roundstone, we do just the opposite. We offer two opportunities each year for you to earn cash back:

- You keep unused funds in your self-funded claims account. With our group captive insurance plan, you fund your own employer deductible claims account. Any unused funds in that bank account are yours to keep. Many Roundstone clients are able to build up cash reserves, improve cash flow, and stabilize employee health plan contributions over time.

- Return of unused stop-loss premiums. These premiums go into the shared risk pool layer of your plan. At the end of the plan year, the captive returns any unused amount to employers on a pro-rata basis. Last year, we refunded $12.4 million, 17 percent of the funds contributed.

- One hundred percent of our customers save money—we guarantee it. Two-thirds of our captive members report their savings from the first four years with us pay for their fifth year’s claims. And all without shifting the financial burden of health insurance onto their employees in the form of higher shares of their premiums or increased deductibles and copays.

Take Control of Your Healthcare Costs With a Group Medical Captive With Roundstone

Don’t let fully insured plans dictate your costs and limit your options. With a group medical captive, you gain cost transparency, lower premiums, and control over your plan design—all while sharing risk and saving money.

Ready to break free from rising premiums? Contact Roundstone today to explore how a self-funded group captive can benefit your business.