- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

CFO Leadership Survey: 85% Say Healthcare Costs Are Hurting Profitability

- Abbey Hughes

- 6 Minute Read

- Employers

Find this article helpful? Share it with others.

For most businesses, health insurance now ranks as the second-largest expense after payroll. Yet many companies remain trapped in traditional, fully insured plans that offer little transparency, zero flexibility, and double-digit premium increases year after year.

For most companies, this is a strategic threat. So why do so many finance leaders stick with a model that no longer works?

In many cases, it’s inertia, or the mistaken belief that there’s no better alternative. But that’s changing. The most effective financial leaders aren’t waiting for the next renewal hike.

They’re taking control of their company’s health plan now with a self-funded group captive.

The CFO's Role in Cost Containment Has Never Been More Strategic

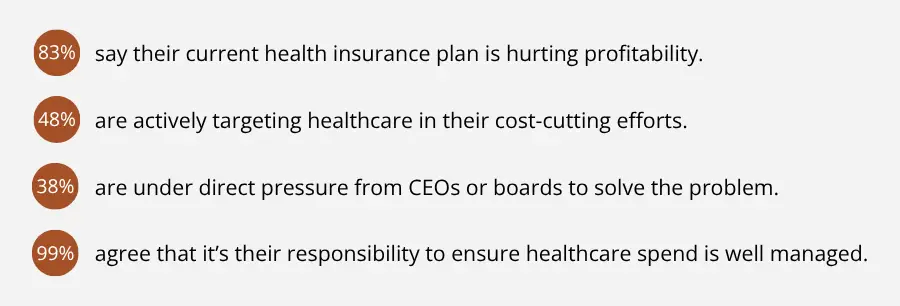

To understand how finance leaders are responding to this challenge nationwide, we partnered with the CFO Leadership Council to conduct a survey of 150 CFOs. What we found was clear: Today’s financial executives are demanding a better approach.

If you’re short on time, here’s what you need to know: The current healthcare model is broken, and PEPY, Per Employee Per Year, cost is the key to fixing it. This blog breaks down the data, benchmarks, and actionable solutions CFOs need to take control of healthcare spend in 2025 and beyond.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

The Brutal Reality: Healthcare Spending Is Out of Control

The numbers tell a harsh story, but despite these testimonials, most CFOs are flying blind. Nearly a third of respondents didn’t know their company’s Per Employee Per Year (PEPY) healthcare cost,an essential basic metric that is table stakes for evaluating plan performance. Only 45% were using it to guide decision-making.

Healthcare costs have spiraled out of control and are an excessive burden for a company our size

CFOs are under pressure from all sides—company boards demanding better margins, HR requiring competitive benefits to retain talent, and employees who expect access to high-quality care. But traditional insurance plans make it almost impossible to deliver on all three.

Premiums keep rising, transparency is nonexistent, and employers are locked into one-size-fits-all plans that fail to meet their needs.

It’s not just frustrating—it’s unsustainable.

PEPY: The Simple Metric That Puts CFOs in Control

If you can’t measure it, you can’t manage it. That’s why understanding your PEPY healthcare cost is a must for any CFO trying to rein in rising expenses.

Despite the simplicity of the PEPY metric, it is still widely unknown. Not utilizing it is like running a business without knowing your cost per unit.

Here’s why PEPY matters: It gives you an apples-to-apples comparison to assess how well your healthcare plan is performing against industry benchmarks. It’s also the fastest way to spot inefficiencies, identify overspending, and find room for improvement.

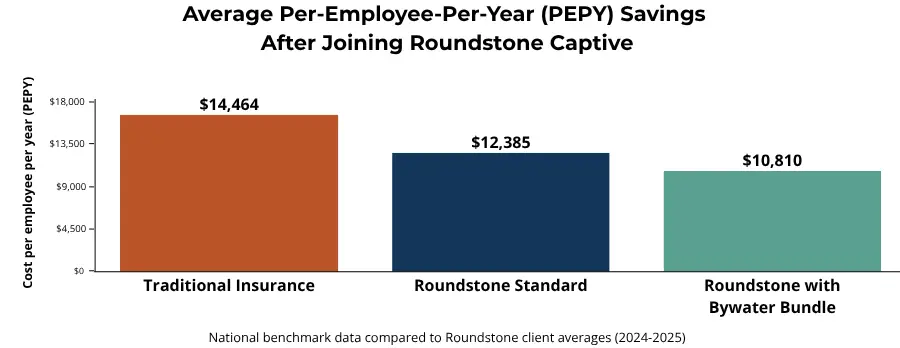

National Benchmark vs. Roundstone's Results

Looking at the numbers, there’s a potential for savings of over $5,000 per employee per year compared to the national average. For a company with 200 enrolled employees, that’s $1 million in potential savings—money that could be reinvested in your workforce, used to enhance benefits, or dropped straight to the bottom line.

Understanding your PEPY isn’t just important, it’s foundational to creating a healthcare strategy that delivers results. - Jonathan McCorkle, CFO of Roundstone

Why CFOs Overlook PEPY—and the High Cost of Inaction

The reason many CFOs overlook PEPY? Lack of data. Fully insured plans often bundle costs and provide little to no transparency into claims data. Without this visibility, CFOs are left guessing whether their plan is working.

Self-funded group captive plans, like Roundstone’s, change that. CFOs gain full visibility into their claims data, empowering them to track PEPY, identify cost drivers, and take proactive steps to improve outcomes.

If you are measuring it but not acting on it, you’re missing one of your biggest opportunities to impact your bottom line.

What’s Holding CFOs Back from Health Insurance Cost Savings?

If the financial upside of managing healthcare costs through PEPY is so clear, why haven’t more CFOs made the switch?

Our survey with the CFO Leadership Council revealed two primary roadblocks:

38% cited implementation complexity

37% pointed to budget contstraints

Let’s unpack both and why they don’t have to stand in your way.

1. Percieved Complexity: "It's Too Much Work"

For many CFOs, the idea of moving away from a fully insured plan feels overwhelming. There’s a myth that self-funding is too complicated, too risky, or too hands-on. And when you’re already wearing multiple hats, the last thing you need is more operational lift.

But with Roundstone, you aren’t alone.

Our team works with your broker to guide you every step of the way, from benchmarking your current costs to designing a plan tailored to your business. We handle underwriting in-house, provide a seamless onboarding experience, and help you select trusted partners like Third-Party Administrators (TPAs) and Pharmacy Benefits Managers (PBMs) from our vetted network.

CFOs tell us all the time: ‘We thought this would be more work—but you made it easy. Rob Hamilton, EVP of Sales at Roundstone

With our Partner Solutions, you also get support identifying high-cost claims, vetting solution providers, and uncovering new cost-containment strategies through transparent claims data on Roundstone Reporting.

2. Budget Concerns: "We Can't Afford to Make a Change Right Now"

Budget cycles are tight, but here’s the catch: Staying fully insured is often the most expensive option.

Fully insured premiums are fixed, whether you use the care or not. You’re paying for someone else’s risk, and any savings go straight to the carrier’s bottom line—not yours.

In contrast, Roundstone’s group captive model lets you:

Only pay for the care you use

Cap your risk with stop-loss coverage

Get a cash refund on unused premiums

Since 2005, we’ve returned over $91.8 million in unused premiums back to our captive members.

Real Results: Cost Containment in Action

The Roundstone model isn’t just theory. It’s working in the real world for real CFOs.

Across industries, companies are reducing healthcare costs, improving employee satisfaction, and gaining the control they’ve never had with fully insured plans.

Here are two powerful examples.

Roundstone Insurance

When Roundstone reached 35 employees, we faced the same challenge many mid-market companies do: double-digit premium increases that threatened our bottom line.

So, we practiced what we preach. We switched to one of our own self-funded group captive plans.

8 consecutive years without raising employee premiums

Over $1 million in cumulative savings compared to our old fully insured plan

A surplus of $224,700 reinvested back into employee benefits

We were able to control costs, and we used those savings to expand benefits and access to care. Some employees now pay less than they did eight years ago, thanks to wellness incentives. Read the full case study.

Totem Solutions: Zero Deductibles, Higher Satisfaction

Totem Solutions, a leading benefits consulting firm in Georgia, made the leap from a traditional PEO health plan to a Roundstone group captive.

They were frustrated with surprise rate hikes, high deductibles, and zero insight into claims data. Sound familiar?

After switching to Roundstone, they achieved:

$0 deductibles fore employees

Lower copays and expanded access to personalized primary care

A 12% refund on unused premiums in year one

A spot on Inc. Magazine’s Best Workplaces list—thanks in part to improved employee satisfaction

And they didn’t stop there. With help from Roundstone’s Partner Solutions Team, Totem used real claims data to find new cost-containment opportunities, fine-tune their plan, and deliver even more value.

These stories aren’t outliers. They’re the outcome when CFOs stop settling for the status quo and start owning their healthcare strategy.

The change has resulted in lower-cost coverage, higher-quality care, and happier employees. - Geoff Rowson, SVP of Sales at Totem

Employee Health Benefits Don’t Have to Break the Budget

If you’re a CFO tired of double-digit renewals, flying blind on claims data, and watching healthcare costs chew through your margin, here’s the good news:

There is a better way.

You don’t have to keep guessing what’s driving your healthcare spend. You don’t have to settle for one-size-fits-none plans. And you certainly don’t have to keep paying for coverage your employees aren’t even using.

With Roundstone, you get:

Transparency into every dollar spent

Flexibility to design a plan that fits your people and your bottom line

Protection against high-cost claims

Savings you can reinvest in your team—or your business

And unlike traditional carriers, we put our money where our mouth is. That’s confidence backed by performance.

Employee Health Benefits Don’t Have to Break the Budget

You’ve read the stats. You’ve seen the real-world results. Now it’s time to explore your options.

Read the full report and learn how finance leaders are using data, benchmarks, and Roundstone’s group captive model to drive down costs and deliver ROI.

Schedule a quick conversation with our team. We’ll help you calculate your PEPY, benchmark your current plan, and show you what’s possible.

You don’t have to wait for the next painful renewal cycle. Start building a smarter, more sustainable healthcare strategy today.

ABOUT THE AUTHOR

Abbey Hughes

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025