Use Data Insights to Cut Employee Benefit Costs and Improve Savings in a Self-Funded Plan

Highlights

- Rising employee benefit costs threaten your company’s bottom line.

- Measuring and analyzing your healthcare data allows you to understand where your highest healthcare costs are occurring and how to mitigate them, which can improve the savings of your self-insured plan.

- With Roundstone’s Area to Impact (ATI) reports, employers can compare their costs to national benchmarks and implement strategies to save money and improve the savings of their self-funded insurance plans.

- Using a cost-controlling transparency tool like an ATI report can help you reduce expenses while providing your employees with top-notch care.

With employee benefit costs increasing, the amount your business spends on healthcare may negatively impact your revenue. To prevent passing those high costs on to your employees through increased premiums or reduced employee benefits, you need to implement cost containment strategies. The beauty of self-insurance is you can implement cost containment strategies to reduce spend and improve savings. But where do you learn how to identify a great cost containment opportunity that delivers results?

Roundstone’s data transparency tools allow your company to identify your biggest healthcare expenses and help find solutions to reduce them. This can substantially improve the savings of a self-funded insurance plan.

The Area to Impact Report: What You Need to Know

The Area to Impact (ATI) report is a newer addition to our data transparency tools, designed to keep you in the know and improve the savings of a self-funded insurance plan. Our team of data analysts and healthcare clinicians dedicate a significant amount of time to compiling health data and reviewing medical records and claims as Cost Savings Investigators.

This work allows them to understand available treatment options and how benefits are currently being used in their self-funded insurance plans. They create reports, including the ATI report, to detect trends in claims and spending. They also address possible solutions to help contain costs.

Roundstone generates a new ATI report for clients every quarter, detailing employer-funded healthcare spending. The reports focus on pressing areas of medical costs, including:

- Mental health services

- Urgent care use

- Prescription costs

Each ATI report presents HIPAA-compliant data visually and narratively to help you understand your company’s healthcare spending trends. Most critically, the ATI report provides actionable insights into your data through the ATI Dashboard.

This tool compares what your business is spending on employee health benefits to national benchmarks and trends for your market and presents the data in easy-to-understand graphs and charts.

You can also download the ATI Companion Guide, which provides a narrative with more insights into your claims information. This companion guide also suggests actionable steps your company can take to help drive down costs and improve the savings of your self-funded insurance plan.

How Claims Data Insights Help You Reduce Employee Benefits Costs and Improve the Savings of Self-Insurance

The disruptions caused by the COVID-19 pandemic, both economically and socially, have increased levels of stress, anxiety, and depression. In the past two years, your workers may have used their mental health benefits for the first time, or increased their use. This is why mental health is an “area to impact” and an opportunity for plan optimization and savings in a self-funded insurance plan.

The sample report below details how one company’s workers used their mental health benefits through one quarter. It shows both the total number of mental health office visits for your company and the rate of visits per 1,000 to compare your rate with the benchmark.

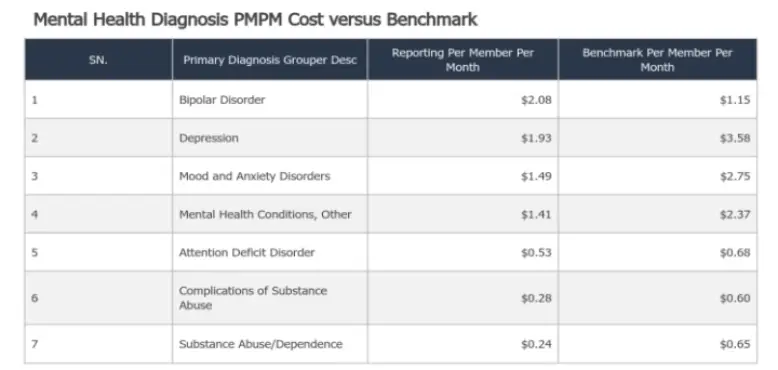

PMPM – Per member per month costs

According to the sample report, this company’s mental health visit utilization rate of 708.99 is 50.30% lower than the benchmark. The report will also note your per member per month (PMPM) costs compared to the benchmark and the number of mental health prescriptions filled.

The quarterly graph charts the number of visits over time, so you can spot longer trends and see when mental health benefits are used.

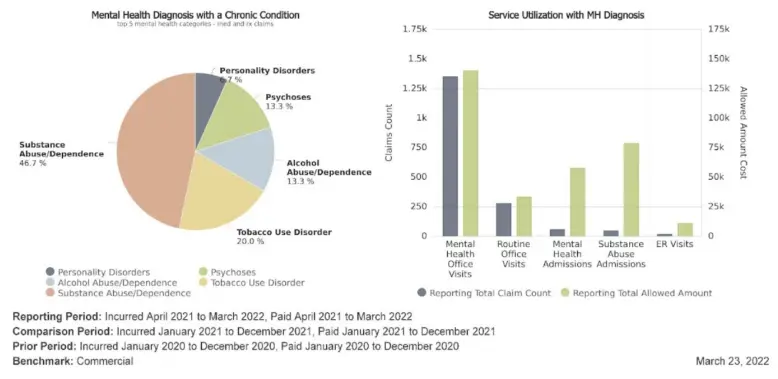

The ATI report details chronic mental health conditions diagnosed and the services employees with mental health conditions used. This information can help identify areas to use cost-savings strategies and improve the savings of a self-funded insurance plan.

The report can help employers understand what visits are needed for chronic mental health conditions. All workers may need to access mental health visits from time to time when dealing with significant life changes. Those diagnosed with a mental health condition may require more routine care to help manage their condition.

Incentivizing them to use lower-cost services — like primary care and telehealth — prevents them from needing more expensive emergency care or hospitalization if their disorder is unmanaged. Implementing an Employee Assistance (EAP) program is another option to assist employees in resolving personal problems that may be negatively affecting productivity and worklife.

You can also achieve savings by seeing what services your covered employees most often use and which can be cut back to lower your costs. The reported claims of office visits by people with a mental health diagnosis are close to the total allowed amount for this company, while mental health admission claims are much lower than the total allowed costs.

If this trend holds, you may be able to reduce your annual mental health admissions costs without it impacting the benefits your employees need. This is a great way to save while simultaneously improving the quality of your self-funded insurance plan.

Cost Containment Strategies for Group Captive Self-Funded Insurance Plans

With an ATI report, you can assess the data to discover cost containment strategies to reduce your healthcare spending in your self-funded insurance plan.

Better Management of Chronic Conditions in a Self-Funded Insurance Plan

From the data provided by the sample ATI report for this company, a significant portion of over-the-benchmark mental health costs is related to depression, substance use disorder, and mental health conditions. Mood and anxiety disorders also account for higher spending than benchmarks.

Depression, mood disorders, and substance abuse are often recurring or chronic conditions. In many cases, mental health diagnoses are also associated with chronic physical conditions. As a cost-saving solution, this company might consider implementing chronic condition management strategies like ongoing employee education and resources and access to patient-centered treatment programs.

By helping their employees better manage these chronic conditions, the company can cut down on recurring mental health visit expenses. This can go a long way in significantly improving the savings of a self-funded insurance plan.

Pharmacy Benefits Solutions

According to the report, this company’s employees had 1,779 antidepressant prescriptions filled, so mental health-related pharmacy spending is an important area to cut costs wherever possible.

This company can address pharmacy costs by working with a transparent or pass-through Pharmacy Benefits Manager (PBM) to help them find affordable prices on mental health medications and offer a predictable pricing structure.

Employee Well-Being Programs

As indicated by the sample ATI report, many employees may benefit from well-being programs that can help them boost their mental health. Well-being programs encourage participants to improve their physical health through nutrition and exercise, positively impacting mental health issues like anxiety and depression.

This company can implement a well-being program to boost overall well-being among employees.

Access to Telehealth Services

Access to mental health providers through telehealth services may provide another cost containment opportunity for this company. Better access to care through telemedicine services means employees get care when needed, typically at a lower cost to their employer. Providing better coverage for telehealth therapy or treatment programs can cut down on long-term mental health costs.

Reduce Employee Benefit Costs with Roundstone’s Self-Insurance Solution

With Roundstone’s self-insurance solution, you can access the information you need to stay in front of rising employee benefit costs. Implementing effective strategies offered through our ATI reports will let you continue to offer the same great benefits to attract and retain workers while remaining financially competitive in your market.

Contact us to learn all the ways your business can benefit from Roundstone’s commitment to data transparency.