This blog was inspired by the webinar Why All Captives Are Not Created Equal, now available on demand. Watch it here.

Highlights

- Knowing how to save money with a captive insurance plan from Roundstone can help you lower healthcare costs for your business – saving 20% on average.

- With a 20-year history, Roundstone is an industry leader in the group captive space, having pioneered the industry’s first captive for self-funded insurance in 2005.

- Roundstone offers better savings and more flexibility than many other group captive providers offering self-funded insurance for company health benefits. It also has high distribution rates and cash returns of unused premiums.

- Roundstone is a trusted partner, providing transparent claims, data access, cost containment solutions, and plans tailored to your employees.

As healthcare costs like premiums and pharmacy spending continue to rise, more employers are turning to alternative funding solutions for their employee health benefits, such as captive insurance, to manage expenses. With a more than 20-year proven track record, Roundstone Insurance is a leader in self-funding, offering substantial savings and personalized service that addresses each business’s unique needs when it comes to company health benefits.

If you plan to transition to self-funding for your employee healthcare plan, choosing the right captive partner is crucial to maximize savings and optimize benefits. At Roundstone, our commitment to cost-effectiveness, data transparency, and high distribution rates ensures businesses get the most out of their company healthcare solutions.

Following are the top six reasons you’ll save money on company healthcare benefits with a group captive plan as part of Roundstone’s self-funded solution.

Watch our on-demand webinar, Captive Essentials Webinar Series Pt 2 | Why All Captives Are Not Created Equal, for even more insights.

1. Guaranteed Savings

Roundstone Insurance offers a strong incentive for businesses to switch from fully insured models to captives: guaranteed savings. Unlike other captive partners, we offer the Roundstone Guarantee, which promises that you’ll save money over a five-year period compared to traditional insurance, or we’ll make up the difference.

This unique guarantee is backed by our innovative approach to insurance, which is tailored to manage risks and control costs, maximizing cost-effectiveness. With risk management strategies like pooled claims funds and stop-loss insurance combined with an employee health plan that meets the needs of your workforce, we limit unnecessary expenses.

As Mike Schroeder, Founder and President of Roundstone, states, “We can pretty much guarantee you’re going to save money because we know there’s a lot of low-hanging fruit that’s in the traditional insurance market that we can cut out in terms of excessive cost.”

This provides financial security and peace of mind for businesses looking to make a smart, future-proof investment in their healthcare funding.

2. Lower Collateral Requirements

In captive insurance, collateral is like a safety net. It’s extra money you set aside when joining a group insurance plan and is only used if insurance claims are higher than expected to cover the extra costs. It’s essentially a reserve fund that ensures everything can be paid for without any surprises. Tapping into collateral is an exceedingly rare event in a sizable, well-established captive like Roundstone.

Roundstone beats the competition by requiring only 7% collateral. We charge a much lower collateral than the typical industry requirement of 11 to 15%. Roundstone also doesn’t stack collateral, meaning collateral is charged two years in a row, as many captives require. Our collateral is a one-time payment, though there may need to be adjustments depending on if the number of covered employees increase or decrease in future years.

This approach reduces initial costs for small to midsize companies and substantially eases the financial burden over time. It also means you can get your unsecured collateral back when leaving the captive, with interest paid. Most other captives will pocket your collateral or only pay back partial credit.

Mike Schoeder explains, “You might ask how Roundstone is able to pull this off, that we’re at least a third and then maybe in some cases 50% of what other captives are charging for collateral. That occurs because over time and as we’ve grown, we’ve been able to negotiate better financial terms with our fronting carriers and our reinsurers, lower costs, lower fixed costs.”

He continues, “We’ve passed those savings on to the captive pool . . . we decided to return those savings and those fixed costs to the employer pool. . . . We move in what’s in the best interest of the employer.”

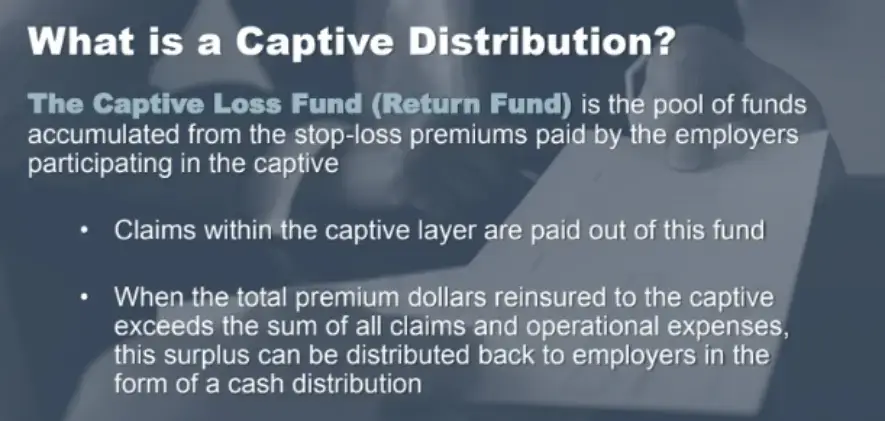

3. 100% Return of Surplus/Unused Premiums

One of the main benefits of choosing a group captive for insurance is the potential to get back unused premiums. However, many captive insurers only return a portion of these funds or restrict how you can use them, limiting the true financial benefit to your business.

With Roundstone, you get back 100% of your unused premiums with no strings attached. This process is quick and straightforward — we give you back your unused premiums with cash distributions just six to eight months after the underwriting year ends. It’s your money – you should get paid back all of your unused healthcare spend, prorata, in cash.

Our focus at Roundstone is on making every dollar work harder for you. By reducing fixed expenses, we maximize the amount of premiums we return to employers. This boosts your company’s financial health and aligns our goals with yours, making Roundstone a trustworthy partner committed to implementing cost containment measures and lowering healthcare benefit expenses.

Hands down, you’ll earn more back with Roundstone. If you take the same amount of money and place it in Roundstone’s Captive and a competitor’s captive, the Roundstone captive will return a greater distribution every time. That’s because our fixed costs are lower – which means you keep more of the savings for your employee health benefits.

4. High Distribution Rates and Low Fixed Costs

Pay attention to distribution rates when looking for a group captive partner as part of a self-funding solution for a group health insurance plan. These affect the portion of funds that can be returned to you at the end of the year.

While many in the industry offer lower distribution rates for unused premiums due to higher operational costs, Roundstone boasts an industry-leading 68-70% loss fund/return fund percentage. This ensures a significant portion of the money you invest in a customized plan can be returned to you.

Mike Schroeder explains how Roundstone does it: “So if you’re with another captive and their return fund is only 60 cents, you know your claims may be more than that and you’re not going to get any money back, whereas with Roundstone you will. Our financial efficiency of low fixed cost and a return of the surplus has allowed us to have a distribution history of 10% over the last five years and 7% since the inception of the program.”

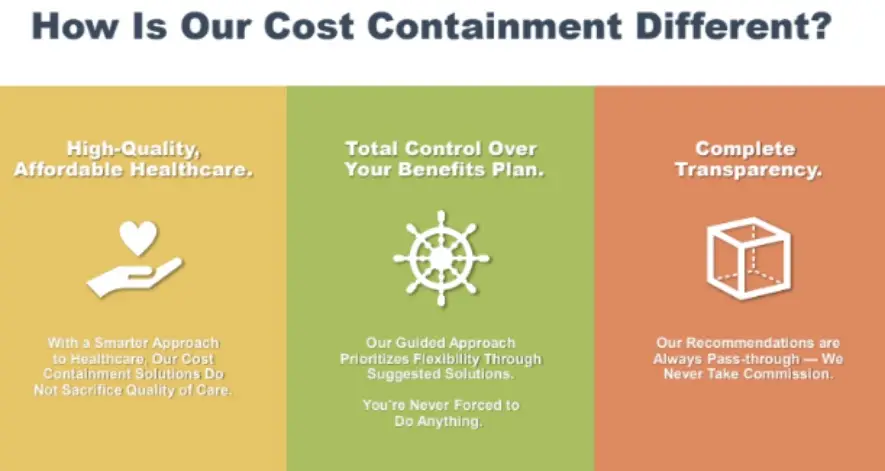

5. Effective Cost Containment Through Data Transparency Means Greater Savings for Your Health Benefits

Fully insured plans often mean you’re working with a lack of data transparency, leaving you in the dark about where your premiums are going. They also tend to cost more year over year. For instance, premiums rose by 7% from 2022 to 2023. Without the ability to implement solutions for healthcare cost control, you’re often paying more for services your employees don’t use or need.

Unlike a standard insurance plan, Roundstone’s group captive arrangement provides transparent claims data to help identify potential areas for cost savings in an employer sponsored insurance plan. Our CSI Dashboard helps you see plan utilization and claims costs and compare them to industry benchmarks. You’re able to make data-driven decisions about plan design changes, such as new vendors or providers, and cut wasteful spending on services you don’t need.

Jasmine Bibb, Vice President of Customer Success, gives an example of an employer dealing with high costs for an employee with a chronic health condition like diabetes:

“We don’t mandate who someone can use. We do have recommendations of vendors that really help when you think about a Pharmacy Benefits Manager (PBM) or disease management or chronic care, but we like to think of it as a library or a directory of options or flexibility. We typically allow from a cost containment perspective for the data to drive those kinds of decisions.”

6. Flexible Plan Design Based on Employer Needs

Many captive insurance providers operate with rigid plan designs, often mandating specific solutions regardless of whether they align with an employer’s health plan needs. This one-size-fits-all approach can lead to paying for services you don’t need, unnecessarily inflating costs in a group health insurance plan.

Roundstone deviates from the standard approach by offering flexible plan designs tailored to the specific healthcare needs of your employees. We use detailed data to inform our recommendations, ensuring that the solutions we propose are relevant, essential, and uniquely suited to your situation when it comes to your employer health plan.

For instance, when A New Start recovery center in Kentucky switched to a Roundstone plan, we looked at their needs and what was already available to them. Since they already had primary care doctors on-site, we were able to set up a primary care program that lowered their deductible and allowed a $0 co-pay for the service.

As part of a Roundstone group captive, you only pay for what you really need, which helps reduce premiums and lowers the burden of unnecessary costs in your employee health insurance. With us, you get a partner who listens and responds to your needs, developing a plan that fits and supports your business objectives.

Learn More

Watch our Captive Essentials Webinar Series to learn more about the Roundstone Guarantee and our unique, self-funded solutions for small to midsize businesses.

Save Money with a Captive Insurance Plan From Roundstone

Roundstone is an innovative employee health benefits company. We help small and midsize businesses offer competitive benefits at a lower cost by self-funding health insurance through our group medical captive. The Roundstone Captive enables companies to self-insure safely by pooling hundreds of employers together to share risk and save money.

With easy onboarding and personalized support every step of the way, the Captive offers control, flexibility, and transparency and returns all savings back to employers where they belong. We believe in always aligning with the employers’ best interests and remain committed to our mission — quality, affordable healthcare and a better life for all.

Ready to work with an insurance partner who can help you lower costs and provide better coverage to your employees? Talk to your Roundstone today. We’ll explain how group captive insurance works as part of self-funding and why it can help you see more flexibility and thousands in premium savings year over year.