Highlights

- Recent trends show a steep rise in the cost of traditional health insurance.

- Increasing insurance prices are causing adverse effects on businesses and their employees.

- Despite those trends, group captive insurance members are saving money and getting better coverage.

- A group captive plan from Roundstone gives you the freedom and control to build your own insurance plan, one that saves you money.

The Kaiser Family Foundation recently released their 2021 Employer Health Benefits Survey. The results, as expected, are discouraging. Yet, despite out-of-control annual increases in the cost of small business health insurance, most Roundstone group captive insurance members actually saved money in 2021 while providing their employees with high-quality care. Read on to learn how they’re bucking the trend.

The Trend

Here’s what the 2021 employee-sponsored health insurance market looked like, according to the Kaiser survey:

- Average single annual premiums are up to $7,739 per person.

- The average premium cost for family coverage is $22,221.

- Premiums increased 4% in the last year alone.

- The average worker is contributing $1300 per year for a single employee and $6,000 for family coverage; employers are paying the rest.

- Premiums have increased 22% in the previous five years and 47% in the last 10 years.

- This increase is much higher than the 10-year increase in wages (31%) or inflation (19%).

- On average, covered workers in small companies paid a higher percentage of their premiums (37%) than those in larger companies (24%).

Not surprisingly, the cost of health insurance is projected to continue rising. Employee contributions are expected to grow by 2%, while employer contributions are estimated to increase by 5% in 2022.

Impact of Rising Insurance Costs

As the expenses associated with fully insured employer-sponsored insurance plans continue to increase, businesses and their employees are feeling the effects. These include employment cuts, reduction in health benefits, higher deductibles, and more out-of-pocket costs.

Employment Cuts

To offset the cost of health insurance, some employers reduce the size of their workforce. They may lay off staff or place a freeze on hiring new employees. A common trend in recent years is for a company to place more responsibility on full-time workers with health insurance or to hire a team of part-time workers who are ineligible for benefits.

Reduction in Health Benefits

Employers who struggle to find affordable health insurance may choose to reduce the number of benefits their employees receive. For example, in 2021, around 33% of employers are narrowing their provider networks, limiting the care their employees can access.

Higher Employee Contributions

Although businesses are reluctant to increase employees’ share of their premiums, rising costs often force them to ask for higher contributions from their workers. This results in employees paying more out of their paycheck each month, effectively reducing take-home pay. It also negatively affects the company’s ability to retain and attract new employees.

High Deductibles and Copays

Some employers are switching to high-deductible plans and increasing co-pays, placing a greater financial burden on their employees and reducing healthcare accessibility. This reduces monthly premiums but is difficult for many people who can’t afford services upfront.

It’s also a short-sighted solution, as many people forgo primary care and routine screenings because of the high out-of-pocket costs, often resulting in more expensive healthcare needs later. It may sound counter-intuitive, but making primary care accessible and affordable upfront reduces catastrophic claims costs later. Health insurance is one market where it literally pays (in savings) to play the long game and make a long-term plan.

Fully Insured vs. Group Captive Plans

As companies look for new ways to combat rising health insurance prices, many turn to innovative solutions like Roundstone’s self-funded group captive plan.

In the traditional insurance model, you choose a health insurance plan, typically among very few choices. Once chosen, you have no control over any aspect of your plan. You are stuck using the vendors, network providers, and pharmacy benefits manager (PBM) your fully insured insurance carrier chooses for you.

Worst of all, you can’t see where your premiums are going because the large insurance carriers won’t provide that information.

Compared to the traditional model, group captive plans offer employers more control over what they cover and what they do not. Roundstone members design their own coverage plan according to the needs of their company and employees. They choose their third-party administrators (TPAs), network providers, vendors, and PBMs.

With a Roundstone group captive plan, members also enjoy full data transparency regarding their claims data. They see exactly where their healthcare dollars are being spent. As a result, they can implement cost-containment strategies to keep costs low, just as they do with any other business expense.

How Roundstone Group Captive Members are Saving

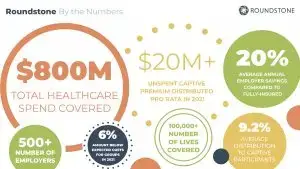

A group captive plan with Roundstone helps members save by focusing on choice, control, and transparency. So how did Roundstone clients perform in 2021?

- 20% average annual employer savings compared to fully-insured.

- 9.2% average distribution to captive participants.

- $20M+ unspent captive premium distributed pro rata in 2021.

- 6% amount below expected costs for groups in 2021.

Roundstone clients save twice: by keeping 100% of their unused claims funding and receiving a distribution check at the end of the year. Want to replicate these numbers in your own health plan? Here’s how we do it:

Freedom of Choice

With a group captive plan, you choose your vendors and network providers. You pick vendors that meet your employee-specific needs rather than pay for services and benefits your workers don’t use. You can also choose low-cost, high-quality providers who may not be included in your fully insured plan’s network.

With a Roundstone group captive plan, members get to choose:

Third-party administrators

Group captive members save when they pick a TPA who works with similar-sized companies. TPAs handle all the administrative burden, so working with a TPA you know and trust and who communicates openly saves you money and administrative hassle.

Pharmacy benefit managers

In the traditional model, PBMs often work for the BUCAAs (Blue Cross and Blue Shield, UnitedHealth Group, Cigna, Aetna, and Anthem), so any savings they’re able to negotiate on drugs go back to the insurance carriers, not to employers.

With a group captive plan, you are free to choose a PBM who operates on a pass-through or transparent basis, which allows you to see their fees up front. Additionally, savings and rebates they negotiate on prescription drugs are passed on to captive group members, not to the mega carriers.

Full Data Transparency for Cost Control

Fully insured plans don’t allow you access to your claims data, preventing you from understanding how your claims affect costs. With a group captive plan from Roundstone, you can access your claims data at any time through our CSI Dashboard.

You’ll be able to compare your data to national benchmarks. You will also have access to our Cost Savings Investigator (CSI) Team, who will work with you to identify opportunities for cost savings so you can make changes, often without having to wait until your next annual renewal.

Unused Premium Refunds

With a group captive plan, you profit when you lower expenses. If you have unused premiums at the end of the year, Roundstone issues you a 100% refund on those unspent funds.

What’s more, Roundstone group captive members also receive an annual distribution check of the captive’s leftover pooled stop-loss premium money on a pro rata basis.

Roundstone guarantees that its members will save money over five years. On average, our members save around 20%; over two-thirds of our captive members save enough in their first four years in the plan to cover their fifth-year premium costs.

Find Out How Your Company Can Buck the Trend

Group captive members are saving money on health insurance costs despite the ever-spiraling increase in health insurance premiums in the fully insurance market. With self-funded group captive insurance, you have transparent access to claims data and the freedom to build a plan that works for you.

To find out why group captive insurance with Roundstone is a better alternative than fully funded insurance. Book a demo and benchmark review today.

The secret is out! There’s a new way to approach employee insurance plans.