- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

How Strategic Chronic Disease Management Lowers Healthcare Costs in a Self-Insured Plan

- Roundstone Team

- 11 Minute Read

- Category Here

Find this article helpful? Share it with others.

Twenty percent of your employees are generating 80% of your healthcare costs. You know this pattern exists. What you probably don’t know is which twenty percent, what conditions are driving the spend, or what you can do about it.

That’s by design.

Fully insured carriers profit from keeping you in the dark. They aggregate claims, hide the data, and send you a renewal notice with double-digit increases. You can’t see the patterns. You can’t intervene, so you can’t control costs.

Self-funded health insurance through a medical captive changes this completely.

Why Chronic Disease Management Matters for Self-Funded Employers

Chronic conditions represent the single largest driver of healthcare spending for American employers. For self-funded employers, this concentration creates both a challenge and an opportunity.

Unlike fully insured plans where you have no visibility into spending patterns, chronic disease management in self-funded plans puts you in control. You can identify which employees need support, put targeted programs in place, and directly benefit from every dollar saved.

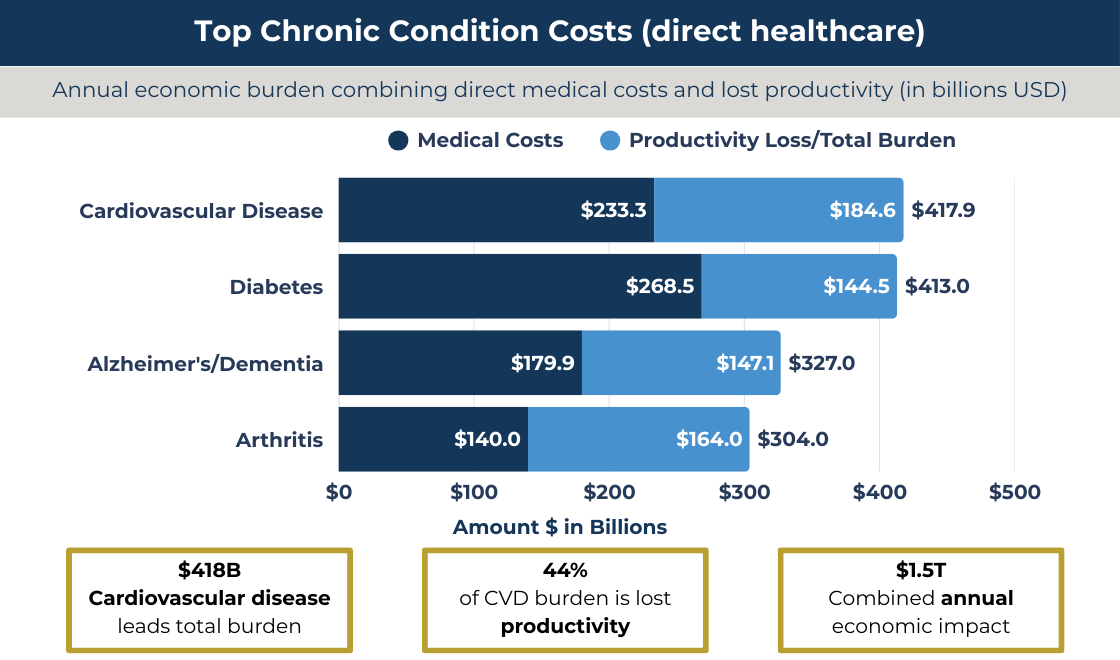

The Financial Impact of Chronic Disease on Healthcare Costs

According to the Centers for Disease Control and Prevention (CDC), six in ten Americans live with at least one chronic disease. These conditions account for 90% of the nation’s $4.5 trillion in annual healthcare spending. They hit self-funded employers particularly hard because you pay these claims directly.

Chronic conditions drive spending through multiple channels that compound over time:

Total national impact: Chronic diseases and mental health conditions drive 90% of all U.S. healthcare expenditures.

Direct costs: Direct healthcare treatment for chronic conditions now exceeds $2.2 trillion annually.

Employer productivity loss: Poor workforce health costs U.S. employers $575 billion annually in lost productivity.

The "hidden" cost: For every $1 spent on healthcare benefits, typically another $0.61 is lost to illness-related absence and reduced performance.

Time away: U.S. workers lose nearly 1.5 billion days annually to illness and injury.

Sources: CDC (2024), Integrated Benefits Institute (2020)

How Recurring Care Costs Compound Over Time

Employees with diabetes, heart disease, or asthma require ongoing medication, regular specialist visits, and continuous monitoring. These aren’t one-time expenses. They’re recurring costs that compound month after month, year after year. When poorly managed, costs escalate dramatically.

Preventing Complications That Drive Exponential Cost Increases

Poorly managed chronic conditions lead to emergency department visits and hospital admissions. An employee with poorly managed diabetes may develop kidney disease requiring dialysis or cardiovascular complications demanding extensive intervention. Each outcome costs exponentially more than proactive disease management.

A single preventable hospitalization can cost more than years of proactive chronic disease management combined.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

Data Sources: American Diabetes Association (2024); American Heart Association (2025 Update); Alzheimer’s Association (2024); National Association of Chronic Disease Directors

The Hidden Costs: Productivity Loss and Absenteeism

The Integrated Benefits Institute reports that poor health costs the U.S. economy $575 billion annually, with chronic disease driving much of this loss through absenteeism and reduced productivity. That’s lost output your company absorbs.

Comorbidities compound the problem. Employees with diabetes often develop hypertension, cardiovascular disease, or depression. Each additional condition adds medical expenses while reducing productivity and increasing time away from work.

Turning Predictable Risks into Cost Containment Opportunities

Here’s the opportunity: chronic disease spending follows identifiable patterns. You can see these patterns in your claims data. That means you can interrupt them before costs spiral out of control.

This is where cost containment in healthcare becomes most effective. With claims transparency, you spot the high-risk employees early and intervene strategically.

Strategic interventions reduce expenses while improving employee quality of life, a rare win-win in healthcare finance.

Chronic disease management is a proactive, data-driven system for keeping employees with ongoing conditions stable and out of the hospital. Instead of waiting for expensive episodes like ER visits, uncontrolled diabetes, or unmanaged hypertension, you identify risks early, intervene quickly, and maintain steady health over time.

The shift is simple but powerful: from reactive sick care to continuous health management. Fully insured plans hide the claims data you need to do this. Self-funded plans make it possible.

To learn more about what fully insured carriers won’t tell you, download our free guide.

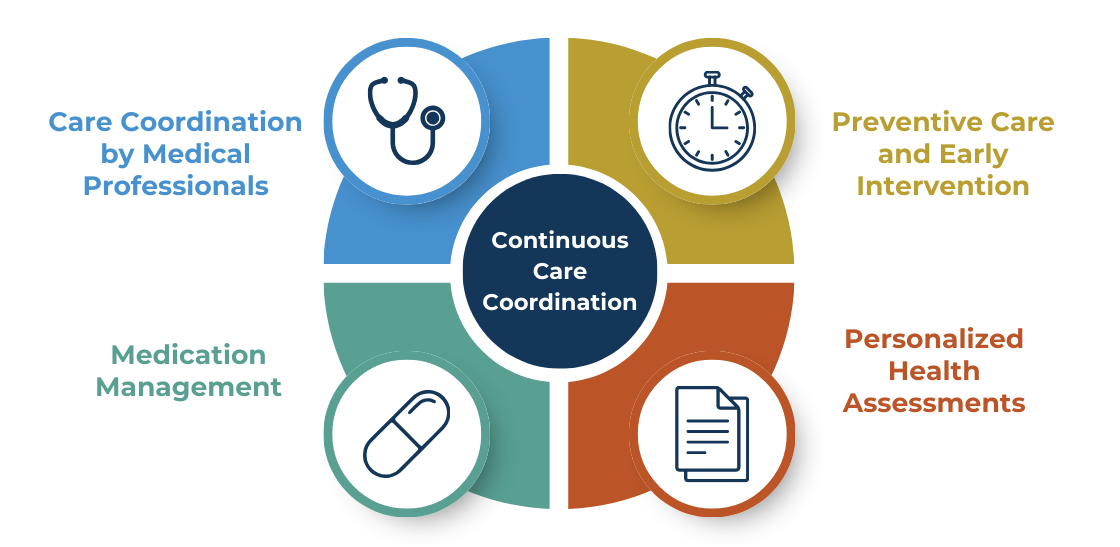

Implementing Clinical Care Management for Chronic Conditions

Once you have access to real claims visibility, clinical care management is the expert layer that turns data into action. Registered nurses and healthcare professionals step in as care navigators for employees with complex or chronic needs, preventing the small issues that become catastrophic claims.

Care Coordination by Medical Professionals

Care managers guide employees through the healthcare system. They coordinate appointments, see that providers share information, and help employees understand their conditions. The Agency for Healthcare Research and Quality shows coordinated care reduces medical errors and improves outcomes, which directly reduces high-cost claims.

Personalized Health Assessments

Generic wellness programs alone don’t move numbers. Clinical managers work with physicians to build individualized plans tailored to each employee’s condition and medical history. This personalized approach allows for evidence-based interventions.

Medication Management

Medication non-adherence costs the U.S. system between $100 billion and $289 billion annually, according to the National Council for Mental Wellbeing. Care managers make sure employees stay on track, manage side effects, and access financial assistance to avoid hospitalizations and worsening chronic disease.

Preventive Care and Early Intervention

Continuous monitoring catches issues early. When warning signs are addressed before they escalate, you avoid the ER visits and inpatient admissions that drive the majority of claims.

Clinical care management is how health plans actually bend the cost curve to reduce cost-shifting to employees and keep people healthier at the same time.

Direct Primary Care (DPC): A Proactive Approach to Disease Management

Direct primary care (DPC) gives employees unlimited access to their primary care physician for a flat monthly fee, typically $50 to $150, with no copays or claim forms. With insurance billing out of the picture, physicians can focus on care instead of throughput.

How DPC Cuts Costs

According to GoodRx, DPC physicians typically care for 600 patients instead of 2,500+. That means:

30–60 minute visits instead of 7–10

Same-day or next-day appointments

More time for chronic disease coaching

Early intervention before costly care is needed

The Society of Actuaries reported roughly 40% fewer emergency department visits and 53% lower ER spending for employees in a direct primary care-style model compared with traditional plans.

Sources: Rowe et al., 2017; Brekke, 2016; Colorado Health Institute, 2018; Society of Actuaries, 2016–2020; Mercatus Center, 2019.

Integrating DPC With Self-Funded Plans

In a self-funded plan, DPC becomes a strategic asset. Data flows to your third-party administrator (TPA) and clinical care management team, giving them earlier signals and faster opportunities to intervene. You have the flexibility to choose DPC partners based on your claims trends rather than a carrier’s network limitations.

Read 8 Secrets to Finding a TPA That Fits Your Self-Funding Needs to learn how to evaluate these partners.

How Self-Funded Plans Enable Effective Chronic Disease Management

Self-funded health insurance provides structural advantages unavailable in traditional fully insured arrangements.

Using Claims Data Transparency to Identify Risks

You get detailed information showing which chronic conditions affect your population, medication adherence patterns, and opportunities for intervention. Roundstone Reporting provides actionable insights into chronic disease populations, letting you measure program effectiveness and adjust strategies in real time.

With fully insured plans, you’re flying blind. With self-funding, you see exactly where your healthcare dollars are going and can act on that information immediately.

Flexibility to Customize Programs

You can put targeted interventions in place based on your population’s specific needs. If claims data reveals high costs from poorly controlled diabetes, you can add a diabetes management program mid-year without waiting for renewal.

This flexibility means you’re not stuck with one-size-fits-all solutions that don’t address your actual cost drivers.

Vendor Choice and Integration

You select best-in-class chronic disease management partners rather than accepting dictated vendors from fully insured carriers.

Want to work with a specific direct primary care provider? Need a specialized diabetes management program? You have the freedom to choose partners that deliver real results for your population.

Financial Incentives Aligned with Outcomes

You directly benefit from every dollar saved through chronic disease programs. In fully insured plans, carriers keep all savings while you pay increasing premiums.

When your chronic disease management program prevents a hospitalization, that savings stays with your company. When medication adherence improves and complications decrease, you see those cost reductions in your bottom line.

Implementing Chronic Disease Management Programs: 4 Practical Steps

Effective chronic disease management requires a systematic approach that builds on data insights and gets employees involved proactively.

1. Analyze Your Claims Data

Work with your TPA and clinical team to identify which chronic conditions are most common, which drive the highest costs, emergency department use patterns, medication adherence rates, and high-risk individuals who may benefit from intervention.

2. Select Evidence-Based Interventions

The National Association of Chronic Disease Directors maintains resources on evidence-based programs. Effective interventions include clinical care management with nurse coordinators, direct primary care partnerships, condition-specific programs, pharmacy optimization through PBMs as your self-funded plan’s secret weapon, and behavioral health integration.

3. Engage Employees Proactively

Programs only succeed when employees participate. Use personal outreach from clinical staff, eliminate financial barriers by removing copays for chronic disease care, provide convenient access through telemedicine and DPC, communicate clear benefits, and make sure participation is voluntary with strict HIPAA protections.

4. Coordinate Care and Monitor Outcomes

Make sure your TPA, clinical team, PBM, and specialty vendors share data and coordinate interventions. Track cost trends, clinical outcomes, engagement levels, and employee satisfaction using Roundstone Reporting and regular reviews.

Cost containment strategies for managing catastrophic diagnoses provide additional frameworks for tracking outcomes.

Benefits advisors: Lead your clients to real savings while you grow your business.

Roundstone's Integrated Approach to Chronic Disease Management

Roundstone’s model uniquely supports complete chronic disease management through integrated components that work seamlessly together. Here’s how each piece contributes to better outcomes and lower costs:

Group Medical Captive Structure

The group medical captive pools risk across hundreds of employers, providing stability that makes long-term investment in chronic disease programs possible without punitive rate increases.

When you invest in proactive chronic disease management, you’re not penalized with higher premiums the following year. The captive structure protects you from volatility while you build healthier, more cost-effective outcomes.

Bywater TPA Integration

Bywater TPA integration provides claims administration with clinical expertise built in, making sure interventions are put in place quickly without friction.

There’s no delay between identifying an opportunity and taking action. The clinical team and administrative team work as one unit, streamlining everything from data analysis to program implementation.

Roundstone Reporting

Roundstone Reporting provides dedicated support to analyze claims data, identify chronic disease opportunities, and recommend evidence-based interventions with real-time visibility into program performance.

You’re not left to figure out the data on your own. Expert analysts identify your highest-impact opportunities and track results as programs are implemented.

Vendor Flexibility

You select chronic disease management vendors that best fit your population. Want a specific diabetes management program? Prefer a particular direct primary care provider? You have the freedom to build the right solution for your employees.

Proven Results

Roundstone members putting complete programs in place achieve meaningful cost reductions while maintaining or improving quality of care. Self-funded employee satisfaction improves when chronic disease management provides tangible support. They benefit from better health, easier access to care, and lower out-of-pocket costs.

Learn how Roundstone employees had no premium increase for 8 straight years.

Measuring Success: ROI and Key Metrics

Complete measurement captures cost, clinical, and engagement outcomes. Here’s what to track to understand whether your chronic disease management programs are delivering results:

Cost Metrics

These numbers show the financial impact of your chronic disease management efforts:

Per-employee-per-year costs for chronic disease populations

Emergency department use and costs

Hospital admission rates

Pharmacy spend for chronic conditions

Total medical cost trends year over year

When these metrics trend downward while quality stays consistent or improves, you know your programs are working.

Clinical Metrics

These indicators measure whether employees with chronic conditions are getting healthier:

Medication adherence rates

Condition control measures like HbA1c for diabetics

Preventable complication rates

Primary care engagement

Specialist visit appropriateness

Better clinical outcomes directly translate to lower costs and healthier, more productive employees.

Engagement Metrics

Programs only work when employees participate. Track these measures to understand adoption:

Enrollment rates in chronic disease programs

Care plan completion

Employee satisfaction with chronic disease support

Health risk assessment participation

High engagement typically predicts strong cost and clinical outcomes within 18 to 24 months.

HR professionals: Learn why switching to self-funding is easier than you think.

Overcoming Challenges in Chronic Disease Management Implementation

Implementing chronic disease management programs comes with predictable obstacles. Here’s how to address the most common concerns:

Employee Privacy Concerns

Employees worry about who sees their health information. Address this head-on through strict HIPAA protections, de-identified aggregate data, and voluntary programs that are supportive rather than punitive.

Make it clear: participation is always voluntary, health information stays private, and the goal is to help—never to penalize employees for health conditions.

Low Participation Rates

Programs only work when employees engage. Boost participation by:

Eliminating all financial barriers (no copays for chronic disease management visits)

Providing convenient access through telemedicine and direct primary care

Using personal outreach from trusted clinical staff, not automated emails

Communicating benefits in terms employees care about—feeling better, spending less on medications, avoiding complications

When employees see tangible benefits without added costs or hassle, participation rates climb.

Measuring Impact Takes Time

Don’t expect overnight results. Many payers and vendors report achieving positive ROI from population health initiatives within roughly 2–3 years, depending on program scope and baseline risk, but timelines vary widely.

Set appropriate expectations with leadership and highlight early indicators like improved engagement rates, reduced emergency visits, and better medication adherence. These leading indicators predict long-term cost savings.

Integration Complexity

Coordinating between your TPA, clinical team, PBM, and specialty vendors can get complicated fast. Roundstone’s integrated model solves this challenge—Bywater, the CSI Team, and clinical partners coordinate seamlessly from shared data.

You get one team working from one data source with one goal: better health outcomes at lower costs without data gaps or coordination headaches.

Why Investing in Employee Health Pays Off

In a traditional fully insured model, effective chronic disease management creates a perverse incentive: If you successfully lower claims by keeping employees healthy, the carrier keeps the savings and likely still raises your rates.

Your hard work increases their profit margin, not your bottom line.

Roundstone’s Group Medical Captive changes the financial equation entirely. By self-funding with Roundstone, you align your company’s financial incentives with your employees’ health.

You Keep the Savings

When proactive management prevents a $100,000 hospitalization, that capital stays in your plan rather than disappearing into a carrier’s black box.

You Share in the Success

Because you are part of a captive, effective risk management across the pool leads to annual distributions. When the group performs well, you get a check back. Unused premium is returned to you, not kept by an insurance giant.

You Stop the Trend

Instead of accepting a 15% annual increase as “market trend,” you actively bend your own cost curve, stabilizing expenses for the long term.

Partner With Roundstone for Proactive Cost Containment

It takes more than good intentions to implement a chronic disease management program. You need the right data, the right partners, and the right infrastructure.

You don’t have to build this alone.

Roundstone empowers you to move from reactive “sick care” to continuous health management. We provide the claims transparency to spot risks early, the clinical care management to support your most vulnerable employees, and Roundstone Reporting to help you implement best-in-class solutions.

Stop paying for preventable complications and start investing in a system that rewards you for a healthier workforce.

Contact Roundstone today to request a proposal and see how active chronic disease management can lower your costs.

Alzheimer’s Association. “2024 Alzheimer’s Disease Facts and Figures.” Alzheimer’s Association, 2024. Accessed 23 Jan. 2026.

American Diabetes Association. “Economic Costs of Diabetes in the U.S. in 2022.” Diabetes Care, 2024. Accessed 23 Jan. 2026.

American Heart Association. “Heart Disease and Stroke Statistics – 2025 Update.” American Heart Association, 2025. Accessed 23 Jan. 2026.

Brekke, K. “Direct Primary Care: Evaluating an Emerging Model.” Health Watch Newsletter, Society of Actuaries, May 2016. Accessed 23 Jan. 2026.

Centers for Disease Control and Prevention. “About Chronic Diseases.” CDC, updated 12 Jan. 2026. Accessed 23 Jan. 2026.

Centers for Disease Control and Prevention. “Fast Facts: Health and Economic Costs of Chronic Conditions.” CDC, 2025. Accessed 23 Jan. 2026.

Colorado Health Institute. “Direct Primary Care: An Innovative Alternative to Traditional Health Insurance.” Colorado Health Institute, 2018. Accessed 23 Jan. 2026.

GoodRx Health. “What Is Direct Primary Care (DPC)?” GoodRx, n.d. Accessed 23 Jan. 2026.

Integrated Benefits Institute. “Poor Health Costs U.S. Employers $575 Billion in 2019.” Integrated Benefits Institute, 2020. Accessed 23 Jan. 2026.

Mercatus Center at George Mason University. “The Benefits of Direct Primary Care: Improving Quality and Reducing Costs.” Mercatus Center, 2019. Accessed 23 Jan. 2026.

National Association of Chronic Disease Directors. “Arthritis: A Chronic Disease Fact Sheet.” National Association of Chronic Disease Directors, 2025. Accessed 23 Jan. 2026.

National Association of Chronic Disease Directors. “Resources: Evidence-Based Public Health Programs and Practices.” National Association of Chronic Disease Directors, n.d. Accessed 23 Jan. 2026.

National Council for Mental Wellbeing. “Medication Adherence and the Cost of Nonadherence.” National Council for Mental Wellbeing, n.d. Accessed 23 Jan. 2026.

Rowe, K., et al. “Direct Primary Care: An Innovative Alternative to Traditional Health Insurance.” Journal of the American Board of Family Medicine, 2017. Accessed 23 Jan. 2026.

Society of Actuaries. “Direct Primary Care Evaluation Model.” Society of Actuaries, 2016. Accessed 23 Jan. 2026.

Society of Actuaries. “Evaluating the Impact of Direct Primary Care: An Actuarial Model.” Society of Actuaries, 2020. Accessed 23 Jan. 2026.

U.S. Agency for Healthcare Research and Quality. “Care Coordination.” AHRQ, n.d. Accessed 23 Jan. 2026.

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025