- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

Pharmacy Benefit Managers: Your Key to Self-Funded Cost Containment

- Roundstone Team

- 8 Minute Read

- Category Here

Find this article helpful? Share it with others.

Pharmacy benefit managers (PBMs) can reduce prescription drug costs by 20–30% through transparent partnerships, making them essential for healthcare cost containment. The right PBM strategy can save employers thousands annually while improving employee access to medications.

As prescription drug prices continue to climb, employers need cost containment strategies that work—not just for the short term, but as part of a comprehensive, long-term plan. That’s where a pharmacy benefits manager (PBM) comes in.

The right PBM plays a strategic role in cost containment—not just by lowering pharmacy spend, but by contributing data and clinical tools that support broader initiatives like claims analysis, chronic disease management, and catastrophic risk mitigation.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

Why Pharmacy Cost Management Is Critical for Cost Containment

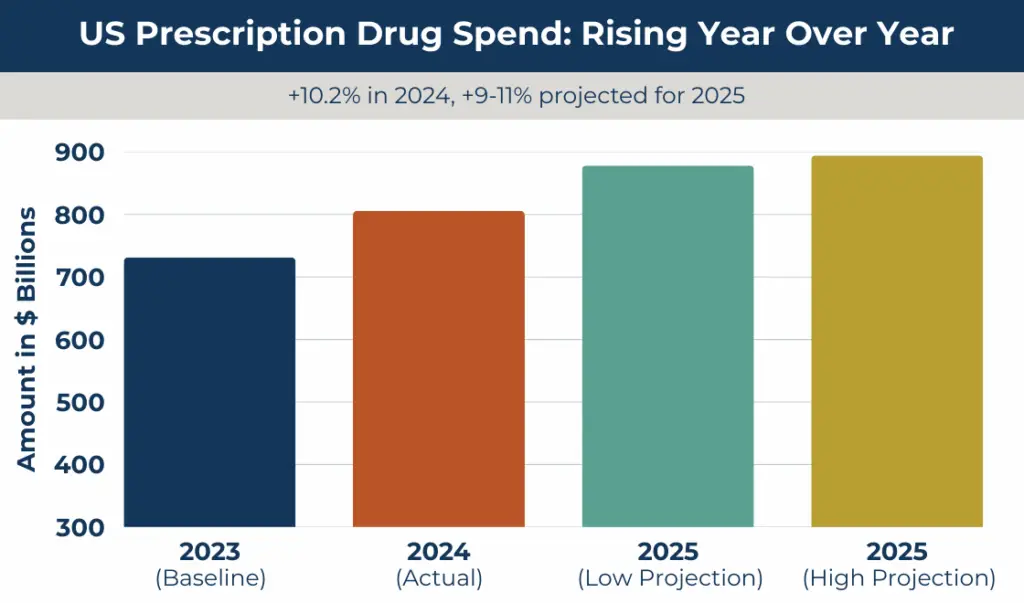

Prescription drugs account for 18% of total healthcare spending. Those costs increased by 10.2% in 2024 and are projected to increase another 9% to 11% in 2025. For self-funded employers, pharmacy cost management is one of the five core cost containment strategies that can reduce total healthcare spend by up to 34%.

Transparent PBM partnerships reduce costs by 20–30%, generic drug utilization saves 80–85% over brand-name medications, specialty drug management prevents catastrophic claims, and clinical programs ensure appropriate medication use and cost control.

Pharmacy savings are just one part of a broader cost containment strategy that puts employers in control of their healthcare spending.

To understand how PBMs deliver these savings, let’s start with the basics.

What Is a Pharmacy Benefit Manager (PBM)?

A pharmacy benefit manager administers prescription drug benefits for health plans, negotiating prices with manufacturers and pharmacies to reduce the costs of medication for employers and employees.

Managing pharmacy costs effectively starts with understanding your PBM. In a self-funded environment, your PBM isn’t just a vendor—they’re a strategic lever in your cost containment toolkit.

A PBM acts as the intermediary among drug manufacturers (negotiating rebates and pricing), pharmacies (establishing networks and reimbursement terms), health plans (managing formularies and prior authorizations), and patients (enabling access to affordable medications).

While fully insured plans include a PBM by default, you don’t get to choose which one—and often can’t see what they’re charging. With a self-funded plan, you choose the PBM that delivers the most value for your people and your bottom line.

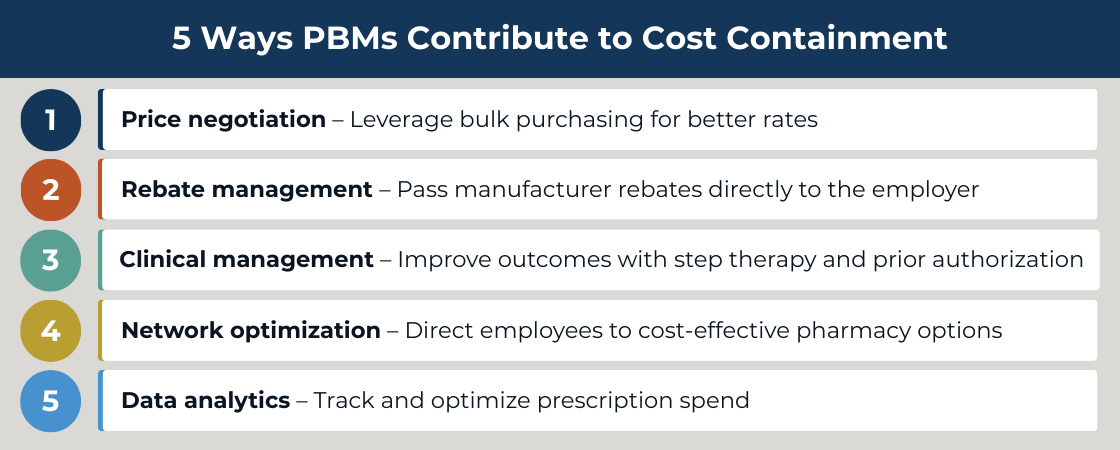

PBMs contribute to cost containment through five main functions:

These five PBM functions become even more powerful when they work alongside your other cost containment initiatives.

How Pharmacy Cost Management Integrates with Other Cost Containment Strategies

A truly effective pharmacy cost containment strategy doesn’t operate in a silo—it works in close coordination with your third-party administrator (TPA). When your PBM and TPA align under a self-funded group captive plan, you gain a fully integrated approach to managing healthcare costs.

Your TPA plays a critical role in turning pharmacy savings into long-term value. From integrated claims analysis to coordinated care navigation and vendor oversight, their collaboration with your PBM ensures that cost containment strategies work seamlessly across your entire plan.

Pharmacy data fuels this broader ecosystem. It enhances claims analysis, supports per employee per year (PEPY) metrics, and enables predictive analytics to identify high-cost drug trends before they escalate.

PBMs also support employee wellness initiatives by promoting medication adherence and effectively managing chronic conditions. Preventive drug coverage reduces downstream medical claims, contributing to better outcomes and greater long-term savings.

And for high-cost specialty drugs, PBMs can work with your stop-loss insurance to minimize the impact of catastrophic claims. Transparent PBM pricing enhances your ability to forecast and control your healthcare budget, strengthening your overall risk management strategy.

For more information about how captives help control prescription drug costs, download our free ebook Strategies to Contain the Rising Costs of Pharmacy.

CFOs: Learn how self-funding can reduce your annual healthcare spend by 20%.

Real-World Pharmacy Cost Containment Results

At Roundstone, we’ve seen firsthand how transparent PBM partnerships support a much larger cost containment strategy. PBMs are often the unsung hero in a savings story that also includes data analytics, wellness engagement, and smart stop-loss coverage.

Here’s a realistic example of how it plays out in the real world:

Company Profile: 150-employee manufacturing company

Challenge: Rising pharmacy costs caused 15% annual premium increases

Solution: Transparent, pass-through PBM model

Results:

- $60,000 saved annually (35% reduction in pharmacy spend)

- $400 per employee per year in savings

- Zero hidden fees—full rebate pass-through

- Improved access through manufacturer coupon programs

When combined with other strategies, this employer also realizes an additional $25,000 in medical savings via data analytics and $15,000 in preventive care savings through their wellness program—for a total of $100,000 saved annually, a 28% reduction in overall costs.

What drove these results? A transparent PBM partner, effective clinical programs like step therapy and prior authorization, high generic utilization (boosted from 65% to 85%), and integrated data through Roundstone Reporting.

Want to see how your numbers stack up? Try our Cost Savings Calculator.

No premium increases in 8 years? Read our own case study to learn we did it.

How to Implement Pharmacy Cost Containment: Step-by-Step Guide

When you’re ready to transition to self-funding, you’ll need an implementation plan. A successful pharmacy cost containment strategy follows a proven path:

Phase 1: Assessment (Weeks 1–2)

- Analyze current pharmacy spend using PEPY

- Review PBM contracts for hidden fees and rebate terms

- Identify high-cost medications

- Benchmark pharmacy spend (goal: 15–25% of total healthcare spend)

Phase 2: PBM Selection (Weeks 3–4)

Choose a PBM with:

- Transparent, pass-through pricing

- 100% rebate return

- Clinical program capabilities (e.g., step therapy)

- Pharmacy access and real-time reporting

Questions to ask:

- “Do we keep all manufacturer rebates?”

- “What are the total administrative fees?

- “What clinical programs do you offer for cost control?”

- “How is pharmacy data reported and shared?”

Phase 3: Implementation (Weeks 5–8)

- Communicate with employees about any network changes

- Launch clinical programs

- Set a cost containment tracking baseline

- Align PBM data with wellness and stop-loss strategies

Phase 4: Optimization (Ongoing)

- Review PBM reports monthly

- Monitor high-cost drug trends

- Adjust clinical programs

- Integrate pharmacy data with total plan performance

Pharmacy cost containment delivers the strongest results when built on a clear, phased implementation strategy. From assessment to optimization, each step plays a critical role in driving long-term value.

When your PBM is aligned with your TPA and overall cost containment strategy, you gain the control, clarity, and cost savings your business needs—without compromising care quality.

Still have questions? See our FAQ below to learn more about pharmacy cost containment with Roundstone.

Advisors: Learn how you can offer innovative solutions that save your clients money.

Start Your Pharmacy Cost Containment Strategy Today

Pharmacy costs don’t need to be a black box—and they don’t need to keep growing.

At Roundstone, we help employers build pharmacy strategies that align with a complete cost containment ecosystem. That means real savings, improved care access, and greater control for your business.

Contact a Roundstone Regional Practice Leader today to discuss how self-funding through a Roundstone group captive can save you money on healthcare costs.

Frequently Asked Questions About Pharmacy Cost Containment

Pharmacy cost containment refers to strategies and practices aimed at reducing the overall expense of prescription medications. This includes negotiating better pricing, encouraging the use of generics, and implementing clinical management programs to control unnecessary spending.

Traditional PBMs often keep rebates and charge hidden fees. Transparent PBMs return 100% of rebates to employers and charge clear admin fees.

The top five strategies include:

- Transparent PBM contracts

- High generic drug utilization

- Clinical management programs

- Specialty drug oversight

- Data analytics for trend forecasting

Employers should look for:

- 100% rebate pass-through

- Transparent pricing

- Real-time reporting

- Clinical programs

- Integration capabilities

PBM strategies align with claims analysis, wellness initiatives, and risk management for a comprehensive, long-term savings strategy.

Employers typically see immediate savings through rebates and discount networks. Full impact occurs within 3–6 months.

Aggressive cost containment measures may lead to shorter patient-pharmacist interactions, rushed service, and increased dispensing errors if not properly managed. Balancing savings with quality is essential for maintaining care standards.

Generic drugs offer the same effectiveness as brand-name medications at significantly lower costs. Encouraging generic utilization with incentives or lower copays helps employers and payers reduce their pharmacy expenses.

Rebates negotiated by PBMs with manufacturers can lower net drug costs when passed through to plan sponsors. Transparent PBM contracts ensure these savings benefit employers directly, promoting greater cost containment.

Specialty drugs account for a large portion of pharmacy spend due to their high cost and complex management needs. Oversight ensures appropriate use, potential alternative therapies, and effective formulary management—all controlling costs for employers.

Clinical management programs target appropriate prescribing, medication adherence, and coordination of care. These programs help prevent waste, reduce adverse drug events, and enhance therapeutic outcomes while controlling costs.

Medication therapy management, often provided by pharmacists, reviews patient medications for safety, interactions, and cost-effective options. MTM supports better health outcomes and reduces unnecessary pharmacy spending.

Data analytics enable employers and PBMs to identify spending trends, forecast costs, and detect outliers. This supports informed decision-making for formulary, plan design, and intervention strategies.

MAC programs set the highest reimbursement rate a PBM or payer will pay for generic drugs. By controlling payment rates and encouraging competitive pricing, MACs lower pharmacy costs.

Some pharmacy cost containment programs include coverage limitations or incentives for OTC alternatives to reduce prescription drug spend. Using OTC drugs when possible can help further lower costs.

PBMs can align cost containment initiatives with claims analytics, wellness programs, and risk management strategies. This integrated approach amplifies savings across the total health plan.

Plan design elements like copays, coverage tiers, and prior authorization policies shape member behavior and drive cost savings. Selecting thoughtful plan features can significantly impact pharmacy spend.

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

How Do Wellness Programs Impact Your Company’s Bottom Line?

How to Use PEPY as a Benchmark to Contain Healthcare Costs

Roundstone Insurance © 2025