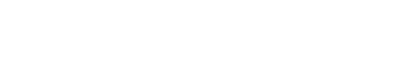

The reversal of 1973’s Roe v. Wade on June 24, 2022, is leading many employers to question how the decision will affect abortion coverage in their self-insured benefits plans. Companies with self-funded insurance will need to review their Summary Plan Document (SPD) and stop loss coverage to assure coverage for abortions after this SCOTUS decision.

One of the most significant issues arising from the Roe v. Wade reversal is the potential illegality of the abortion procedure in some states and how this affects insurance coverage.

Your self-funded health insurance will only cover expenses outlined in your SPD as long as they aren’t illegal. For example, if an employee gets an abortion in a state where the procedure is legal, and your self-insured group captive plan covers abortion, then your plan would cover the expense as usual.

If your employee must travel to another state where it’s legal to have the abortion done, your coverage would cover the expense. If you’ve written travel costs into your SPD, this coverage would include reasonable travel costs.

If your employee has the procedure done in a state where it isn’t legal, then your self-funded health insurance won’t cover the expense.

How to Maintain Abortion Coverage for Your Employees in a Self-Funded Healthcare Plan

If you’re worried about how the new abortion laws will affect your employees and their covered family members, you can take action to protect their coverage through your self-funded health insurance plan.

Here’s how:

Understand the Facts

You must understand the facts of how the SCOTUS decision affects abortion procedures in order to make informed decisions about your self-insured healthcare plan rather than rely on misinformation.

First, understand that the reversal ended federal protections for abortions but did not make abortions illegal.

Secondly, the Supreme Court’s decision gave states the right to decide on the procedure’s legality. This means each state will enact its own bans, restrictions, and permissions for abortion procedures.

Third, these changes do not impact the eligibility of expenses. The IRS allows tax deductions for legally performed abortions and medical-related travel expenses under various health savings and flexible spending accounts. If you build these into your SPD, you will still gain these tax benefits.

Assess Your State’s Abortion Laws

Due to the shifting legal landscape of state abortion laws, with some states enacting trigger bans and others with upcoming abortion amendment votes, it’s vital to know and understand your state’s abortion laws. This can help you build coverage into your SPD to cover employees’ expenses if they must travel to another state to have the procedure performed.

Stay on top of developments in your state and take a proactive approach to your SPD. With Roundstone, you can work with your benefits advisor at any time during the coverage period to enact changes to assure your intended coverage.

Know Your Options

While considering changes to your SPD for abortion-related expenses, consider your options and what you want to cover. For instance, if employees must travel out of state, consider whether you will cover all of their medical, lodging, and food expenses for the trip.

Work with your Roundstone advisor to discuss possible ways to build this coverage into your SPD, such as:

- Integrated health reimbursement accounts (HRAs)

- Stand-alone HRA

- Specialty accounts

Design Your Self-Funded Health Insurance Plan and Communicate with Your Employees

Communicate with your employees as openly as possible as you design your plan. Let them know about the coverage available and how you’re working to ensure they have coverage for the procedure and that their expenses are covered.

Take control over your self-funded healthcare plan design and where your company’s health insurance money is going. Speak with Roundstone today to learn more about our self-insured group captive insurance plans and how we offer you the freedom to build your plan your way to better cover your employees.