- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

How Do Wellness Programs Impact Your Company's Bottom Line?

- Roundstone Team

- 8 Minute Read

- Category Here

Find this article helpful? Share it with others.

Wellness programs are much more than employee perks. They’re strategic investments that deliver measurable financial returns. From reduced healthcare claims to improved productivity, the right wellness initiatives can transform your company’s bottom line.

For employers with self-funded health insurance, these savings flow directly back to you. Unlike traditional insurance, where carriers keep surplus premiums, self-funded plans let you capture every dollar saved through prevention and early intervention.

Real-world results prove the model works. Roundstone’s own employees have experienced eight consecutive years without premium increases through strategic wellness programming, saving over $1.1 million.

Why Do Wellness Programs Matter for Your Company's Bottom Line?

Understanding why these savings matter starts with the healthcare cost challenge every employer faces. Healthcare costs are increasing faster than general inflation. Between 2009 and 2019, healthcare costs jumped 30%.

This forces employers into difficult choices: reduce coverage, increase what employees pay, or accept unsustainable cost growth.

Wellness programs offer a different path. They address health issues before they become expensive medical events. This proactive approach saves money while improving employee health and satisfaction.

Think about how traditional insurance works. You pay premiums, and the insurance company manages everything. When employees get sick, claims happen. You have no control over costs; you just watch premiums rise the next year.

Wellness and preventive care programs flip this script. Well-designed programs drive meaningful improvements in health behaviors, preventive screenings, and productivity.

They help employees:

Catch health problems early through screenings

Manage chronic conditions before complications arise

Make healthier lifestyle choices that reduce future claims

Access mental health support before reaching crisis points

For self-funded employers, this matter is even more significant. You pay actual claims costs. Every prevented hospitalization, every managed chronic condition, every avoided emergency room visit—those savings stay with you.

The numbers prove it works. Companies with strong wellness programs see measurable reductions in medical claims costs, absenteeism and sick days, employee turnover, and disability claims.

Wellness programs are part of broader cost containment strategies in healthcare. They work alongside other tactics like pharmacy benefit management, claims data analysis, and network optimization. Together, these strategies give you control over your healthcare spend.

The key difference? With wellness, you’re investing in prevention. You’re helping employees stay healthier. And you’re capturing the savings that come from fewer medical crises and better health outcomes.

What Financial Returns Can Employers Expect from Wellness Programs?

The financial payoff from employee wellness programs is clear. It goes beyond just health. A 2022 study from Cigna and Avalere Health found that companies earn about $1.47 for every dollar spent on employee well-being initiatives. The Harvard Business Review found that figure to be as high as $6.00 for every dollar spent.

In plain terms, today’s data shows that investing in wellness initiatives pays off through lower healthcare costs, fewer sick days, and stronger employee performance.

Several factors affect wellness program ROI:

Participation rates determine program reach. Programs with higher participation deliver significantly better returns.

Program design quality matters tremendously. Generic programs deliver lower returns than targeted initiatives designed around your workforce's specific health needs. Using data insights to identify your population's health risks allows you to design programs addressing actual cost drivers.

Integration with plan design amplifies results. When wellness programs work seamlessly with broader cost containment strategies—including pharmacy benefits optimization and chronic disease management—the combined impact exceeds individual program returns.

For self-funded employers, the advantage is clear. In traditional fully insured plans, carriers keep surplus premiums as profit even when wellness programs reduce claims. In self-funded plans, you keep 100% of wellness-driven savings.

This is why self-funded health insurance paired with strategic wellness programs delivers such powerful results. You’re in control of the design. You see the data. You capture the savings.

Several variables affect wellness program ROI:

Participation rates determine program reach. Programs with higher participation deliver significantly better returns.

Program design quality matters tremendously. Generic programs deliver lower returns than targeted initiatives designed around your workforce's specific health needs. Using data insights to identify your population's health risks allows you to design programs addressing actual cost drivers.

Integration with plan design amplifies results. When wellness programs work seamlessly with broader cost containment strategies—including pharmacy benefits optimization and chronic disease management—the combined impact exceeds individual program returns.

For self-funded employers, the advantage is clear. In traditional fully insured plans, carriers keep surplus premiums as profit even when wellness programs reduce claims. In self-funded plans, you keep 100% of wellness-driven savings. Tools like Roundstone Reporting give you complete transparency to measure ROI precisely.

This is why self-funded health insurance paired with strategic wellness programs delivers such powerful results. You’re in control of the design. You see the data. You capture the savings.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

How Do Wellness Programs Reduce Healthcare Costs and Which Deliver the Highest ROI?

Wellness programs reduce healthcare spending through multiple mechanisms, each addressing different cost drivers in your health plan.

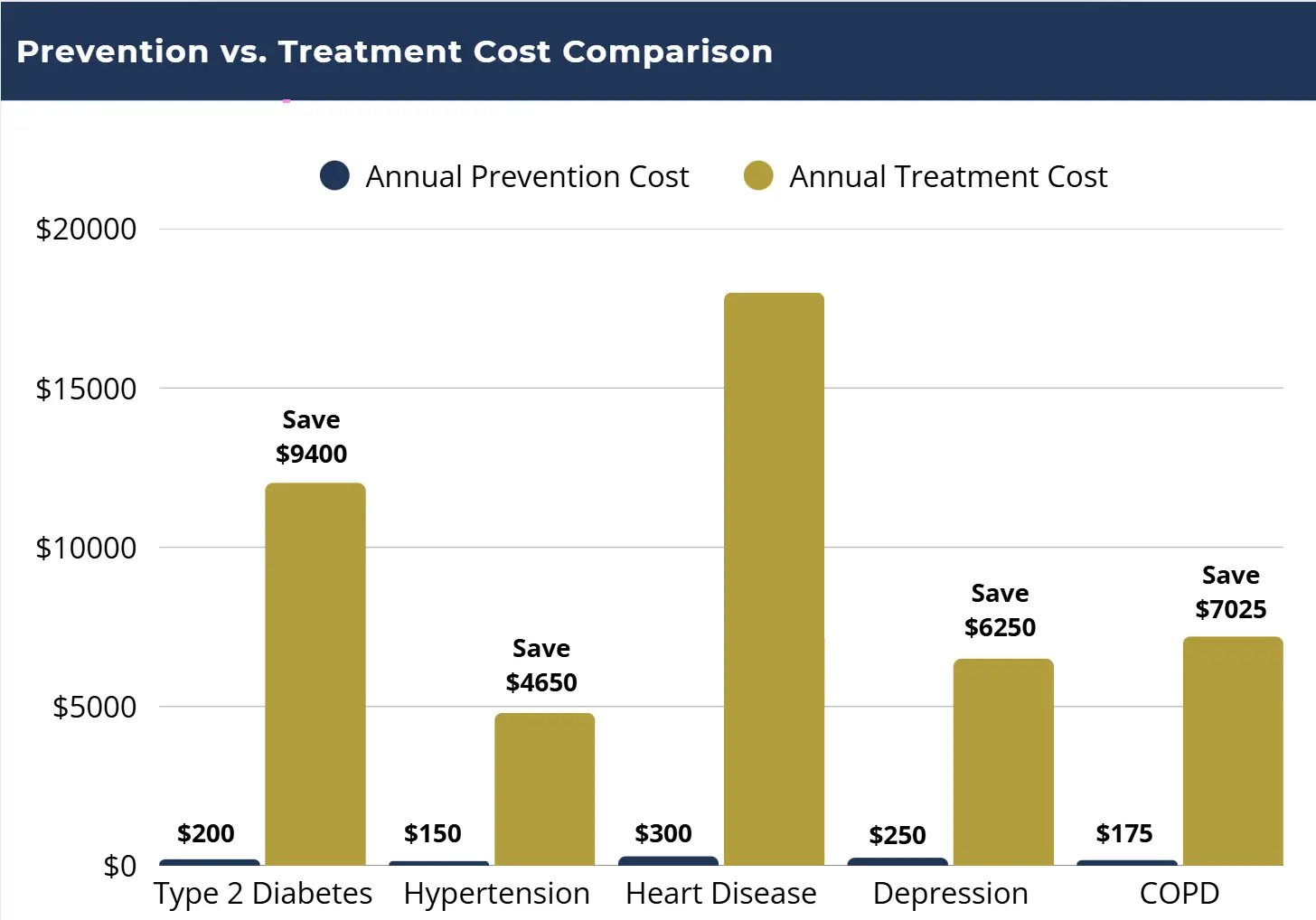

Early Detection Through Preventive Care Prevents Expensive Conditions

Health screenings and biometric assessments identify risk factors before they develop into chronic conditions requiring ongoing medical management. Consider the cost difference:

A single prevented case of type 2 diabetes saves nearly $10,000 annually in treatment costs. Multiply this across your workforce, and the financial impact becomes substantial.

Chronic Disease Management Reduces Complications

For employees already managing chronic conditions, structured support programs prevent expensive complications. Diabetes management programs help employees maintain blood sugar control. This avoids hospitalizations, emergency department visits, and secondary complications like kidney disease or cardiovascular events.

Mental health support programs provide early intervention for anxiety and depression, preventing conditions from escalating to crisis levels requiring hospitalization or long-term disability.

Preventive Care Reduces Emergency Utilization

Wellness programs that incentivize preventive care and provide convenient access to primary care services reduce expensive emergency department and urgent care use.

Offering zero-dollar copays for preventive services removes financial barriers to early intervention, while telehealth options give employees convenient access to care.

Which Wellness Program Components Deliver the Highest ROI?

Not all wellness programs deliver equal returns. Here’s what the data show:

Smoking Cessation (4:1 ROI)

Smoking-related healthcare expenses average $1,200 more per year than for non-smokers. Programs costing $150–$250 per participant deliver returns of roughly 4:1 within 12–18 months through reduced respiratory infections and absenteeism.

Companies report $3–$4 saved per $1 invested once smoking prevalence declines among enrolled employees.

Health Screenings and Biometric Assessments (4.5:1 ROI)

Annual screenings, costing $50–$100 per employee, yield high returns by catching hypertension, elevated cholesterol, and pre-diabetic conditions early. Employers achieve an estimated 4–5:1 return from lower long-term claims and early intervention savings, consistent with workplace health ROI benchmarks cited across 2025 employer reports.

Mental Health and Stress Management (2:1 ROI, increasing to 2.18:1)

Investments of $150–$300 per employee in therapy access, resilience training, and mindfulness support deliver measurable returns through reduced disability claims, absenteeism, and turnover. Data show a median 1.6–2.2 ROI, rising as programs mature beyond three years and benefit from consistent engagement.

Chronic Disease Management (3.8:1 ROI)

Condition management for diabetes, heart disease, and COPD costs $200–$400 per participant but delivers a 3.5–4:1 return by avoiding hospitalizations, reducing ER visits, and improving adherence to treatment plans. Programs like those described in recent 2025 ROI analyses highlight how chronic disease prevention is a key driver of employer cost containment.

Strategic Program Selection

Your company’s most effective initiatives depend on its workforce health profile. Use claims data analytics to identify cost drivers and implement targeted wellness programs based on ROI likelihood.

The highest ROI programs for your company depend on your workforce’s specific health risks. Use claims data insights to identify which conditions drive your costs, then implement wellness programs targeting those areas.

What Impact Do Wellness Programs Have on Employee Productivity?

Wellness programs deliver returns beyond direct medical savings. They improve employee productivity and engagement in measurable ways.

Reduced Absenteeism

Companies with robust wellness programs see 28% reduction in sick days. This translates to $2.73 in absenteeism savings per dollar invested. For a company with 100 employees, that’s tens of thousands of dollars annually in recovered productivity.

Decreased Presenteeism

Presenteeism—when employees come to work sick—costs employers more than absenteeism. Employees working while ill are less productive and spread illness to coworkers. Wellness programs address this by helping employees manage health conditions effectively.

Improved Employee Engagement and Morale

Wellness programs demonstrate employer investment in employee wellbeing, which improves job satisfaction and engagement. Engaged employees are more productive, deliver better customer service, and contribute more to company success.

Lower Turnover Rates

Companies with robust wellness programs see 15-20% lower turnover than those without. For a company with 100 employees and average salary of $50,000, reducing turnover by just 3 percentage points saves $75,000-$300,000 annually in recruitment and training costs.

Recruitment Advantage

Job seekers increasingly prioritize employer benefits. Comprehensive wellness programs make your company more attractive to top talent, giving you a competitive edge in tight labor markets.

These productivity and retention benefits make the business case even stronger. But what happens when companies skip wellness programs entirely?

What Are the Hidden Costs of Not Having a Wellness Program?

The true cost of skipping wellness programs extends beyond obvious medical expenses. Consider what you’re missing:

Escalating Chronic Disease Costs

Without early intervention, minor health issues become chronic conditions. That employee with pre-diabetes develops type 2 diabetes. The one with occasional back pain develops chronic musculoskeletal issues. Each progression multiplies healthcare costs exponentially.

Higher Disability Insurance Claims

Unmanaged health conditions lead to disability claims. These claims cost employers through higher disability insurance premiums and lost productivity from absent employees.

Workers Compensation Impacts

Employee health status affects workers’ compensation claims. Employees with chronic conditions face longer recovery times from workplace injuries. Poor overall health increases injury risk.

Competitive Disadvantage in the Talent Market

Top candidates compare benefit packages. Without wellness programs, you’re at a disadvantage. You may lose great candidates to competitors offering better benefits.

Lower Employee Morale Affecting Productivity

Employees notice when employers don’t invest in their wellbeing. This affects morale, engagement, and productivity. The cost shows up in reduced output, lower quality work, and decreased innovation.

Opportunity Cost of Preventable Healthcare Spending

Every dollar spent on preventable healthcare is a dollar not invested in business growth, employee development, or competitive wages. The opportunity cost compounds year over year.

What Does Real-World Wellness ROI Look Like?

These financial benefits aren’t just theoretical. At Roundstone, we practice what we preach. After transitioning from fully insured coverage to our own self-funded group captive, we implemented a comprehensive wellness program with meaningful incentives.

“Some employees now pay less than they did 8 years ago. Their out-of-pocket expense is less when they participate in the wellness programs.” — Mike Schroeder, President and Founder, Roundstone

Read the complete Roundstone case study for detailed program implementation and year-by-year financial results.

Still have questions about wellness programs? See our FAQ below.

How Do You Measure Wellness Program Success and ROI?

Ready to achieve similar results? Measuring wellness program effectiveness requires establishing baseline metrics, tracking key performance indicators, and calculating financial returns.

Establishing Your Baseline

Before implementing wellness programs or evaluating existing initiatives, document current performance across key metrics:

Total annual claims costs

PEPY spending

Emergency department and urgent care utilization rates

Average biometric values (blood pressure, cholesterol, BMI)

Chronic condition prevalence

Preventive care completion rates

Average sick days per employee

Turnover rates

Without baseline data, you can’t prove your wellness program works.

Wellness Program KPI Dashboard

Track these metrics to measure progress:

Tracking Leading and Lagging Indicators

Leading indicators predict future results and can be tracked frequently:

Wellness program participation rates

Health screening completion

Preventive care utilization

Employee engagement with wellness resources

Monitor these monthly or quarterly to identify issues early and adjust programs.

Lagging indicators reflect actual outcomes but take longer to measure:

Healthcare claims cost trends

Chronic disease prevalence and management

Absenteeism and disability rates

Employee turnover

Track these annually to measure long-term program impact.

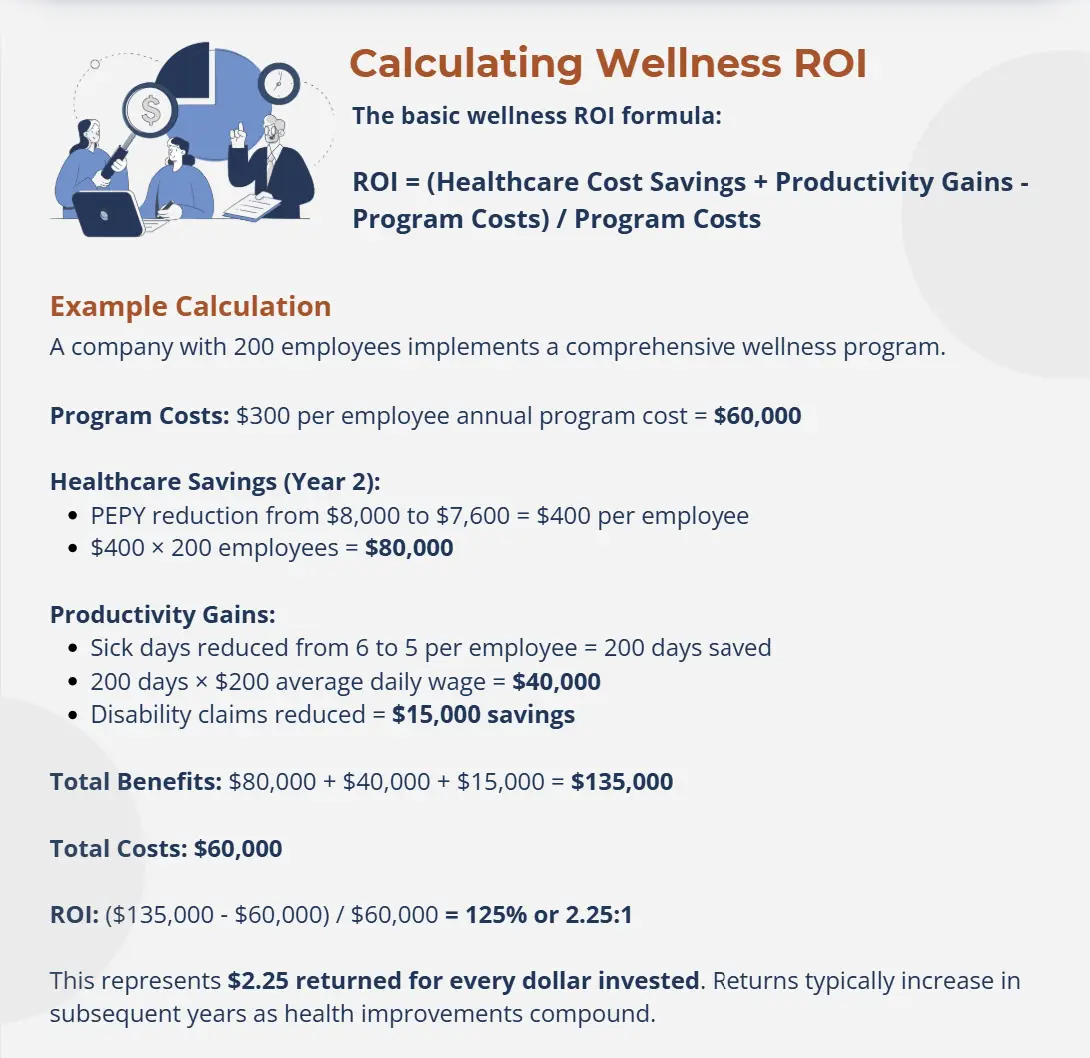

Calculating Wellness ROI

Once you have baseline data and ongoing metrics, you can calculate the financial return on your wellness investment. Here’s the basic wellness ROI formula:

ROI = (Healthcare Cost Savings + Productivity Gains – Program Costs) / Program Costs

Below is an example of how one company calculates its wellness program ROI.

Ready to Achieve Wellness Program ROI?

Wellness programs aren’t just the right thing to do for employees; they’re smart financial investments delivering measurable returns. With self-funded health insurance through Roundstone, you gain the transparency, flexibility, and savings capture needed to maximize wellness program ROI.

Roundstone’s own experience proves the model works. Eight consecutive years without employee premium increases, over $1.1 million in cumulative savings, and employees who actually pay less than they did eight years ago demonstrate that strategic wellness programs deliver sustainable results.

Contact a Roundstone regional practice leader today to discuss how a wellness program can reduce your healthcare costs while improving employee health and satisfaction. We’ll review your current spending, identify wellness opportunities, and show you exactly how self-funding maximizes wellness program returns.

Wellness Programs FAQs

Research shows wellness programs deliver approximately $6 in combined returns for every dollar invested—$3.27 in healthcare cost reduction plus $2.73 in absenteeism savings. However, ROI varies by program type.

Industry benchmarks suggest investing 1-3% of total healthcare spending on wellness programs, translating to $80-$240 per employee annually for companies spending $8,000 per employee.

Smoking cessation programs deliver the highest ROI at 5.2:1, followed by health screenings (4.5:1), mental health support (4.3:1), and chronic disease management (4:1).

Yes, self-funding through a group captive makes wellness programs affordable for small businesses by providing economies of scale and flexible implementation options.

Wellness programs contribute to lower turnover rates by demonstrating employer investment. Companies with robust wellness programs see 15-20% lower turnover than those without.

In fully insured plans, insurance carriers keep surplus premiums as profit even when wellness programs reduce claims. In self-funded plans, employers keep 100% of wellness-driven savings.

The wellness ROI formula is: (Healthcare Savings + Productivity Gains – Program Costs) / Program Costs. Calculate healthcare savings by comparing PEPY costs before and after program implementation.

Track participation rates (target 70%+), health screening completion (target 75%+), PEPY trends, chronic disease management rates, absenteeism and disability rates, and emergency department utilization.

Initial results typically appear within 6-18 months, including increased preventive care utilization and early disease detection. Full ROI generally materializes within 18-36 months.

In self-funded plans, wellness programs directly impact costs through reduced claims, allowing stable or reduced premium contributions.

American Diabetes Association. “New American Diabetes Association Report Finds Annual Costs of Diabetes Reach $12,022 Per Person.” ADA, 2023, https://diabetes.org/newsroom/press-releases/new-american-diabetes-association-report-finds-annual-costs-diabetes-be

American Fidelity. “Wellness Programs Decrease Employee Turnover.” American Fidelity, 2024, https://americanfidelity.com/blog/strategy/wellness-programs-decrease-turnover/

American Heart Association. “Cardiovascular Disease Cost Analysis.” AHA Journals, 2025, https://www.ahajournals.org/doi/10.1161/circ.140.suppl_1.15765

American Lung Association. “New COPD Trends Brief Underscores Critical Need for Early Screening and Intervention.” ALA, 2025, https://www.lung.org/media/press-releases/new-copd-trends-brief-underscores-critical-need-fo

Centers for Disease Control and Prevention. “Heart Disease Facts and Statistics.” CDC, 2025, https://www.cdc.gov/heart-disease/data-research/facts-stats/index.html

Cigna and Avalere Health. “Evaluating Health and Wellness ROI in the Modern Workforce.” U.S. Chamber of Commerce Foundation White Paper, 2022, https://www.uschamber.com/assets/documents/20220622_Chamber-of-Commerce_ESI-White-Paper_Final.pdf

Corporate Wellness Magazine. “The Real ROI for Employee Wellness Programs.” Corporate Wellness Magazine, 2024, https://www.corporatewellnessmagazine.com/article/the-real-roi-for-employee-wellness-programs

Harvard Business Review. “What’s the Hard Return on Employee Wellness Programs?” HBR, 2010, https://hbr.org/2010/12/whats-the-hard-return-on-employee-wellness-programs

Health Affairs. “Employer Wellness Programs and Health Behavior Improvements.” Health Affairs Journal, 2020, https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2020.01808

Infeedo. “Why Corporate Wellness Programs Are Worth Every Penny in 2025.” Infeedo Blog, 2025, https://www.infeedo.ai/blog/corporate-wellness-programs-worth-every-penny-2025

JoinForma. “How to Measure Employee Wellness Programs ROI & VOI in 2025.” Forma Resources, 2025,

https://www.joinforma.com/resources/employee-wellness-programs-roi

McKinsey Health Institute. “Thriving Workplaces: How Employers Can Improve Productivity and Change Lives.” McKinsey & Company, 2024, https://www.mckinsey.com/mhi/our-insights/thriving-workplaces-how-employers-can-improve-productivity-and-change-lives

MindArch Health. “Cost of Prevention vs. Treatment in Mental Healthcare.” MindArch Health, 2025, https://www.mindarchhealth.com/articles/cost-of-prevention-vs-treatment-in-mental-healthcare

OpenLoop Health. “25+ Compelling Employee Wellness Statistics.” OpenLoop Health, 2025, https://openloophealth.com/blog/25-compelling-employee-wellness-statistics

Psico-Smart. “The Impact of Remote Health Monitoring on Chronic Disease Management: Case Studies and Success Stories.” Psico-Smart Blog, 2025, https://blogs.psico-smart.com/blog-the-impact-of-remote-health-monitoring-on-chronic-disease-management-case-studies-and-success-stories-180927

TCIPP. “Confronting Our Costly Mental Health Epidemic: Community-Led Prevention Is Key to Cutting Expenses.” Trauma-Informed Care Policy & Practice (TCIPP), 2025, https://www.ctipp.org/post/confronting-our-costly-mental-health-epidemic-community-led-prevention-is-key-to-cutting-expenses

Wisewellness Guild. “The ROI of Workplace Wellness in 2025: A Comprehensive Report.” Wisewellness Guild, 2025, https://www.wisewellnessguild.com/mental-health-career/roi-workplace-wellness-2025

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025