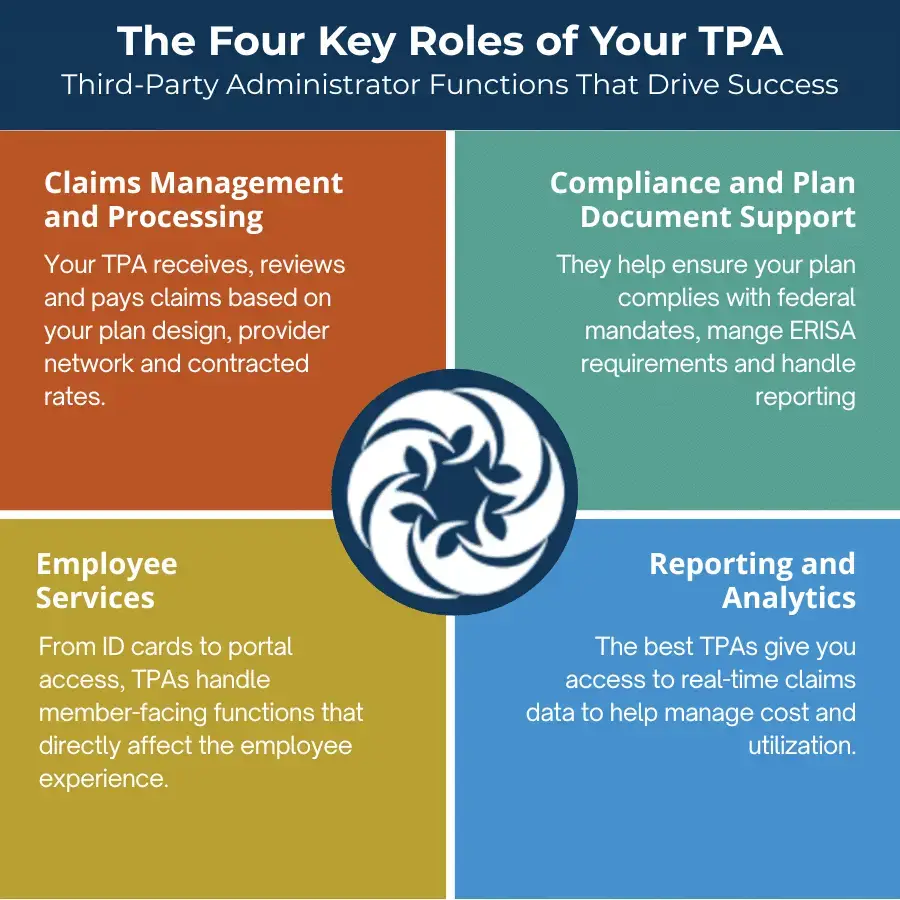

What Does A Third-Party Administrator Do In A Self-Funded Plan?

Think of a TPA as your operational partner. The difference between the right partner and the wrong one is measured in dollars saved, employees helped, and hours of administrative hassle avoided.

The wrong TPA might slow down claims, provide minimal reporting, or limit your ability to customize your plan. The right TPA becomes a trusted extension of your team.

Poor alignment creates friction. If a TPA doesn’t understand your business or your goals, you’ll spend more time managing issues and less time improving your plan.

Strong partners enable performance. A TPA that listens, adapts, and delivers high-quality service can help you streamline your benefits operations and increase savings.

Advisors—often acting as the employer’s advocate—also rely on TPAs to deliver consistency and value to their clients. A trusted TPA partner can help brokers retain business and strengthen their role as strategic consultants.