- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

Specialty Prescription Drugs: Advanced Cost Containment Strategies

- Roundstone Team

- 8 Minute Read

- Category Here

Find this article helpful? Share it with others.

Strategic Guide for Self-Funded Employers

Specialty drugs represent the most complex and expensive segment of prescription management, but they’re also where self-funded employers have the greatest opportunity to control costs.

Self-funding through a group captive empowers small and midsize employers with advanced cost containment strategies specifically designed to tame the specialty drug beast, without sacrificing quality care for your employees.

The Silent Giant in Your Healthcare Spend

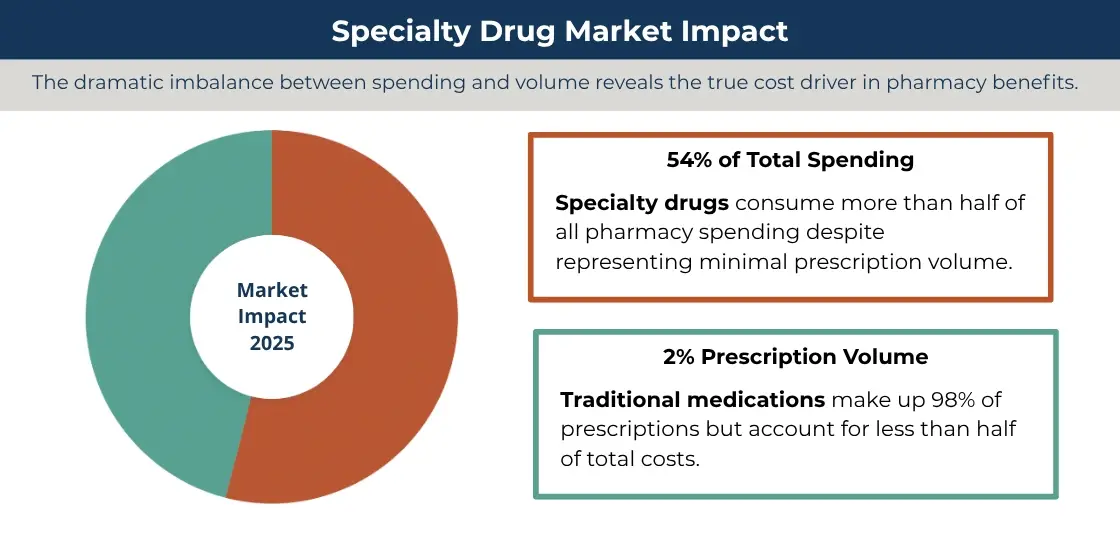

Here’s the scope of the challenge: Specialty drugs account for just 2% of prescriptions but often drive 54% of total pharmacy spend.

The challenge gets worse as specialty drugs become more expensive. Here are a few examples.

A single employee who needs adalimumab (Humira) for rheumatoid arthritis generates $70,000+ in annual prescription costs.

New medications launched in 2023 had median annual treatment costs exceeding $150,000. Oncology and rare disease treatments approached $300,000 per patient.

Cell and gene therapies can cost $400,000-$2 million per treatment episode, creating unprecedented financial exposure.

These high-cost medications, used to treat complex conditions like cancer, MS, and rare diseases, are skyrocketing in both price and usage.

Comparison of market impact of specialty drugs vs traditional medications

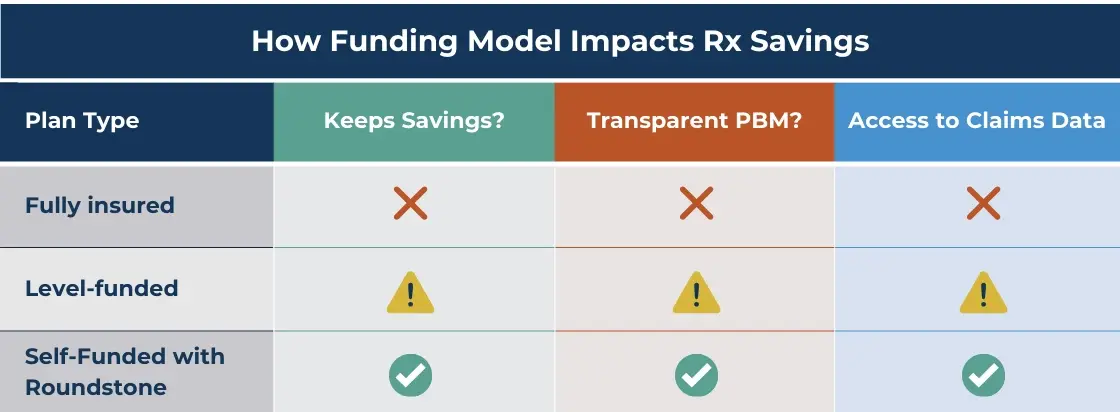

Even with self-funding, one of the biggest obstacles to controlling specialty drug costs lies in how prescriptions are purchased and managed. That’s where the role of the Pharmacy Benefit Manager (PBM) comes in. For many employers, it’s where the real problems begin.

The Traditional PBM Problem: Spread Pricing and Zero Visibility

Traditional PBMs often operate under opaque contracts, charging employers more than the actual cost of the drug and pocketing the difference. This model, called spread pricing, inflates your costs while hiding the true source of your spend.

Worse, traditional, fully funded insurance rarely gives you full access to claims data, so you’re stuck trying to manage one of your largest line items in the dark.

With Roundstone, that changes.

Through our self-funded, group captive model, employers can carve out their PBM, gaining access to transparent or pass-through contracts where all rebates and discounts are returned to the plan.

That means no hidden markups and real cost savings for employers.

To learn more about self-funding vs traditional, fully funded models, read our free download, What Your Fully Insured Insurance Carrier Doesn’t Want You to Know.

Using Data To Find and Fix High-Cost Drug Spend

As the saying goes, you can’t fix what you can’t see. That’s why Roundstone includes Roundstone Reporting (formerly the CSI Dashboard) as part of every group captive plan.

This intuitive analytics platform gives you clear, actionable data about where your pharmacy dollars are going.

You’ll see:

Specialty drug costs vs. generics

High-cost claimants and therapeutic class utilization

Pharmacy trends over time

Benchmarking against national norms

Advanced Pharmacy Cost Containment Strategies

Roundstone goes beyond transparency to help you take action.

Here’s how we help employers reduce specialty drug costs with targeted, proven strategies that keep your plan efficient and your people covered.

Overlay Programs

What they are: Overlay solutions work alongside your PBM to find lower-cost options for high-dollar prescriptions.

How they help: By tapping into alternative pharmacy channels, these programs often cut costs by 30–60%—without changing the medication or care experience.

Real-world impact: Employers can save thousands per employee per year on drugs like Humira, Enbrel, or Cosentyx.

CFOs: Download our free CFO’s Guide to Managing Healthcare Costs.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

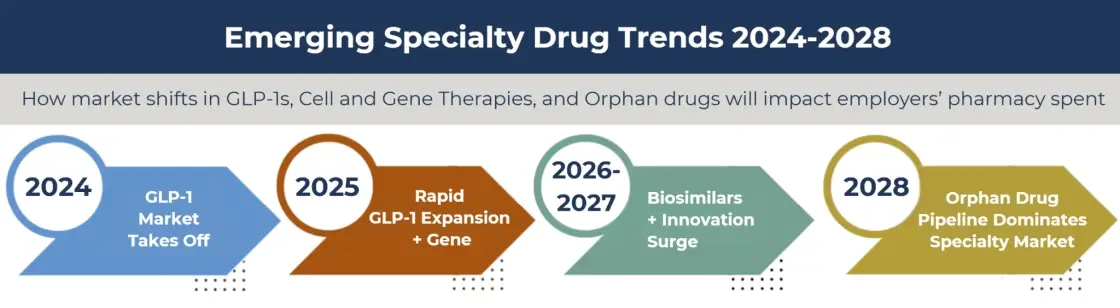

Biosimilars: A Major Savings Opportunity

What they are: Biosimilars are clinically equivalent versions of expensive brand-name biologic drugs. Think of them like next-gen generics.

How they help: They offer the same therapeutic outcomes but at 30% to 50% lower cost. As more biosimilars hit the market, the savings opportunities grow, especially for drugs like Humira, Avastin, and Lucentis.

Why it matters: Employers who prioritize biosimilars in their plan design often see five-figure annual savings per member. With Roundstone’s help, you can update your formulary and educate employees to make the switch with confidence.

The table below illustrates the savings employers can realize when they incentivize generic over brand-name use for the top 10 most-prescribed biosimilars.

Manufacturer Assistance

What it is: Co-pay assistance, foundation grants, and maximizer programs offered by drug makers.

How it helps: We help you take full advantage of these programs to shift costs off your plan and your employees.

Why it matters: It’s money already on the table—and with the right tools, you can capture significant savings.

Direct Sourcing and International Fulfillment

What it is: Access to lower-cost, high-quality medications through trusted specialty or international pharmacies.

How it helps: For select therapies, we connect you to sources offering the exact same medications at a fraction of the price, without compromising safety or quality.

Why it matters: Self-funded plans can act fast when there’s a better deal on the table.

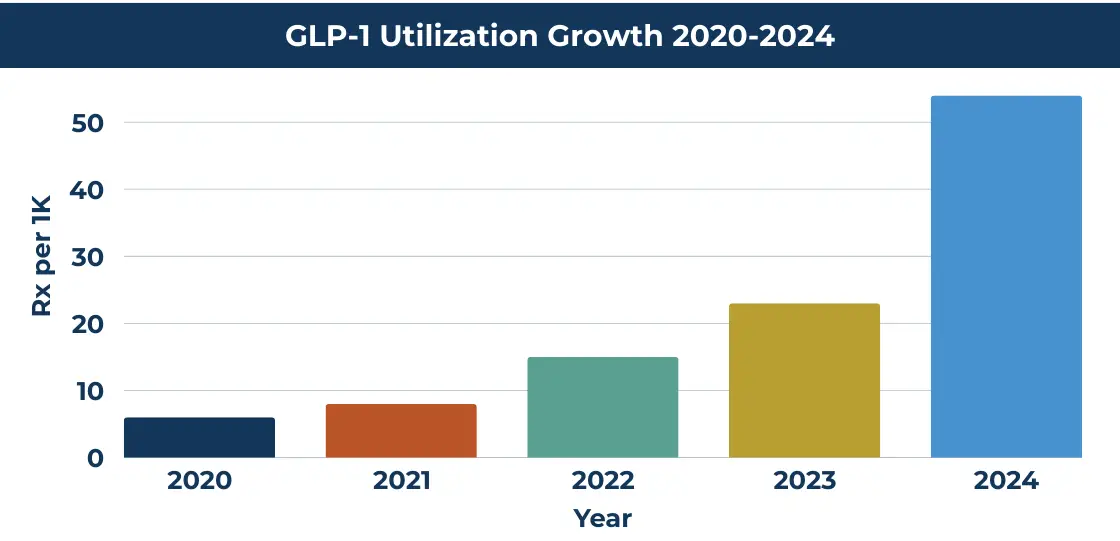

GLP-1 Management: Smart Oversight for Trending Therapies

What it is: GLP-1 drugs like Ozempic, Wegovy, and Mounjaro are in high demand for treating diabetes and obesity and sometimes for off-label weight loss.

How they help: These medications can be effective for metabolic health, but they come at a steep price, often $1,000+ per month.

Why it matters: We help employers implement clear clinical guidelines, eligibility criteria, and wellness program integration to manage costs without compromising outcomes.

Clinical Protocols and Early Intervention

What it is: Tools like step therapy, prior authorizations, and clinical care management ensure the right drug is used at the right time, at the right price.

How it helps: These tools reduce waste and help you avoid six-figure surprise claims by flagging high-cost therapies early.

Why it matters: A single cell or gene therapy could cost $400,000 or more. With early detection, direct sourcing, and assistance programs, Roundstone helps you contain those costs before they hit your bottom line.

Data-Driven Pharmacy Decisions

What it is: Real-time insights from Roundstone Reporting, combined with predictive analytics and benchmarking.

How it helps: You can identify specialty drug trends before they become budget breakers. Our Partner Solutions team helps you act on them.

Why it matters: You’re not reacting to claims after the fact. You’re staying ahead of them, armed with the data to make strategic decisions.

Employee Support as a Cost Strategy

What it is: Case management, education, and real support for members navigating complex conditions.

How it helps: When employees understand their options and get access to assistance, they make better decisions—and avoid unnecessary costs.

Why it matters: Cost containment doesn’t have to mean cost shifting. When you self-fund, it means smarter coverage and better outcomes for everyone.

HR professionals: Learn how Roundstone supports you all the way when you switch to self-funding.

How Self-Funded Captives Put You in Control

Fully insured plans don’t reward cost savings. The carrier pockets the difference when you have a good claims year, but you still get a higher premium next year.

With Roundstone’s self-funded group captive model, employers keep 100% of their unused premium. That means savings from specialty drug reductions go straight back to your business.

What’s more, Roundstone clients save an average of 20% per year, and 100% save money, full stop. We’re so confident in our captive that we guarantee if you haven’t saved money at the end of five years, we will make up the difference.

Since our inception, Roundstone has returned $91.8 million in unused premiums to our captive members.

Still have questions about specialty drug management? Read our FAQ below.

Specialty Drug Costs Are Rising, But You Don’t Have to Follow

There’s no denying it; specialty prescriptions are a growing cost driver. But with the right strategy and the right partner, that doesn’t have to mean ballooning budgets or tough trade-offs.

Roundstone offers a smarter path forward:

Transparent PBM contracts

Actionable claims data

Flexible pharmacy programs

Return of savings to your bottom line

Ready to get specialty drug costs under control? Talk to a Roundstone rep and discover how our advanced cost containment strategies can help you save big—without sacrificing care.

Frequently Asked Questions About Managing Specialty Drugs

Specialty drugs are high-cost medications for chronic, complex, or rare conditions (like cancer, MS, or genetic disorders). Their costs are driven by advanced manufacturing, limited patient populations, and tight patent protections, making generic competition rare.

Though they may only affect 1–2% of employees, specialty drugs often account for 50–80% of pharmacy spend—making them a major driver of cost volatility. Managing them well is one of the few lever points where self-funded employers can materially reduce overall health plan spend.

Spread pricing is when a PBM charges the employer more than what it pays the pharmacy, pocketing the difference. This opaque markup inflates costs and prevents employers from seeing the true price of medications.

With a transparent or pass-through model, all discounts, rebates, and savings flow back to the plan, and pricing is disclosed. This structure aligns the PBM’s incentives with yours and gives you full visibility into what you’re paying.

Overlay programs sit on top of your PBM and source specialty medications from alternative—often lower cost—channels. These programs can reduce costs by 30–60% while keeping the drug therapy unchanged.

Biosimilars are clinically equivalent versions of biologic drugs but typically cost 30–50% less. When included in formulary design and promoted appropriately, biosimilars can deliver significant savings without compromising outcomes.

These programs allow drugmakers (or foundations) to cover patient costs, shifting burden away from both the plan and employee. When integrated properly, they can yield savings in the tens of thousands for eligible members.

Yes—with proper oversight. For certain therapies, vetted specialty or international pharmacies can deliver identical medications at lower cost while complying with FDA import regulations. Quality, safety protocols, and regulatory compliance are essential.

GLP-1s (like Ozempic, Wegovy, Mounjaro) carry high monthly costs—often $1,000+. Employers should establish clear clinical criteria, eligibility protocols, and tie usage to wellness or behavioral programs to drive value rather than open-ended coverage.

Use predictive analytics to flag emerging high-cost treatments, apply clinical review protocols early, and work with specialty pharmacies or manufacturers on outcome-based contracts. That way, you can contain cost spikes before they hit your bottom line.

Real-time tools like Roundstone Reporting allow employers to identify trending therapeutic classes, outlier claims, and utilization shifts before they escalate. That visibility enables preemptive interventions instead of reactive fixes.

While rare-disease or orphan drug therapies can be expensive, providing robust support programs—case management, financial aid navigation, and linkage to foundations—can improve adherence, reduce complications, and ultimately protect your plan from higher downstream medical costs.

In a captive model, employers retain control and benefit directly from cost savings. Transparent contracts, shared risk, and alignment of incentives ensure that savings from specialty drug strategies return to the plan rather than to intermediaries.

Yes, for many captive members, especially in their first few years of transitioning to more transparent models and overlay strategies. Over time, consistently applying advanced containment tactics can deliver significant and sustainable savings.

- American Pharmaceutical Review. (2025, March 12). Top ten FDA-approved biosimilars ranked by therapeutic importance and value. Retrieved from https://www.americanpharmaceuticalreview.com/Featured-Articles/618242-Top-Ten-FDA-Approved-Biosimilars-Ranked-by-Therapeutic-Importance-and-Value/

- BiosimilarsIP. (2025, July 16). Biosimilars boom: 2025’s fast track approvals look to reshape healthcare. Retrieved from https://www.biosimilarsip.com/2025/07/16/biosimilars-boom-2025s-fast-track-approvals-look-to-reshape-healthcare/

- Drugs.com. (2025, July 15). What biosimilars have been approved in the United States? Retrieved from https://www.drugs.com/medical-answers/many-biosimilars-approved-united-states-3463281/

- Samsung Bioepis, BiologicsHQ. (2025, April). Biosimilar Market Report Q2 2025. Retrieved from https://biologicshq.com/wp-content/uploads/2025/04/SB-Biosimilar-Market-Report-Q2-2025.pdf

- Accessible Medicines. (2025, January). The U.S. generic & biosimilar medicines savings report. Retrieved from https://accessiblemeds.org/wp-content/uploads/2025/01/AAM-2024-Generic-Biosimilar-Medicines-Savings-Report.pdf

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025