Highlights

- Knowing how self-funded insurance lowers costs can help you save on pharmacy expenses and provide better access to medications for your employees.

- Self-funding allows you to select a transparent or pass-through Pharmacy Benefits Manager (PBM) who passes savings on to you and your plan members.

- Self-funding in a group captive from Roundstone provides benefits such as custom plan design, data transparency, and cost containment opportunities to lower the overall cost of your healthcare plan.

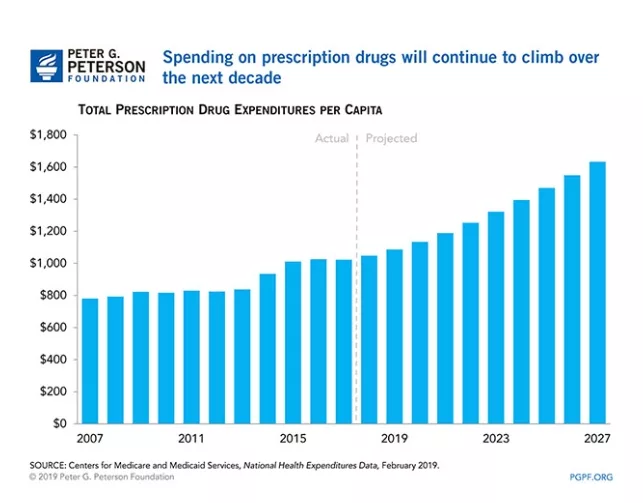

Pharmacy costs are notorious for their impact on insurance plan rate hikes, particularly when it comes to premium drugs. The allure of television-advertised brand-name medications often translates into elevated prices that trickle down to higher premiums for your fully insured plan year-over-year.

However, your company can take back control of pharmacy costs through a self-funded insurance plan. Self-funding lets you select the Pharmacy Benefits Manager (PBM) of your choice, allowing you to realize annual cost reductions that can amount to tens of thousands of dollars, even for a single drug required by a specific employee.

How Does a Pharmacy Benefits Manager Work?

In a self-funded insurance plan, a Pharmacy Benefits Manager manages and controls prescription drug benefits for the plan participants. PBMs act as intermediaries between insurance providers and pharmaceutical companies, working to negotiate costs, ensure access to medications, and reduce pharmacy spend.

Types of PBMs

When selecting a PBM for a self-funded health insurance plan, the best options are a transparent or pass-through PBM. Transparent PBMs have open fee structures and clear contracts, providing transparency in terms of where the money is going.

Pass-through PBMs are compensated through administrative fees and pass on 100% of the savings from manufacturer’s coupons and rebate programs directly to the employer.

How Can a PBM Reduce Prescription Drug Costs

The primary goal of a PBM is to reduce prescription drug costs while improving medication options for employees. They achieve this through various strategies, including:

- Prescription delivery services

- Price negotiation with drug manufacturers

- Co-pay assistance programs

- Access to specialty pharmacies and networks for high-cost prescriptions

- Promoting generic options

- Passing pharmaceutical company rebates to the group captive plan participants

Additionally, PBMs use their purchasing power to negotiate better pricing, discounts, or rebates for high-cost specialty medications. They also provide guidance on substituting expensive brand-name drugs with more affordable alternatives that deliver similar medical outcomes.

By partnering with a PBM, a self-funded insurance plan can benefit from cost savings, improved medication access, and better management of prescription drug benefits. The PBM advocates for the plan participants, working to ensure affordable and effective pharmaceutical solutions while maximizing savings opportunities.

Under fully insured plans, traditional pharmacy benefit managers (PBMs) are infamous for imposing excessive charges and employing the “ingredient cost spread” tactic, where undisclosed additional costs are added to medication prices, burdening the employer. For instance, you might end up paying $200 for 30 Adderall when the PBM’s actual cost is only $150.

Moreover, some drug manufacturers extend rebates on high-cost medications. However, instead of passing on these savings to the employer, traditional PBMs under fully insured plans often keep the rebates for themselves.

This payment model of ingredient cost spread incentivizes traditional PBMs to promote higher-cost drugs and a greater volume of prescriptions, which ultimately does not prioritize the best interests of the patient.

In contrast, Roundstone proposes an alternative approach, suggesting that PBMs should charge a transparent flat fee, such as $3 per prescription, for their services rather than an undisclosed percentage. PBMs would then earn their compensation through a clear agreement, providing greater transparency and fairness.

Advantages of Choosing Your Own PBM With Roundstone

Choosing your own PBM for your self-funded health insurance plan is a strategic decision that can impact your prescription drug benefits. With the Roundstone self-insured captive, you can access plan elements that enable you to optimize your drug coverage and control costs effectively. When you self-insure in the Roundstone captive, you join with hundreds of other employers to share costs and any underwriting profits. This means that if there is any unspent premium at the end of the year, it is returned to the employers pro rata.

The captive helps make self-funding less risky and more cost-effective. PBM choices are an important part of the cost savings strategies, as pharma costs can be a huge part of overall medical spend. PBMs can help mitigate high drug costs, protecting all the businesses in the captive — including yours.

Custom Plan Design

When you choose your own PBM, you can customize your self-funded employee benefits — including prescription drug access — according to your company’s specific needs. Roundstone collaborates with employers to understand their unique requirements and recommends the most suitable PBM.

Designing a self-insured health plan your way lets you tailor prescription drug benefits for optimal coverage and better employee access to medication. When designing your plan, you can include various prescription-savings options, such as:

- Prescription delivery services

- Price negotiation with drug manufacturers

- Co-pay assistance programs with access to specialty pharmacies

- Mail-order pharmacy services

With a customized PBM solution, you can ensure that the prescription drug benefits align closely with your needs and provide the best possible value for your self-funded healthcare plan.

Data Transparency

Data transparency is vital to providing employers and PBMs with the information they need to implement effective cost containment strategies to lower premium drug costs. Your PBM can reduce costs on prescription drug spending by:

- Negotiating favorable pricing. With access to transparent data on drug pricing, including the actual costs and discounts provided by manufacturers, PBMs can effectively negotiate lower prices for premium drugs on behalf of their clients. Transparent data allows PBMs to compare prices, identify opportunities for savings, and leverage their negotiating power to secure more favorable pricing terms.

- Drug rebate optimization. PBMs negotiate rebates and discounts with pharmaceutical manufacturers. Transparent data on the actual usage and performance of premium drugs allows PBMs to optimize rebate contracts. By analyzing the data, PBMs can identify areas where rebates can be maximized, ensuring their clients receive the full benefit of any available savings.

- Benefit design and cost-sharing strategies. Transparent data on the costs and usage of premium drugs can inform benefit design decisions. PBMs can use this data to develop cost-sharing strategies, like tiered formularies or the step therapy program, that encourage using cost-effective alternatives or promote generic substitutions for premium drugs.

By aligning benefit design with the actual value and cost of medications, PBMs can incentivize cost-conscious utilization and help lower the financial burden of premium drugs on patients and health plans.

Cost Savings Strategies

Roundstone’s CSI Dashboard allows for cost containment measures and improved healthcare utilization management. It enables employers to identify areas of high healthcare costs and implement targeted cost-saving recommendations.

The CSI Dashboard is an advanced health insurance analytics platform that offers complete data transparency. With this tool, employers can gain real-time insights into their medical claims, visually assessing healthcare expenditure while safeguarding the anonymity of individual employee claims. The data can identify cost-savings opportunities so you can further optimize the savings of your self-funded health insurance plan.

Using data from the CSI Dashboard, Roundstone’s Cost Saving Investigators (CSI Team) can collaborate with benefit advisors to deliver cost containment recommendations (CCRs) tailored to each employer group. Monthly automated reports compare claims spend to benchmark values, highlighting areas where expenses may exceed or fall below the national average.

Using the CSI dashboard is easy and does not require heavy lifting on your part. Roundstone combs through your data and makes actionable suggestions on cost savings strategies. Choosing whether or not to implement them is totally up to you. We’ll never force you to do anything.

Save on Premium Drugs With Self-Funded Insurance in the Roundstone Captive

When it comes to saving on premium drugs, Roundstone’s self-funded group captive insurance is a valuable solution. With the Roundstone captive, several avenues for cost savings can benefit participants.

Roundstone enables participants to implement cost containment measures and improved healthcare utilization management that can lead to claims savings. Employers can save on claims expenses by actively managing healthcare costs and optimizing utilization.

At Roundstone, 100% of any unspent funds are returned at the end of the coverage period, allowing employers to pay for what they use and accumulate savings over time.

Additionally, the shared risk pool in a self-insured group captive provides greater predictability and stability in premium costs. Spreading the financial risk across multiple employers mitigates the impact of high-cost claims, including the price of premium drugs.

This means employers are not solely responsible for shouldering the burden of expensive medical treatments. This approach enables companies with only 25 employees to self-insure with the same confidence as the Fortune 500s.

By leveraging self-funded health insurance, employers can unlock cost-saving opportunities, reduce the financial burden of premium drugs, and enjoy greater stability in premium costs.

Learn More About How Self-Funded Insurance Lowers Costs

To discover the benefits of self-funding to lower the cost of your prescription drug spending, contact a Roundstone Advisor today. Our team will help you find the right PBM and get you started.

To learn more about reducing pharmacy costs with a self-funded health plan, download our free eBook.