Highlights

- Clinical care management is a team-based approach to healthcare that focuses on helping high-risk patients manage chronic or life-threatening conditions.

- Clinical care management lowers healthcare costs by reducing unnecessary ER and hospital visits and improving patients’ overall health and can be a powerful tool to improve the savings of a self-funded health insurance plan.

- Implementing clinical care management features into your self-funded insurance coverage is essential to lowering your healthcare costs.

- With a self-insured group captive plan from Roundstone, you can easily build clinical care management features into your plan design to lower healthcare expenses.

Clinical care management is a healthcare strategy that uses a comprehensive approach to high-risk patient care. This approach lowers healthcare costs for the self-funded insurer and provides better care for the insured member. The beauty of self-funded health insurance is you can adapt the plan to both lower costs and improve the quality of care, which comes through a proactive approach to clinical care management.

With self-funded group captive insurance from Roundstone, you can build clinical care management features into your plan design to lower healthcare expenses incurred by high-cost members.

What is Clinical Care Management?

Clinical care management (CCM) refers to a well-rounded, team-based approach to healthcare for those diagnosed with chronic or life-threatening illnesses. Unlike case management, which emphasizes treating the condition, care management programs focus on helping individuals manage illness by overseeing and integrating education, care, and support. Prioritizing care management can dramatically improve the savings of a self-funded health insurance plan.

Care management helps lower health risks and manage conditions more efficiently and effectively, reducing the overall cost of care and improving the savings of a self-funded healthcare plan.

Impact of High-Cost Claimants on Healthcare Expenses

According to an Employee Benefit Research Institute report, approximately 20% of the population accounts for 84% of healthcare spending. As one illustration, chronic conditions like diabetes are significant cost drivers among these patients. In a self-insured plan, you can use cost-saving strategies to lower these cost drivers and optimize savings.

One-third of the top 10% of high-expense claimants were diagnosed with diabetes. Of those, 51% also suffered from hypertension, and 25% experienced additional comorbid conditions like respiratory disease, connective tissue disease, and back problems.

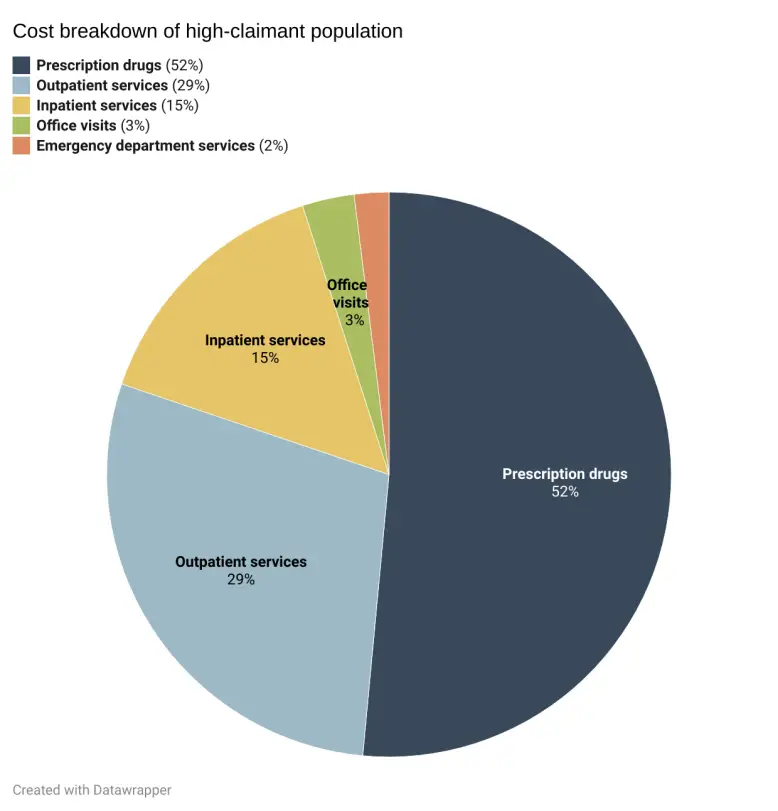

The EBRI study also offered a cost breakdown of this high-claimant population:

- 52%: prescription drugs

- 29%: outpatient services

- 3%: office visits

- 15%: inpatient services

- 2%: emergency department services

These numbers highlight the reality that a small number of employees likely incurs the bulk of your company’s healthcare expenses. Approximately 2.5% of your covered employees could therefore be responsible for about 80% of costs, making an approach like CCM necessary to curb spending and improve health outcomes for these employees.

Clinical Care Management To Lower Healthcare Spending and Optimize Self-Funded Savings

In a self-funded health insurance plan, CCM is a practical approach for lowering your company’s healthcare spending on high-cost claimants. CCM is a holistic method that provides well-rounded care for those employees. It addresses multiple factors affecting their health rather than just treating their condition and can be a useful tool in lowering spend and improving the savings of your self-funded health insurance plan.

CCM involves identifying employees who have high-cost diagnoses and treatments anonymously in a way that is HIPAA compliant. A care manager (typically a nurse) will work closely with those patients to ensure they are given the correct diagnosis, proper medication and care services, lifestyle and health education, and post-treatment care.

When all these factors come together, they reduce the patient’s likelihood of comorbid conditions and help them better manage their primary diagnosis. CCM results in better care for the patient as well as cost containment for the employer. It is one way you can improve the savings while simultaneously improving the care quality available in a self-funded health insurance plan.

Identifying Patients for Clinical Care Management

Again, the first step in implementing CCM for high-cost claimants is identifying high-risk patients. Usually, this involves provider insight into the patient’s living situation, ability to follow through with health goals, and access to social support systems.

The process also takes patient-reported information into account. Patients who self-report needing help to manage their conditions see an increase in hospitalization and emergency room use over those who self-report positive health aspects. When clinicians intervene with CCM early in the care process with these patients, they can help prevent these costly visits and improve the savings of a self-funded health insurance plan.

Care Coordination

This strategy calls for a care manager who coordinates a care team for the high-risk patient. The team then works together to provide an integrative approach to the patient’s health needs.

Clinicians use multiple strategies to control costs. For example, a cancer patient may be prescribed costly biologic infusions or injections, which are normally given in an outpatient setting. With proper training, often these treatments can be done by the patient or a caregiver at home at far less cost.

A care manager might also direct this patient toward biosimilar pharmaceuticals that are significantly less expensive than the prescribed medication.

Coordinated care results in better outcomes for patients. The care team works together to ensure that all of a patient’s needs are covered while eliminating situations that arise when a patient’s providers aren’t communicating about all aspects of the patient’s care.

Support for Self Management

Care managers also provide support for the self-management of chronic conditions. This can come in the form of education about the patient’s condition and coaching or behavioral programs that encourage actions to improve health outcomes.

For instance, if a patient is diagnosed with diabetes, their care team may provide educational resources on diet and lifestyle changes to improve their health. They may also work with the patient to monitor their insulin levels and weight, limiting the risk for comorbid conditions or emergency room visits.

Patient Education

Patient education and outreach are essential components of clinical care management. Outreach includes communicating with high-risk patients about their health throughout the stages of care.

Clinicians may reach out to patients to ensure they:

- Regularly check in with their primary care provider

- Follow the prescribed treatment plan

- Understand how to use their medications and where to get them

- Know when they should seek emergency care versus less costly options

- Receive follow-up care with the appropriate providers

Patients who meet these outreach objectives are less likely to develop comorbid conditions, which accrue additional healthcare costs for employers. They reduce the risk of complications of their primary condition and are less likely to unnecessarily visit the ER or hospital. They are also more likely to use medication as directed, which can help you plan for pharmacy costs. Successfully fulfilling these outreach objectives can dramatically improve the savings of your self-funded health insurance plan.

Obstacles to Providing Clinical Care Management to High-Risk Patients

Despite the beneficial outcomes of CCM for both high-cost claimant employees and self-insured group captive members, you may experience resistance in motivating employees to take advantage of CCM policies. The most common obstacle is employee resistance due to a lack of education about available CCM services or how CCM could benefit them.

As a member of a self-insured group medical captive plan with Roundstone, you have access to your company’s anonymized claims data. This data gives you insights into where your healthcare dollars are going at a bird’s-eye view. With these insights, you can identify the type of care, diagnosis, and medications that account for the bulk of your company’s healthcare spending and can then utilize cost savings strategies to improve the savings of your self-funded health insurance plan..

While you can see this information at a high level, your employees are still protected under privacy laws, which means you can’t identify which employees may need these services. This makes it vitally important to educate all of your covered employees about the CCM services your plan provides. It’s also essential to educate your workers about the impact of high costs to their plan and how CCM can improve their health outcomes.

Building Clinical Care Management Into Your Self-Insured Group Captive Plan

Building clinical care management into your self-insured group captive plan with Roundstone is a natural part of the plan design process. There are numerous strategies you can use to implement care management into your health insurance coverage.

Following are common care management strategies that can have a significant effect on your healthcare costs.

Drug Intervention

Typical CCM involves drug intervention with patients who require specialty medication for their conditions. Cost-containment strategies for your self-insured group captive plan design can take several forms.

First, work with specialty vendors or a pass-through pharmacy benefits manager to ensure that high-risk employees have access to the medication they need. Then, provide educational resources for patients on routine medications so that they know how to fill and take their medication appropriately.

You can also mitigate risk by adding a carve-out for specialty medications to your self-funded healthcare plan, dealing with them separately from your general prescription medication coverage.

Change of Care Site

For high-risk employees, switching the care site is a game-changer for care and cost. If your workers receive care at the hospital, the costs are higher than other options.

Consider offering coverage for treatment centers, such as infusion centers, or even moving a patient to in-home services. In a self-funded healthcare plan, your employees can take advantage of lower-cost options that still provide excellent care and are often more convenient and accessible, so everybody wins.

Second Opinions for Certain Diagnosis

As part of your CCM strategy, build coverage into your self-insured plan for second opinions on certain high-risk diagnoses such as cancer, kidney disease, or heart disease. Treatment plans for these conditions often require high-cost treatments or medications.

When you build coverage into your plan for a second opinion, you allow for additional (possibly less costly) diagnosis and treatment options for your employees.

Substitution of Care

Another CCM strategy you can implement as part of your self-insured group captive plan is to offer care substitutions. This refers to offering coverage for services from alternate healthcare providers.

For example, allowing your workers to obtain at-home care or covering procedures in a wide range of medical centers versus only covering them at in-network hospitals can lower your costs and make high-quality care more convenient for patients.

Elimination of Duplication of Services

As part of building CCM into your self-insured group captive plan, you can add measures that eliminate duplication of services. Duplication of services occurs when your member receives the same service from different providers, or multiple times from the same provider.

For example, a patient’s primary care provider might order lab tests as a routine procedure for chronic conditions. Because the patient must also see a specialist for that condition, this service might be duplicated when the specialist orders the same tests.

You can eliminate redundant treatments or provider visits by streamlining coverage and bringing in CCM services. This can also improve the savings you accrue from self-insurance.

Post-Treatment Care

Post-treatment follow-up care is critical for containing the cost of chronic or catastrophic diagnoses. Sometimes, however, high-risk patients don’t follow through on post-treatment care.

Care management allows you to monitor the patient post-treatment and intervene. For example, many patients don’t schedule follow-up appointments because their coverage forces them to travel to an in-network hospital or provider.

To solve this problem, you can incentivize patients to use telehealth services by offering zero or low-cost copays for telehealth visits.

Reduce Healthcare Costs By Building Clinical Care Management Into Your Self-Funded Group Captive Plan

Clinical care management is an effective approach to healthcare that provides better care for patients and lowers costs for employers. By building CCM strategies into your self-insured group captive plan, you can reduce expenses incurred by high-risk employees and improve their health outcomes in the process.

Discover how self-funded group captive stop-loss insurance from Roundstone can help you track your health healthcare expenses and implement cost-containment strategies such as clinical care management to lower your health insurance costs.