Highlights

- For the first time, there are five generations in the workplace at the same time, creating unique challenges for employers.

- Each generation carries a traditional mindset towards work, including their values, concerns, needs, and expectations.

- Designing a self-funded employee benefits plan that addresses the needs of each generation of workers can create a more unified work environment.

- How to get more flexibility to suit your unique business demographics and needs? A self-funded health insurance solution offers much more flexibility than a cookie-cutter fully-insured plan.

In recent years, the unprecedented appearance of five generations in the workplace is creating unique opportunities for employers. Having a multi-generational workforce brings employers a richness of perspective and experience. This is important for diversity and inclusion as well as for sustaining a vibrant company culture.

Multiple generations also bring their share of challenges with different communications, collaboration, and decision-making styles, for example. And let’s talk about life goals. The 10-year horizon of a 60-year-old looks very different from those of their much-younger team members.

However, companies benefit from the diverse contributions of a multigenerational workforce. Employees may all be striving for different things, yet they can learn from each other and benefit from each other’s generational wisdom.

HR and business leaders should consider all age groups to find the best ways to attract, engage, retain, and develop employees from various life stages. Healthcare benefits are a critical part of this. It’s vital for employers to understand the different mindsets and needs of each generation to design an self-funded employee health insurance plan that addresses them all.

Five Generations in the Workplace: Understanding Mindset Differences

People from each generation bring different values and characteristics to the workplace. Their unique approaches impact how they engage with others and what they expect from employers.

It’s important to engage your employees in your self-insured health plan because happier, healthier employees are more productive employees. Investing in solutions that cater to different generations show employees that they are a valued asset to your company, and the resulting positive workplace culture helps attract and retain top talent in a hot job market.

While we don’t advise adhering strictly to stereotypes, here is a general breakdown of some common differences among the generations.

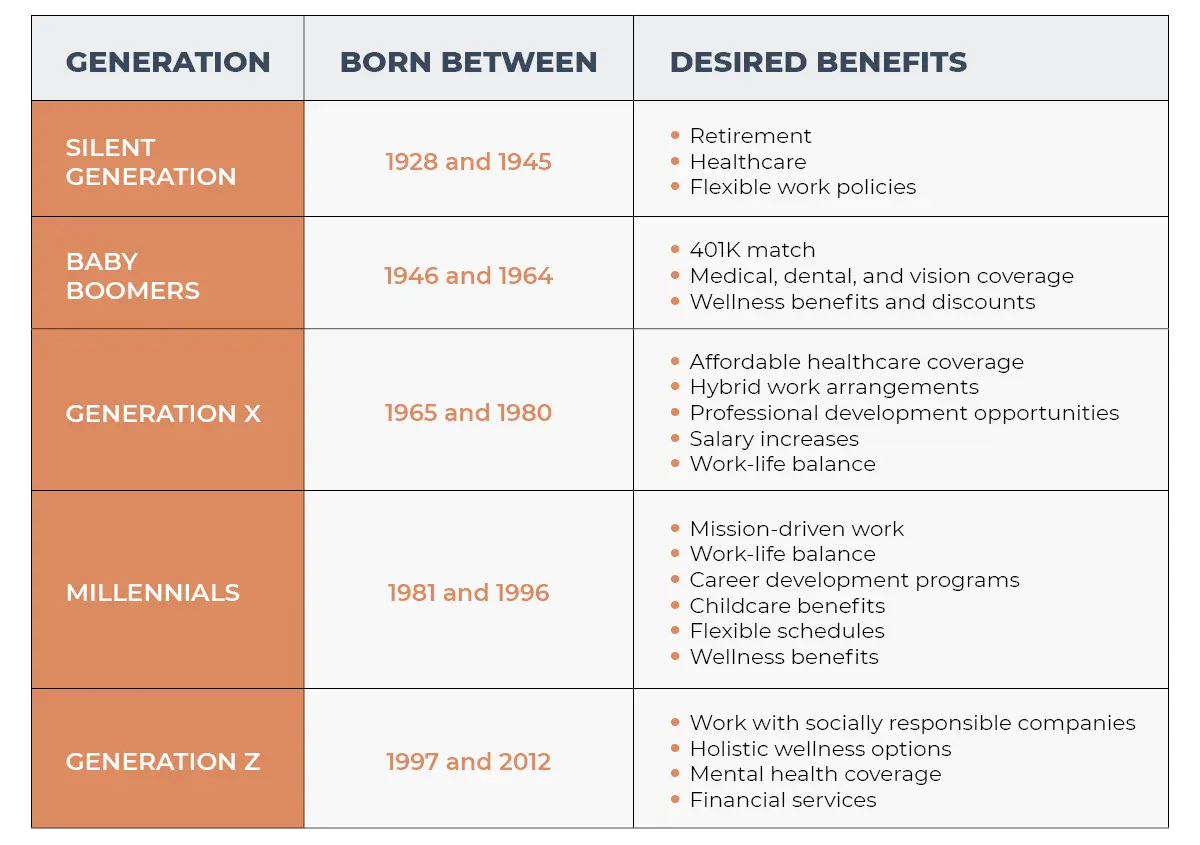

Traditionalists (born between 1928 and 1945)

Also known as the Silent Generation, this group includes people born between 1928 and 1945. They account for 13.9% of the participating workforce in the United States.

These employees tend to value interpersonal relationships, long-term loyalty, and the hierarchy that comes with a structured work environment. A traditionalist employee may be concerned with retirement and healthcare benefits when they enter full-time retirement. They may also appreciate flexible work policies.

Baby Boomers (born between 1946 and 1964)

People born after World War II and up to 1964 are known for their work ethic and goal orientation. Most Baby Boomers value face-to-face interaction and formal work environments. Boomers, if working full-time, will prioritize having a full slate of health insurance benefits — medical, dental, and vision. They may also appreciate wellness benefits like discounts on gym memberships or health services.

66.9% of Baby Boomers retired from the workforce in the third quarter of 2021, an increase over the 64% of Boomers who retired in the same period in 2019. This increase was brought on by the COVID-19 pandemic and a large segment of the population reaching retirement age. Healthcare and retirement benefits such as a 401(K) match have become more important for this generation as they retire from the workforce.

Generation X (born between 1965 and 1980)

Professionals in this generation are known for their self-reliance, entrepreneurial spirit, and fiscal responsibility. Sandwiched between Baby Boomers and Millennials, they were shaped by the rise of computers and the internet in the workplace. Gen X comprise 33 percent of the U.S. workforce. As such, they carry a lot of financial and familial responsibilities.

Gen X’ers who have families tend to be interested in affordable healthcare coverage and at least partially remote work schedules. 59% of workers surveyed by Gallup prefer a hybrid working arrangement post-pandemic.

Many are looking for professional development opportunities to increase their skills and further their careers, well-being programs that support fitness, and benefits that help them care for dependent children or aging parents.

Gen X’ers may also be concerned with salary increases to help pay off debt and having paid time off for better work-life balance.

Millennials (born between 1981 and 1996)

Millennials started working as the internet revolutionized the workplace with new tools to boost productivity and communication. As a result, they tend to be resilient and highly adaptive when it comes to navigating changes in the workplace.

In general, millennials value career development programs, working with mission-driven employers, and work that allows them to prioritize work-life balance.

During the pandemic, over 1.2 million parents have had to leave the workforce to care for their children due to a lack of affordable daycare. Pew Research found that in February of 2022, 51% of parents with children under 12 said they have difficulty finding backup childcare if the primary resource is unavailable. Childcare benefits and on-site daycare can help millennials who are raising families with young children.

Flexible schedules and time off can also help this generation be there for their children as schools experience staff shortages and implement half-days and closings that leave these parents scrambling for childcare.

Millennials need reasons to believe their work has meaning to inspire loyalty and make them proud to work for you. Offering wellness and employee engagement programs, such as company-wide flu and COVID vaccinations, nutrition services, community-oriented service, volunteer opportunities, and fitness incentives, will likely appeal to them.

Generation Z (born between 1997 and 2012)

Members of Generation Z grew up using the internet daily. As “digital natives,” they view smartphones and laptops as essential devices. Many Gen Z’ers prefer to work for companies that value social responsibility and mental health awareness.

One interesting way that COVID-19 affected our world is that it acted as an accelerator of many early-stage trends, including web conferencing, contactless everything, and virtual fitness classes. In the world of healthcare, it also led to wider adoption of telehealth services to meet with healthcare providers. People are also turning increasingly to mobile apps to manage mental health issues like anxiety and depression.

As workers of this generation are more likely to report mental health issues and seek counseling than their elders, many are looking for employers who acknowledge the importance of holistic wellness, which includes physical, financial, and mental health services and benefits.

How to Engage All Five Generations in Your Employer-Sponsored Self-Funded Health Plan

As you think about your health benefits and wellness programs in the context of multiple generations, you soon realize that a one-size-fits-all approach is unlikely to be effective or satisfactory. This is a great reason to consider a self-funded employee benefits solution that allows for plan flexibility and customized design.

If you already have a self-funded health insurance plan, there’s always an opportunity to improve your plan as your demographics and needs change. With a self-insured plan, you can also use data and analytics to help optimize plan usage.

Here are some ideas to engage each generation through your self-funded health benefits plan.

Offer Employee Well-Being Programs

Building an employee well-being program into your self-funded group captive plan can increase employee engagement and retention. Consider implementing a program that offers incentives that appeal to different generations, such as diet and nutrition education for Baby Boomers, biometric and mental health screenings for Millennials, and gym membership discounts for Gen Z.

Financial wellness programs can appeal to all generations, whether it’s introducing a younger employee to the benefits of a 401K, or helping older employees plan their path to retirement or being debt-free. Offer your employees financial educational resources through emails, speakers, or classes where they can learn money management, savings, or investing skills for financial well-being.

Allow Varied Options for Providers and Treatments in a Self-Funded Insurance Plan

According to an industry survey, 12% of Gen X and Z employees focus on coverage regarding their healthcare plan, while 11% of Millennials are more interested in services. To meet the needs of multiple generations, include various providers and treatment options in your self-funded healthcare plan. For example, consider coverage for virtual health services, mental health sessions, and Centers of Excellence care.

You might also consider adding coverage for alternative treatments like chiropractic or acupuncture to appeal to Millenials and Gen Z’ers, who often have a more holistic approach to healthcare, as well as older employees who are open to new routes to wellness. The beauty of a self-funded health insurance plan is you can custom-tailor it to best suit the needs of your employees.

Minimize Out-of-Pocket Costs in a Self-Funded Insurance Plan

Employees from every generation worry about the cost of healthcare. Insurance premiums have risen 43% in the last 10 years, so minimizing out-of-pocket costs is essential to meeting your employees’ needs. Reduce cost-sharing in your plan by doing away with deductibles and lowering co-pays.

At Roundstone, our employee contribution to our self-insured health plan has not changed in seven years — a testament to our well-managed wellness programs and the group captive’s performance. (Yes, we drink our own champagne!)

You can design your self-funded health insurance plan from the ground up with Roundstone, allowing you to create a plan that integrates cost containment opportunities and incentives to offset your costs and keep employee contributions low.

Incentivize Employees Who Use Cost-Effective Services

When designing your self-insured plan, include incentives for employees who use cost-effective services. A self-funded group captive plan gives you the freedom to personalize and choose the most effective tactics. With benefits and incentives, you can reach older employees who may be set in their ways or reluctant to use out-of-the-box services, such as digital well-being tools or online benefits services, while meeting the needs of less-traditional younger employees.

For example, you can embrace multiple modes of communication for older workers, distributing information about your self-insured healthcare plan through flyers, texts, emails, and in-app messages to reach all workers. You can also work with a third-party administrator (TPA) who offers online and automated services and phone call options so that older and younger generations feel comfortable discussing their benefits.

Additionally, you can build incentives into your self-insured plan to use less-expensive forms of care, such as telehealth or primary care, rather than urgent care or the emergency department. Younger workers are more comfortable with telehealth, while older workers may prefer primary care. Offering coverage for virtual healthcare or adopting a direct primary care program helps reach both generations.

You could also incentivize employees to participate in a company well-being program and/or biometric screenings that will benefit employees of every age while cutting healthcare costs for you.

Support All of Your Employees with Roundstone’s Self-Funded Health Insurance

Self-funded health insurance is a great way to build an employee benefits plan that meets the needs of every generation in your workplace. Self-funding with Roundstone’s group medical captive goes even further by giving you, the employer, financial peace of mind over the long term.

Contact us today to learn more about how Roundstone can help you design a customized healthcare plan and save you money on insurance costs through self-insurance.

Engaging all 5 generations in the workplace is a strategy that takes time, just like any other program you put in place to better your employees’ well-being. Learn tips and tricks to help accomplish these goals by tuning in to our latest webinar, now on demand.