- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

TOPIC

Designing Your Group Captive Plan to Cut Costs Your Way

- Roundstone Team

- 6 Minute Read

- Plan Design

Find this article helpful? Share it with others.

Group captive self-funding empowers small to midsize businesses to escape rising healthcare costs by customizing plans based on real employee needs. With data transparency and vendor flexibility, employers gain control, reduce waste, and improve outcomes—all while saving money.

Healthcare costs have put small to midsize businesses in a tough spot: Either pay more each year for rigid plans that don’t meet employee needs, or lose talent to companies offering better benefits.

Fully insured plans provide no flexibility. Employers pay for coverage their teams don’t use while missing benefits they need. Premium increases arrive without explanation, and claim data remains out of reach.

Group captive self-funding changes everything. Employers design plans from the ground up based on the actual needs of their employee population. Real claims data guides smarter decisions. Transparent vendor partnerships put cost control back in employers’ hands.

The result? Better outcomes at lower costs through strategic, data-driven customization.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

Plan Design Fundamentals

Strategic plan design starts with understanding the core elements that shape how a self-funded health plan performs. These fundamentals then create the foundation for every customization decision.

Why Plan Design Matters

Designing a plan without insight leads to wasted spending and missed opportunities. A thoughtful approach ensures every benefit serves a clear purpose and delivers measurable value.

Generic plans waste money on unused benefits and lack essential coverage. A manufacturing business with an older workforce pays the same rates for maternity care as a tech firm with younger employees, even though their employees have vastly different needs.

Group captive self-funding eliminates this waste. Employers fund only what their teams use. With access to claims data, they can see how employees use healthcare and design accordingly.

Tailored plans focus spending where it matters—lowering copays for preventive care, optimizing pharmacy benefits, and addressing emerging issues before they escalate.

The Building Blocks of Effective Plan Design

Every high-performing self-funded plan rests on three key components. These building blocks provide the structure and flexibility needed to create benefits that align with real-world needs.

Clear, customized documentation. The Summary Plan Description (SPD) acts as a blueprint that defines what the plan covers. Roundstone helps employers develop SPDs that reflect specific plan design strategies, including cost-containment and wellness incentives.

Network selection based on need. Employers can choose providers that match their workforce’s geography and preferences, rather than relying on generic carrier networks.

Cost-sharing that drives smart use. Copays and deductibles can steer employees toward high-value, cost-effective care. Lower costs for primary care and generics, and higher costs for avoidable ER visits, create better outcomes.

Customization Strategies That Work

Customization is where strategy meets execution. These approaches help align plan design with what employees want, while keeping spending under control.

Know Your Workforce

A successful plan starts with knowing who it’s for. Use this data-driven approach to align benefits with employee needs.

Demographics reveal benefit priorities. Age, family structure, and health status influence what matters most, from mental health access to chronic disease support.

Claims data highlights utilization trends. Roundstone Reporting identifies which services drive costs, such as specialist visits or ER use, and suggests solutions like telemedicine or urgent care.

Direct feedback adds critical context. Surveys and focus groups help uncover what employees value, like mental health access or pharmacy convenience.

Strategic Design Choices

Once you understand your workforce, these design levers offer the best opportunities to deliver impact without driving up costs.

Preventive care incentives reduce downstream costs. You have the option of lowering copays for routine care, screenings, and disease management to help avoid expensive emergencies and enable early intervention.

You can optimize pharmacy benefits. Transparent pharmacy benefits managers (PBM), smart formularies, and preferred pharmacy networks drive down drug costs while maintaining access to necessary medications.

Behavioral health needs to be accessible. You can reduce copays for therapy, offer telehealth options, and partner with employee assistance programs (EAPs) to improve access and remove stigma.

Wellness programs can be tied to cost-sharing. You can offer HSA contributions or premium discounts for participation in screenings, fitness programs, or smoking cessation.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor.

Plan Design: Vendor Selection Freedom

Employers can choose partners who align with plan design and cost containment goals:

Third Party Administration selection criteria. Choose a TPA that specializes in company size and understand self-funded plan flexibility. Evaluate customer service quality, claims processing speed, and technology platforms.

Pharmacy Benefit Manager partnership strategy. Transparent PBMs pass all savings to plans while traditional models keep significant rebates and fees. Evaluate fee structures, rebate sharing, and formulary flexibility.

Network flexibility. Choose networks based on employee locations and preferences rather than accepting standard carrier options. Regional networks might provide better value for geographically concentrated workforces.

The Roundstone Preferred Bundle. For employers seeking proven vendor integration, Roundstone’s Preferred Bundle combines Bywater TPA, Cigna network, and select transparent PBMs into a coordinated solution.

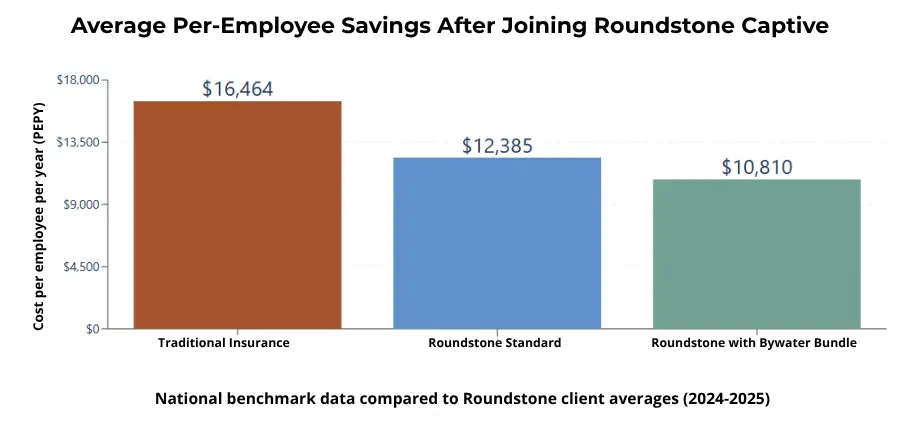

This strategic combination delivers an average of $1,700 less per employee annually compared to other vendor arrangements, representing 34% savings versus industry benchmarks through seamless integration and optimized cost control.

Plan Design: Implementation and Management

Even the best-designed plan won’t deliver results without effective rollout and oversight. This is where smart planning meets day-to-day management.

Getting Started

Start strong with these foundational steps. A clear budget, realistic timeline, and compliance framework set the stage for a smooth launch.

Budget based on workforce trends. Forecast claims and administrative costs using employee health patterns and demographic insights.

Plan for a thoughtful timeline. Coordinate implementation around existing plan cycles and allow time for vendor onboarding, employee education, and possible phased rollouts.

Meet ERISA requirements. Compliance doesn’t limit customization,but it does require clear documentation and guidance from experienced advisors.

Change Management and Optimization

Communication and continuous improvement are critical. Here’s how to educate employees and fine-tune your plan over time.

Use multi-channel education tools. Combine written guides, digital resources, and live Q&A sessions to explain plan changes and reinforce benefits.

Reinforce what’s staying the same. Employees should know that their ID cards, provider networks, and claims process will remain similar.

Review data regularly. Use quarterly Roundstone Reporting to identify cost drivers and opportunities for improvement.

Track beyond cost. Monitor satisfaction, engagement, and outcomes—not just financials—to ensure the plan is delivering value.

Advanced Plan Design Elements

For experienced self-funders, advanced strategies provide greater control over complex challenges, without sacrificing care quality.

Specialized Benefit Design

Some conditions drive a disproportionate share of healthcare costs. With self-funding, group members can use these design strategies to help manage high-impact needs more effectively:

Target high-cost conditions. Use case management and Centers of Excellence to support employees with chronic conditions or cancer while reducing costs.

Take the pharmacy further. Consider specialty drug management and direct contracts with manufacturers for high-cost prescription medications.

Integrate telemedicine. Build virtual care into your plan with reduced copays for both physical and mental health needs.

Download the free ebook Strategies to Contain the Rising Costs of Pharmacy to learn more about how members of a group captive can save money on prescription medications.

Risk Management and Competitive Advantages

Balance innovation with protection. These techniques help manage risk, stabilize costs, and turn your benefits into a business advantage.

Use stop-loss insurance strategically. Set deductibles that match your cash flow and risk tolerance, supported by captive pooling.

Leverage the captive model. Sharing risk across employers for more aggressive design choices without the individual exposure.

Turn benefits into a differentiator. Tailored plans attract talent and support retention by aligning coverage with employee needs.

Take Control of Plan Design

When employers control plan design, everyone wins. Better benefits, lower costs, and long-term flexibility are all within reach. Group captive self-funding puts employers in charge. With data, transparency, and the right partners, you can build a plan that works for your people and your business.

Assess your current plan. Review claims data, employee feedback, and plan performance to identify customization opportunities.

Build your plan with expert input. Work with Roundstone advisors to design a strategy that fits your budget and workforce.

Plan the rollout. Set timelines, align vendors, and develop your employee communication strategy.

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025