- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

What Is Cost Containment in Healthcare? Strategies to Save on Employee Health Insurance

- Abbey Hughes

- 8 Minute Read

- Category Here

Find this article helpful? Share it with others.

In this guide, we explore how healthcare cost-containment strategies—especially through Roundstone’s group captive—can help you spend smarter, improve outcomes, and future-proof your employee benefits.

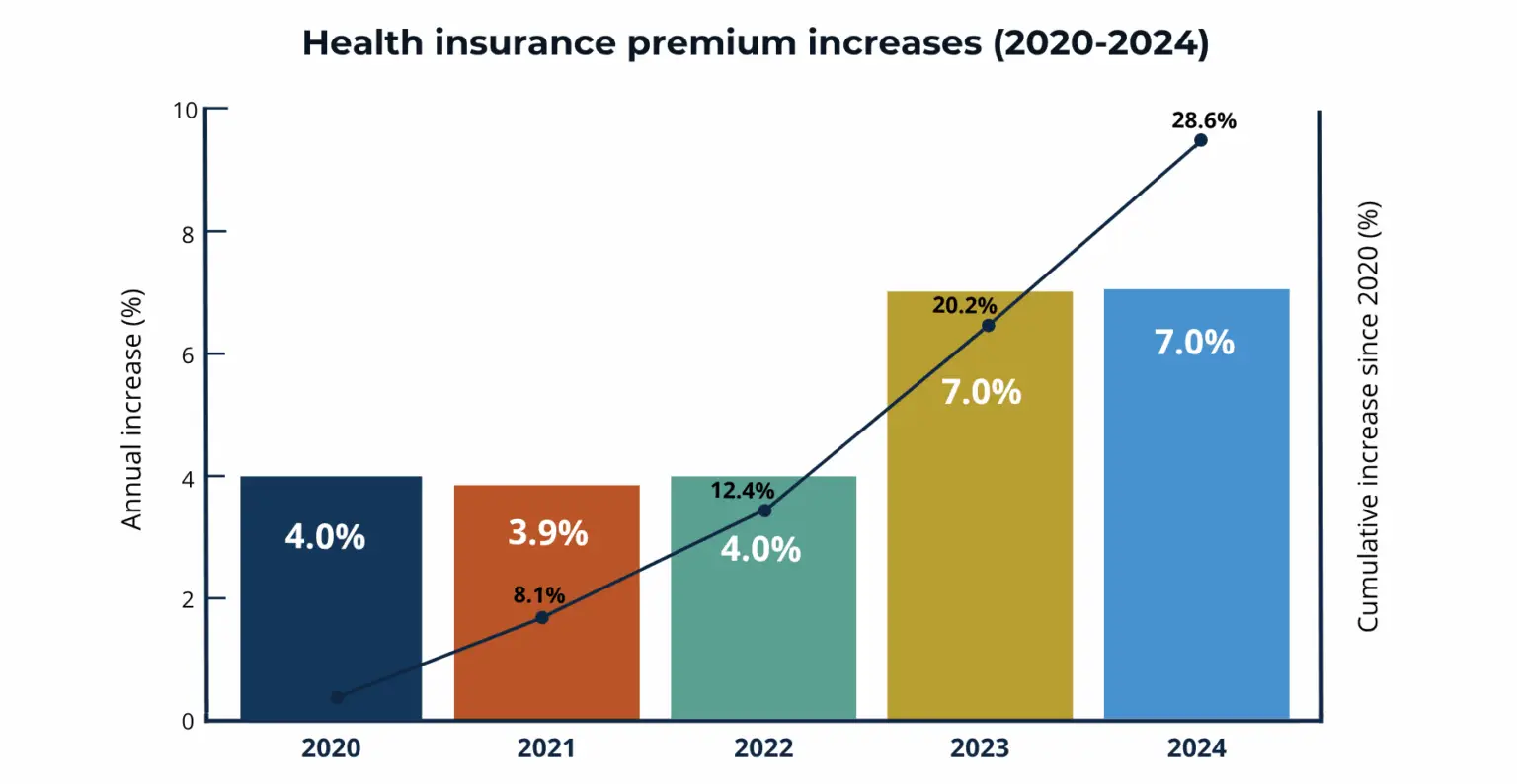

Healthcare costs have surged 28.6% since 2020, making health insurance the second-largest business expense after payroll. For employers, this is much more than a budget issue. It’s a threat to profitability, growth, and talent retention.

Traditional fully insured health plans offer little relief. They bundle costs, limit plan design flexibility, and deliver double-digit premium increases with no transparency into what’s driving expenses. Without claims data, you’re flying blind—unable to act on rising costs or implement solutions.

Roundstone’s self-funded group captive model puts employers back in control. With access to detailed claims data, flexible plan design, and the power of shared risk, companies using our approach have reduced healthcare costs by up to 34% while delivering better benefits to their employees.

Questions about cost containment? Ask us anything below.

Cost Containment FAQs

Cost containment in healthcare is a strategy that works to reduce an organization’s overall costs using historical data.

You can lower healthcare costs by making informed decisions, such as choosing high-value providers, using generic medications, and focusing on preventive care. Understanding your claims data can also help identify patterns and reduce unnecessary spending.

Employers can manage rising healthcare costs by using data to guide plan design, encouraging preventive care, and exploring funding options like self-funded plans that offer more control and transparency. Educating employees on how to use their benefits wisely also plays a key role.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

Why Are Healthcare Costs Rising So Rapidly?

In 2024, the average annual premium for employer-sponsored family health coverage rose to $25,572, marking a 7% increase from the previous year. Employees contributed an average of $6,296 toward these premiums, a slight decrease from 2023.

Several factors drive these increases:

Fee-for-service payment models Providers are paid for quantity of services rather than quality or outcomes. Because most insurers pay under what is called a fee-for-service reimbursement model, they receive payments for every single visit or procedure.

Lack of price transparency Without clear visibility into costs, employers and employees cannot make informed decisions about care options.

Administrative complexity Traditional insurance involves layers of administrative costs that add to overall healthcare spending.

This continued escalation in healthcare costs underscores the importance of strategic cost-containment measures.

What Is Healthcare Cost Containment?

Healthcare cost containment means implementing strategic, data-driven methods to reduce medical plan costs while ensuring high-quality care. It’s not about slashing benefits—it’s about smarter spending.

That starts with transparency.

For most employers, healthcare costs feel like a black box—premiums go up year after year with no clear explanation. You’re forced to implement strategies like wellness programs or high-deductible plans reactively, without knowing whether they’re actually making a difference.

True cost containment starts by understanding where your money is going. That means having access to the right data, choosing the right partners, and designing a health plan around the actual needs of your workforce—not what a traditional carrier offers off the shelf.

Self-funded plans offer the tools to make that possible. With Roundstone, you gain:

Complete claims transparency to identify and act on cost drivers

Flexible plan design tailored to your workforce

With self-funding, you’re no longer at the mercy of opaque insurance carriers. You’re in the driver’s seat.

For guidance on how to plan financially for a self-funded arrangement, read our guide to budgeting for a self-funded health plan.

How Do Group Medical Captives Enable Better Cost Containment

Instead of going it alone, employers join together in a shared-risk model—retaining ownership of their plan while gaining access to resources typically reserved for much larger organizations.

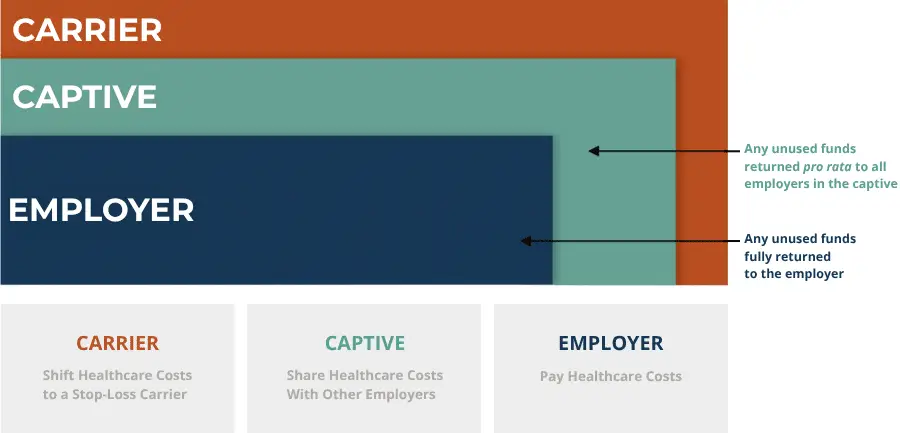

At the core of this approach is a three-tier funding structure—often called the “layer cake”—that transforms a fixed insurance expense into a variable cost you can actively manage:

Employer layer (65%): This funds your day-to-day employee healthcare claims. Any unused dollars are fully retained by your business—resulting in immediate savings when claims come in under projections.

Captive layer (25%): This is the shared-risk pool across all participating employers. It protects against mid-sized claims that exceed your employer layer but aren’t catastrophic. Unused funds in this layer are returned pro rata to all members.

Carrier layer (10%): This top layer represents your stop-loss insurance. It caps your maximum liability and shields you from high-cost, catastrophic claims.

The Benefits of A Captive Insurance Model

This structure delivers several advantages:

Collective purchasing power Gain leverage as part of a larger group to negotiate better rates with providers, pharmacy benefit managers (PBMs), and networks.

Cost control Pay only for healthcare services your employees actually use, with full transparency into spending patterns.

Plan Flexibility Design benefits that match your workforce needs rather than accepting one-size-fits-all options from traditional carriers.

Data access Gain visibility into claims data to identify cost drivers and optimization opportunities.

Potential savings Receive cash distributions from unused premium dollars—averaging 10.4% annually for Roundstone members.

With in-house underwriters, dedicated Regional Practice Leaders, and a Cost Savings Investigator (CSI) Team that provides actionable insights, Roundstone supports your success every step of the way.

With a 90–95% client retention rate, our group captive model consistently delivers sustainable results and long-term value.

How Much Can Businesses Save With Cost Containment Strategies?

The potential savings from effective cost-containment strategies are substantial. One of the most important metrics for understanding and comparing healthcare costs is Per Employee Per Year (PEPY).

This simple calculation divides your total annual healthcare spend by the number of enrolled employees—giving you a clear, apples-to-apples benchmark to track performance and evaluate savings opportunities.

Here’s how PEPY compares across different plans:

- National average PEPY: $16,464

- Roundstone book of business: $12,385 (24% savings)

- Roundstone preferred bundle: $10,810 (34% savings)

For a company with 100 employees, that’s a potential annual savings of $565,400.

What powers these savings? Our data shows employers using Roundstone’s preferred configuration—Bywater as third-party administrator (TPA), Cigna as network, and TrueRx/ServeYouRx/Cigna as pharmacy benefits manager—save an additional $1,700 per employee over non-preferred options.

This cost advantage doesn’t sacrifice quality—our plans maintain an 82.04% actuarial value, equivalent to gold-level coverage.

Roundstone’s model is so effective that we guarantee it.

For more on how to plan financially for a self-funded arrangement, read How to Budget for a Self-Funded Plan, or watch our on-demand webinar.

What Are The Most Effective Cost-Containment Strategies?

Reducing healthcare costs starts with understanding where the money goes—and what you can do about it. These cost-containment strategies offer proven ways to control spending, improve outcomes, and get the most from your health plan.

Here are the most impactful ways to reduce costs without sacrificing care quality.

1. Claims Analysis

Roundstone’s CSI Dashboard provides real-time claims data and benchmarking to support cost-saving decisions.

This transparency allows you to:

Identify high-cost claim patterns: Roundstone’s CSI Team helps you spot trends that drive expenses—like high emergency department use—and address them proactively.

Target specific interventions: Use data to implement the right solutions for your unique workforce.

Measure results: Track the impact of your cost-containment initiatives to ensure they deliver expected savings.

With the CSI Dashboard, you gain the insight needed to turn rising healthcare costs into measurable savings and long-term plan optimization.

2. Pharmacy Cost Management

Prescription drug spending continues to be one of the fastest-growing healthcare expenses for employers. Without the right strategy in place, pharmacy costs can quickly erode the savings gained from self-funding.

Controlling these costs requires a strategic approach that includes:

Transparent PBM partnerships: Work with a pharmacy benefit manager that provides complete transparency in pricing and rebates. Roundstone's preferred PBMs deliver an average of $210 lower pharmacy costs per employee annually compared to non-preferred options.

Generic medication utilization: Generics offer significant savings—typically 80-85% less than brand-name alternatives—while providing the same therapeutic benefits. Implementing programs that encourage generic use can substantially reduce pharmacy spending.

Formulary management: Strategically design your drug formulary to balance cost management with clinical effectiveness, including step therapy protocols and tiered copay structures.

3. Provider Network Optimization and Care Direction

Your network strategy significantly impacts healthcare costs. Employers can save by directing employees to high-quality providers that offer cost-effective care.

Roundstone’s Bywater + Cigna network consistently delivers value across industries with cost-containment tools like these:

Network selection: Choose networks with strong discount arrangements and high-performing providers. Roundstone's data shows that the Bywater TPA with Cigna network delivers consistent cost advantages across group sizes.

Centers of excellence: Identify and partner with specialized facilities known for delivering high-quality care for specific procedures at competitive prices. Centers of excellence share a common strategy: an integrated practice unit made up of a team providing the full episode of care for the patient's condition.

Reference-based pricing: Consider reference-based pricing models that set payment limits based on Medicare rates or other objective benchmarks rather than arbitrary network discounts. This approach can reduce facility costs significantly while maintaining provider access.

A well-optimized provider network ensures employees receive high-quality care while employers achieve greater cost efficiency and plan performance.

4. Wellness and Preventive Care

Strategic wellness initiatives address health issues before they become expensive claims. Well-designed programs not only reduce costs but also improve employee satisfaction and productivity.

Cost-saving wellness strategies you can offer with a self-funded plan include:

Preventative care incentives encourage regular checkups, health screenings, and immunizations by eliminating cost barriers. Many self-funded plans offer zero-dollar copays for preventive services to maximize participation.

Chronic disease management focus resources on helping employees manage chronic conditions like diabetes, heart disease, and asthma. Clinical care management programs provide personalized support that improves health outcomes while reducing costly complications.

Well-being incentives offer financial rewards or premium reductions for healthy behaviors. Programs often include benefits like reducing employees' cost-share obligations, gym memberships, smoking cessation support, and rewards for maintaining a healthy weight.

Roundstone’s own employees have avoided premium increases for eight straight years thanks to these strategies.

5. Alternative Care Models

Innovative care delivery models can reduce costs while improving access and quality. Examples include:

Telehealth integration: Virtual care provides convenient access for minor illnesses, mental health services, and follow-up care. Integrating this option into your plan can reduce expensive in-person visits and emergency care.

Direct primary care: DPC arrangements remove fee-for-service barriers to primary care access. For a fixed monthly fee, employees receive comprehensive primary care services without additional costs, encouraging early intervention and reducing downstream expenses.

On-site or near-site clinics: For larger employers, dedicated clinics offer convenient access to primary care, occupational health services, and wellness programs, reducing productivity losses associated with off-site appointments.

Group medical captives bring the power of self-funding to small and midsize businesses by pooling risk and providing the flexibility and control needed to manage healthcare costs effectively.

How Can CFOs Measure Healthcare Cost Performance?

The Per-Employee Per-Year, or PEPY metric, is the most powerful for evaluating healthcare plan performance. Yet, only 45% of financial executives actively use this critical metric to guide strategic decisions.

Nearly one-third of CFOs don’t even know their company’s PEPY—a blind spot that’s costing them millions. It’s like running a business without knowing your cost per unit.

PEPY is a simple calculation that gives you an apples-to-apples comparison against industry benchmarks and helps identify optimization opportunities.

Calculate Your PEPY

To Calculate your PEPY:

1. Add all healthcare-related expenses for the year

2. Divide by the total number of enrolled employees

3. Compare to industry benchmarks and prior years.

Beyond the Per-Employee Per-Year benchmark, other important evaluation tools include:

Claims distribution patterns help you understand where your healthcare dollars go—hospital, pharmacy, specialty care, etc.—and allows you to further target cost-containment strategies.

Actuarial value represents how much of total healthcare costs your plan covers. Roundstone plans maintain an 82.04% actuarial value, equivalent to gold-level coverage.

Utilization metrics track how employees use different services to identify opportunities for steering to more cost-effective options.

Roundstone provides the tools—and expert support—to turn these insights into action.

The Advisors Role in Cost Containment

Forward-thinking benefits advisors have evolved beyond traditional plan placement to become strategic cost-containment consultants. They serve as the critical link between employers seeking financial relief and the sophisticated solutions available through self-funding.

Effective advisors leverage data transparency to identify savings opportunities, recommend targeted interventions, and measure results that impact their clients’ bottom line. With Roundstone’s group captive model, advisors gain access to powerful tools that enhance their value proposition:

Data-driven consulting: The CSI Dashboard provides advisors with real-time claims analysis and benchmarking capabilities, enabling more strategic client conversations based on actual performance data rather than insurance carrier projections.

Implementation expertise: Roundstone's team works alongside advisors to develop customized cost-containment strategies aligned with each client's unique workforce needs and financial objectives.

Measurable business impact: By focusing on PEPY metrics and specific savings opportunities, advisors demonstrate quantifiable value that strengthens client relationships and improves retention.

For employers, working with a skilled advisor means navigating the complex world of healthcare cost-containment becomes significantly easier. The right advisor brings specialized knowledge of vendor selection, plan design, implementation timing, and employee communication strategies essential for successful cost management.

Why Choose Roundstone as Your Cost Containment Partner?

At Roundstone, we don’t just help you contain healthcare costs—we help you take control of them. As the pioneer of the group medical captive model, we’ve returned $91.8 million in unspent premiums to our members and consistently deliver savings of up to 34% compared to traditional insurance.

Whether you’re looking to reduce rising costs, gain transparency, or build a long-term benefits strategy, Roundstone gives you the tools and support to succeed.

Contact a Roundstone RPL today for a personalized proposal and benchmark review. Discover how our self-funded group captive can help you provide better benefits at a lower cost.

ABOUT THE AUTHOR

Abbey Hughes

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025