Highlights

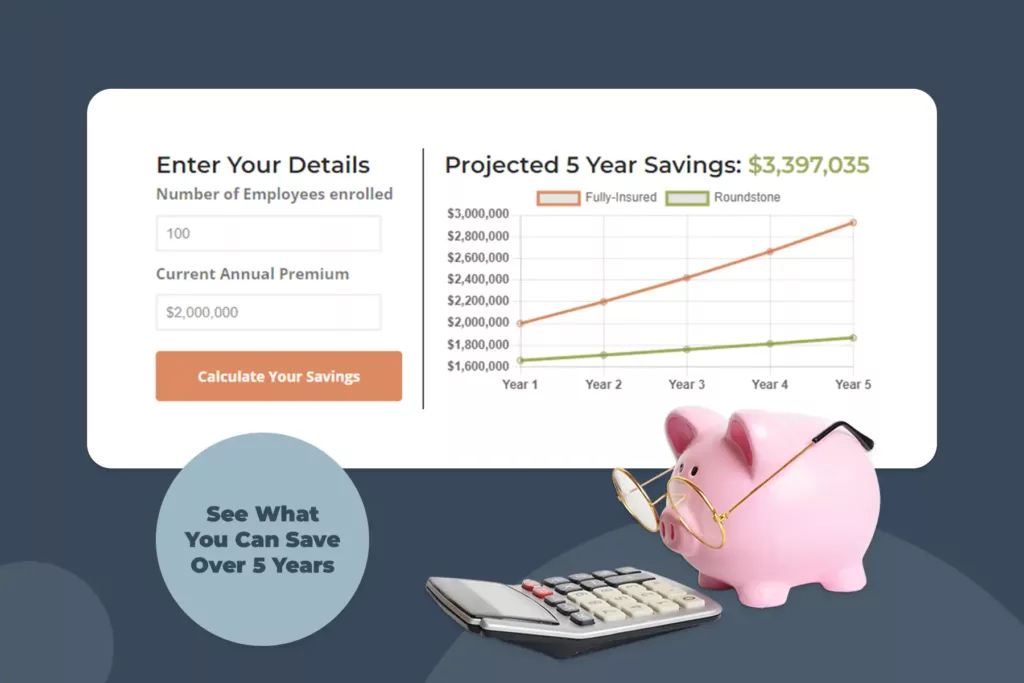

- Roundstone’s cost calculator provides a quick and easy understanding of the potential savings offered by a stop-loss captive in a self-funded health insurance plan.

- Captive members tend to save about 20% annually by self-funding their benefits, compared to a traditional insurance plan.

- Roundstone captive members save through a more cost-effective approach to benefits and utilize data-driven cost saving strategies to further improve the cost efficiency of their plans.

Why is health insurance so expensive? That’s likely a question you (or your clients if you’re a broker advisor) ask yourself every renewal season when a 20% to 40% increase hits. Typically, you aren’t given a reason why, since you have no data insight into the plan. Just pay up or else. The pain is both palpable and frustrating.

The high cost of healthcare is squeezing employers across America, and they can’t afford to sustain much more. Healthcare has become a top business expense, second only to payroll. Over the last 10 years, the cost of healthcare has increased over 150%, according to a Mercer Survey – and is projected to double in the next four years.

Fortunately, employers have a solution. They can choose to self-fund their benefits, something the Fortune 500 companies have done for decades because it’s more affordable and sustainable. They only pay for the healthcare their employees need – they get to keep any unused spend.

Until recently, this option wasn’t available to small to midsize businesses because they didn’t have the risk predictability of a large employee population. But the group captive changes all that. It pools many small to midsize employers together so they can offset risk. With a captive, companies with only 25 employees can self-fund their benefits with the same confidence as a Fortune 500 company.

With Roundstone’s Captive, you are guaranteed to save over five years.

The savings of Roundstone’s solution is real and verified. The Validation Institute recently found that employers who participate in the Roundstone Captive for self-funding their group health insurance have lower per member, per year costs than they would have paid for a fully insured plan.

“Validation Institute reviewed four years of data, which showed an employer’s per member, per month cost averaged $675 less than what they could have paid for a fully-insured plan. This is significant savings for the employer,” said Linda Riddell, Chief Data Scientist, Validation Institute.

How Much Can You Save with Self-Funding? Let’s Do the Math

So how much can you save with a group captive by self-funding your benefits? We’re glad you asked. Our data specialists made it easy for you with the Roundstone Cost Calculator. Simply enter the number of employees you want to enroll and your current annual premium, and the app will quickly estimate your savings.

Typically, we find our clients save 20% over traditional insurance. Even if you do have a rough patch occasionally, other years will balance it out to about a 20% year over year average.

Keep in mind these savings will accrue substantially over time. That’s why we’re confident in offering the Roundstone Guarantee. In five years, you’ll save money over a traditional plan, or we’ll make up the difference.

In fact, two-thirds of Roundstone clients save enough in their first four years to entirely pay for their fifth year of claims. And 100% save money, full stop.

Why You Save with Roundstone’s Group Captive

Roundstone is able to deliver these savings because we offer a more cost-effective model, when you compare self-funding against traditional, fully insured health plans. You only pay for the healthcare you use – you get to keep what you don’t spend, what would otherwise be pocketed by the insurance company as profit. You pay for the health insurance you actually deserve to pay.

In Roundstone’s self-funded insurance plans, any unused premium from employers’ pooled captive funds is returned annually to employer clients on a pro-rata basis. Last year, Roundstone paid $8 million in cash in unused claim spend, pro-rata, back to members of its stop-loss captive.

Keep in mind not all captives work like this. Many don’t pay distributions, or credit the unused spend for subsequent years. Roundstone pays its distributions in cash, six to seven months after the policy year concludes.

In a self-funded health insurance plan, roughly 85% of your costs are variable – meaning you have control over those costs and can lower them through data-driven cost savings solutions. You have high control over plan design. But under a fully insured plan, 100% of your costs are fixed – you pay up or else. Sure, it’s predictable with a fixed monthly payment – but you can also predict getting squeezed again next year come renewal season.

Under a self-funded health insurance plan, you also can save substantially on your pharmacy costs, if you use a transparent, pass-through Pharmacy Benefits Manager who passes any potential savings onto you. Under a fully insured plan, any pharmacy savings stay with the carrier. Under a self-funded plan, every dime of savings is returned to you, including the rebates from the drug companies.

What is Data Driven Cost Containment? You’re in Control of Your Savings

Ultimately, how much you save in a self-funded plan is up to you.

That’s the power of your data and analytics. In a self-funded plan, you have access to all the data that drives your plan, so you have insight into what drives claims. If you work with a Third Party Administrator (TPA) that integrates cost savings data, you can utilize this data to design cost-saving solutions and further optimize savings.

You can analyze the data against national benchmarks to identify trends and then adjust your plan to improve savings and care quality.

The beauty is you don’t have to do this work yourself. Roundstone’s team of Cost Savings Investigators (CSI) will analyze your data and make cost savings suggestions to improve plan savings.

Keep in mind these are only suggestions, not mandates, unlike other captives on the market. It’s your plan to design as you wish.

Take Roundstone’s Cost Calculator for a Spin

With the Roundstone Cost Calculator, you get an easy understanding of the potential savings of Roundstone’s group captive model. This is great data you can quickly share with clients, or your CFO or CEO, so you can begin to see what’s possible when you switch to a self-funded plan.

These savings are just the beginning. Roundstone’s approach to self-funding is designed for a long-term strategy. As you learn to use your data to further drive cost optimization, the potential for savings grows with the effort you put in.

Stop being a victim to America’s health insurance crisis. Take the Roundstone Cost Calculator for a spin and see what’s possible. It could be just the beginning of a rewarding cost-saving journey that finally turns the tables in your favor. Your employees deserve great benefits – and you deserve a health insurance solution that’s affordable and sustainable.