- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

How to Lower Prescription Drug Prices: Beyond PBMs to Complete Cost Control

- Roundstone Team

- 8 Minute Read

- Cost Containment

Find this article helpful? Share it with others.

A Strategic Guide for Self-Funded Employers

Most employers assume their pharmacy costs are set in stone, negotiated far upstream by insurers and drug manufacturers. But in reality, there are multiple points of control hidden in your plan design, prescription choices, and employee engagement.

Relying on a Pharmacy Benefit Manager (PBM) is only part of the answer. Employers who self-fund and combine generic-first strategies, smarter plan design, employee education, and clinical programs consistently reduce prescription spend by 25–35%.

The key is building a system where every piece works together—PBMs included—to deliver savings without sacrificing care quality.

Why Prescription Drug Costs Keep Rising (And How to Fight Back)

Prescription drugs in the United States cost nearly three times more than in other developed countries. The pace of increases is staggering: In 2022 (the most recent year for which data is available), manufacturers raised prices on more than 4,200 drugs.

Nearly half of those hikes beat inflation, with an average increase of 46.2%, almost $590 per drug.

In 2025, prices increased on 700 drugs in January alone.

Perhaps most strikingly, the median annual list price of new drugs exceeded $370,000 in 2024.

For employers, that translates into sudden premium spikes that can blow up budgets overnight.

But here’s what most employers don’t realize: You have more control than you think. Self-funded insurance gives you the tools to tackle prescription costs from multiple angles, not just through selection of a pharmacy benefit manager.

The secret is understanding that prescription cost management is a system, not a single strategy. When you combine smart plan design with employee engagement and clinical management, you gain the power to control one of your biggest healthcare cost drivers.

Generic Drug Utilization: Your Biggest Savings Opportunity

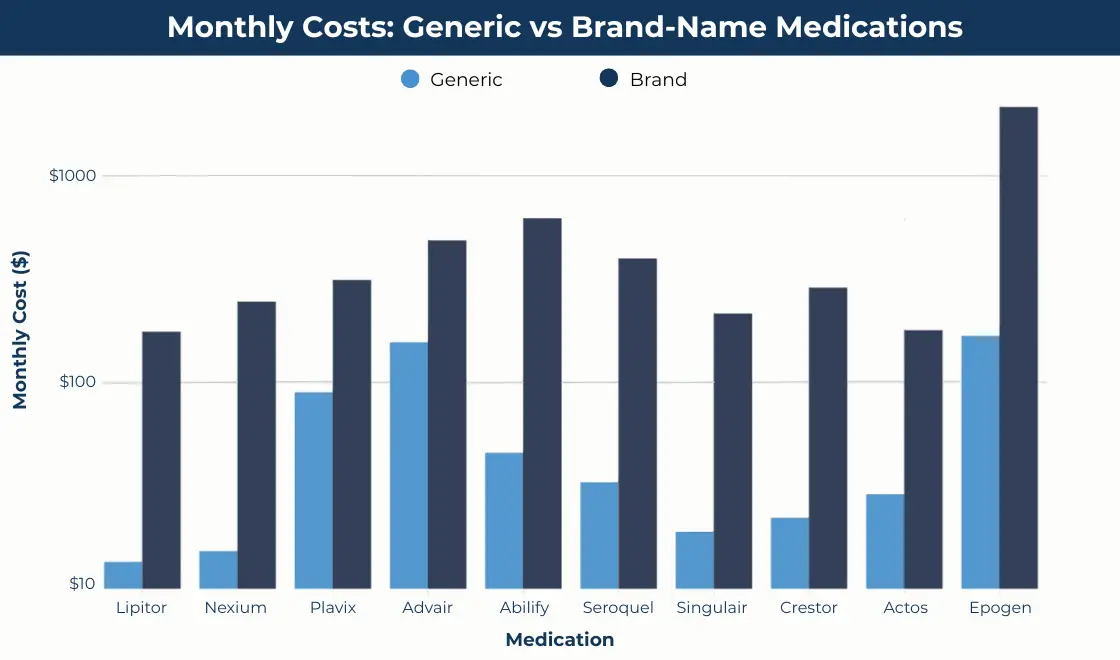

Generic drugs represent the most powerful cost reduction tool in your prescription arsenal, but most employers aren’t maximizing this opportunity.

Generics deliver identical therapeutic benefits at 60-90% lower costs than brand-name alternatives, yet many employers see generic utilization rates stuck at 65-70% when they could easily achieve 85% or higher.

When you multiply the savings across your entire employee population, strategic generic utilization can single-handedly reduce your pharmacy spend by 20-30%.

Methodology*

Building a Generic-First Strategy

Smart employers know that generic adoption requires strategic intervention, not just hope that employees will make cost-effective choices.

Here’s how to build a system that drives results.

Employees don’t automatically switch to generics. Employers who save the most money create plans that make generics the clear, easy choice.

Copay incentives. Set copays at $0–$5 for generics and $30–$50 for brand-name drugs when a generic exists. This approach raises generic use from 65% up to 85% or more.

Automatic substitution. Direct your PBM to default prescriptions to generics unless a doctor requires the brand. This step cuts unnecessary brand costs.

Provider outreach. Educate doctors about therapeutic alternatives and highlight savings of 20–30% when prescribing generics.

Employee campaigns. Share real-world comparisons—atorvastatin at $46 versus Lipitor at $1,217—so employees see the personal savings.

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

Overcoming Generic Barriers

Perception is the biggest obstacle to generic utilization. Employees often associate higher prices with better quality, so they’re reluctant to accept generic alternatives even when copays favor generics.

Combat this through targeted education that emphasizes FDA requirements for generic bioequivalence. Share specific examples of generic savings that demonstrate how choosing generics can save employees hundreds annually while delivering identical therapeutic benefits.

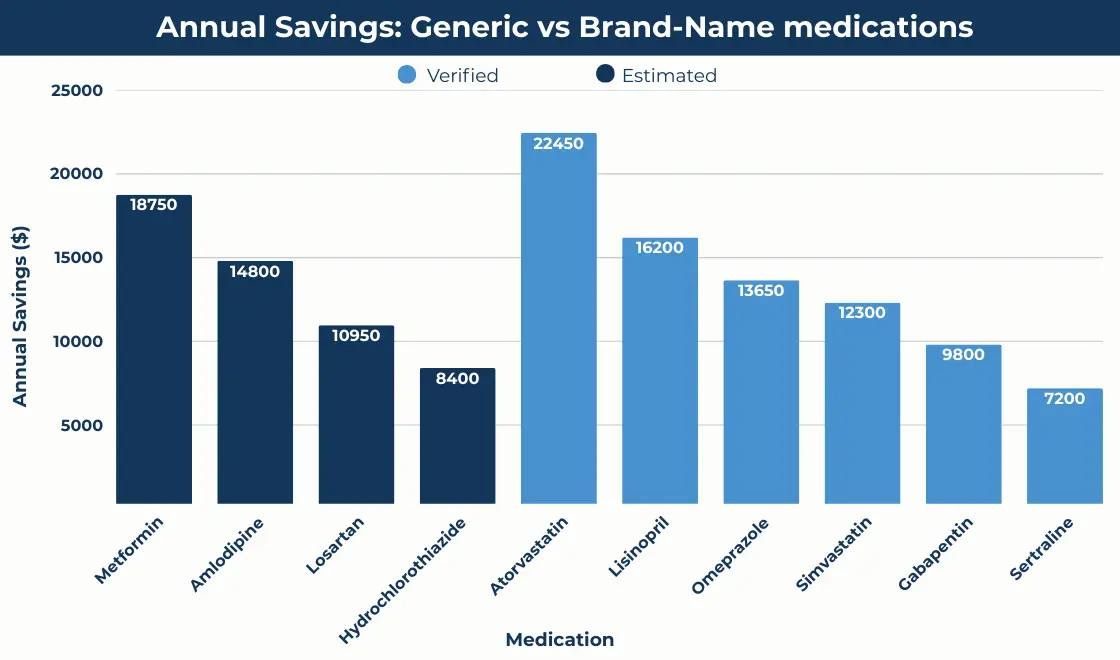

For chronic conditions requiring long-term medication, calculate annual savings to show the real impact. For example, an employee taking generic metformin for diabetes saves $1,800 annually compared to brand-name Glucophage.

That’s money that stays in their pocket while they’re getting identical blood sugar control.

Plan Design Strategies That Drive Down Costs

Your benefit plan design represents a powerful tool for steering employees toward cost-effective prescription choices, but most employers barely scratch the surface of what’s possible.

Think of your plan design as a GPS for prescription decisions. Just as a GPS guides drivers to their destination via the most efficient route, smart plan design guides employees to the medications they need via the most cost-effective path.

Tiered Formulary Systems

A well-designed formulary guides employees toward the most cost-effective options. Multi-tier structures and dynamic updates make price differences clear at the pharmacy counter while still preserving choice and access.

A typical formulary structure might look like this:

Multi-tier copay structures. Create four tiers: $0 for generics, $15 for preferred brands, $40 for non-preferred brands, and $100+ for specialty medications.

Dynamic formulary management. Update regularly for new generics, biosimilars, and therapeutic equivalents.

Therapeutic substitution with clinical review. Steer employees toward effective, lower-cost alternatives while ensuring physician oversight.

Biosimilar adoption. Promote biosimilars as safe, lower-cost alternatives to specialty biologics.

Mail Order and Convenience Programs

Convenience can be a powerful cost-control tool. Mail-order options, 90-day supplies, and retail partnerships reduce per-unit costs and improve adherence by making it easier for employees to stay on track.

Employers can encourage smarter purchasing through:

90-day mail-order supplies. Reduce per-unit costs and improve adherence.

Retail clinic partnerships. Provide affordable access to prescriptions for common conditions.

Direct purchase programs. Leverage low-cost suppliers like Mark Cuban's Cost Plus Drugs.

Preferred pharmacy networks. Lower copays at pharmacies that deliver the best contracted rates.

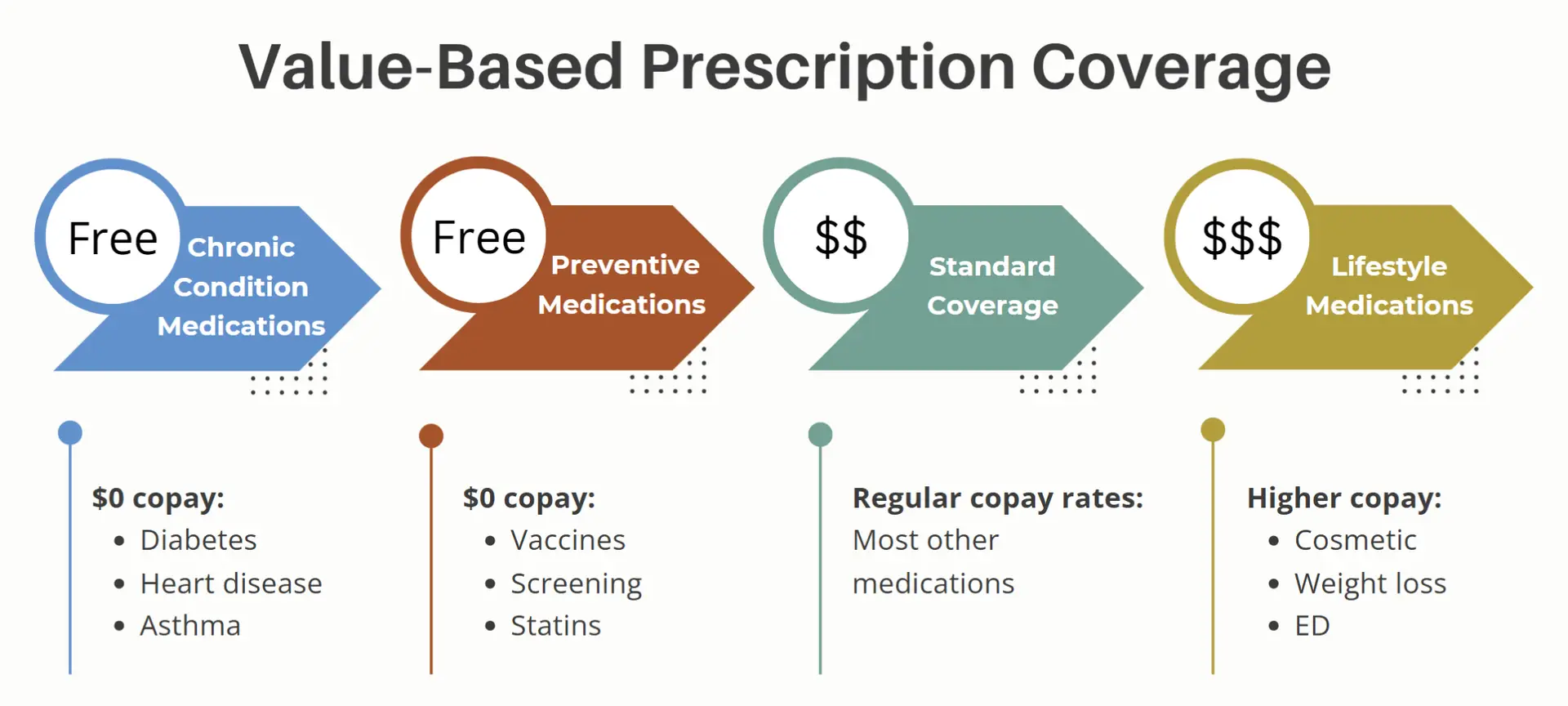

Value-Based Insurance Design

Not all prescriptions deliver equal value. By reducing or eliminating cost-sharing for essential therapies while increasing it for low-value drugs, employers can improve outcomes and lower long-term costs.

Common plan design elements that help accomplish that include:

$0 copays for chronic medications. Cover essential drugs like ACE inhibitors or metformin to prevent costly complications.

Higher copays for lifestyle drugs. Set stronger cost-sharing for medications with limited clinical necessity.

Preventive drug coverage. Include statins and other preventive therapies at no cost to reduce future claims.

Preventive supplies. Extend coverage to items like diabetes testing strips or inhalers when adherence reduces acute costs.

Employee Education and Engagement: The Missing Piece

Most employers focus on plan design and PBM contracts while completely overlooking the human element of prescription cost management. Your employees make the final decisions about which medications to fill, how to fill them, and whether to adhere to therapy.

Without employee engagement, even the most well-designed plan will underperform.

Think about it: You can design perfect incentives, but if employees don’t understand them, those incentives won’t drive behavior change. You can offer generic alternatives, but if employees think generics are inferior, they’ll pay higher copays for brand names.

Employee education is a must for cost management success.

Building Prescription Cost Awareness

Employees make daily decisions that directly impact pharmacy spending, but many don’t realize the difference their choices make. Raising awareness ensures they understand the value of generics, mail order, and pharmacy selection.

Employers can build awareness through:

Year-round communication. Keep cost-saving options top-of-mind, not just during open enrollment.

Real-world savings examples. Share specific comparisons that resonate with employees.

Cost transparency tools. Provide apps or online resources to compare prices before filling prescriptions.

Integrated digital nudges. Use text reminders, app notifications, or portals to reinforce low-cost choices at the point of decision.

Medication Adherence Programs

Poor medication adherence costs the U.S. healthcare system $100-300 billion annually, but it also drives up your prescription costs through treatment failures that require expensive alternatives.

Steps you can take to combat that include:

Proactive monitoring. Identify employees who miss refills and provide outreach to remove barriers.

Simplified regimens. Encourage once-daily prescriptions where possible to improve compliance.

Side effect support. Offer programs that help employees manage side effects and stay on treatment.

Automatic refill services. Use mail-order or digital reminders to reduce gaps in therapy.

Pharmacy Selection Education

Not all pharmacies offer the same prices, even for identical medications. Employee education about pharmacy selection can deliver immediate savings without any plan design changes.

Preferred pharmacy incentives. Lower copays at pharmacies that provide the best rates.

Mail-order education. Explain automatic refills and emergency supply benefits to overcome resistance.

Specialty pharmacy support. Direct employees using specialty drugs into cost-effective networks and assistance programs.

Pharmacy comparison tools. Provide apps or resources to show price differences in real time.

Clinical Management Programs That Control Costs

Clinical management programs represent the intersection of cost control and care quality, ensuring that employees get the right medications at the right time while avoiding unnecessary expenses.

These programs go beyond basic prior authorization to provide comprehensive support that improves both outcomes and cost-effectiveness.

The key insight here is that the most expensive prescription isn’t necessarily the wrong prescription. It’s the prescription that doesn’t work or causes side effects that leads to additional medications or medical interventions.

Clinical management focuses on getting the right medication match from the start.

Prior Authorization and Step Therapy

Employers can use checks and balances to keep expensive medications appropriate:

Condition-specific authorizations. Require approvals for high-cost drugs when clinically necessary.

Step therapy. Ensure lower-cost, proven treatments are tried before escalating to pricier options.

Quantity management. Limit dispensing to clinically justified amounts to prevent waste.

Disease Management Integration

When you combine prescription oversight with disease management, your plan becomes even more effective. Coordinating pharmacy and chronic care programs helps prevent complications, improve outcomes, and keep costs in check.

Employers can strengthen results with:

Chronic condition programs. Integrate oversight for diabetes, hypertension, and similar conditions.

Medication therapy reviews. Have pharmacists identify duplication or drug interactions.

Outcome monitoring. Track clinical progress to ensure savings don’t reduce care quality.

Coordinated coaching. Pair disease management with health coaches to reinforce adherence.

High-Cost Medication Oversight

Some prescriptions cost tens of thousands of dollars a year. Managing these high-dollar drugs requires added layers of review and support to ensure both cost-effectiveness and quality of care.

Employers can apply strategies such as:

Clinical advisory panels. Establish physician review panels for ultra-high-cost medications to ensure appropriate utilization while exploring alternative approaches.

Patient assistance program navigation. Connect employees requiring expensive medications with manufacturer assistance programs, foundation grants, and other resources that can reduce or eliminate costs for both employer and employee.

Alternative therapy evaluation. Work with clinical specialists to evaluate whether newer, expensive medications offer sufficient benefits over older, less expensive alternatives to justify the cost difference.

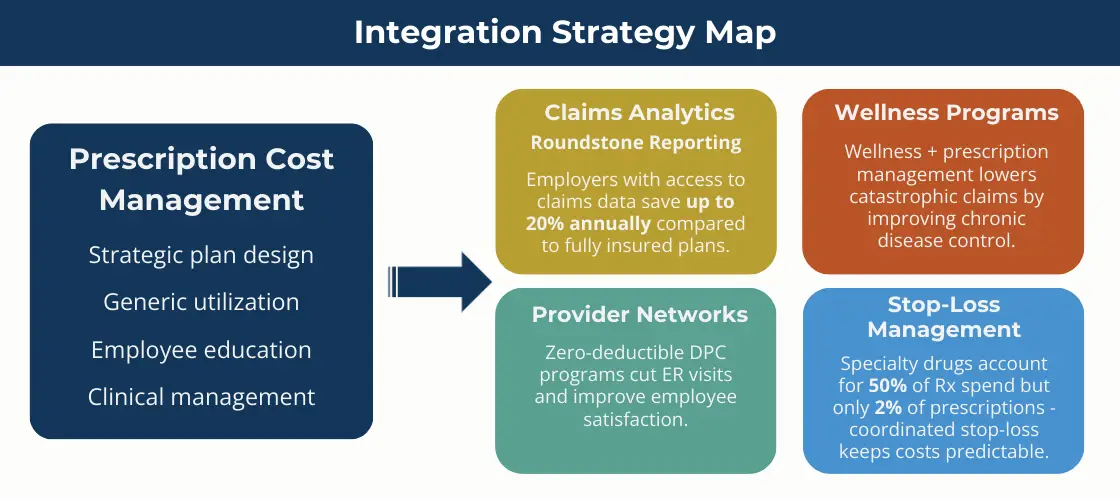

Integration With Your Overall Cost Containment Strategy

Prescription cost management achieves maximum impact when integrated with your broader healthcare cost containment initiatives. Rather than operating as separate programs, your pharmacy strategies should reinforce and amplify your other cost management efforts.

This integration approach recognizes that healthcare costs are interconnected. Poor medication adherence leads to emergency room visits. Inappropriate prescribing drives up both pharmacy and medical costs.

Employees who can’t afford their medications often skip doses, leading to complications that generate expensive medical claims.

Claims Data Integration

Pharmacy cost control is most powerful when it connects to overall claims data. By combining pharmacy and medical insights, employers can spot risks early and prevent cost spikes before they happen.

Effective tactics include:

Predictive analytics. Spot employees at risk for high-cost prescriptions and intervene early.

Total cost of care reviews. Ensure pharmacy savings don’t lead to higher medical spending elsewhere.

Risk stratification. Identify high-risk employees for targeted care management.

Benchmark comparisons. Measure pharmacy utilization against peer employers to identify outliers.

Wellness Program Synergy

Preventive medication coverage. Use your wellness program to identify employees who could benefit from preventive medications that reduce long-term health risks and associated costs.

Lifestyle modification support. For conditions like diabetes and hypertension, combine prescription management with lifestyle programs that can reduce medication requirements over time.

Health coaching integration. Train health coaches to address medication adherence and cost-effective prescription choices as part of their overall health improvement initiatives.

Stop-Loss Insurance Coordination

Specialty drug tracking. Coordinate with your stop-loss carrier to track specialty drug costs and ensure that expensive medications are managed appropriately within your stop-loss structure.

Catastrophic claim prevention. Use clinical management programs to prevent medication-related complications that could trigger catastrophic medical claims.

Claims forecasting. Integrate prescription trend data with medical claims forecasting to improve accuracy of stop-loss coverage selection and premium budgeting.

Measuring Success: Key Metrics and ROI

Effective prescription cost management requires ongoing measurement and optimization based on real-world results. The key is tracking the right metrics that demonstrate both cost savings and care quality improvements.

Most employers make the mistake of focusing only on total pharmacy spend without considering the broader impact of their prescription cost management efforts. The best programs reduce pharmacy costs while improving medication adherence, clinical outcomes, and employee satisfaction.

Clinical cost management ROI*

*Data Sources and Limitations

Financial Performance Indicators

Per employee per year (PEPY) pharmacy costs. Track your pharmacy PEPY compared to benchmarks and your own historical performance. Target reductions of 15-25% through comprehensive cost management programs.

Generic utilization rates. Monitor generic dispensing rates with targets of 85% or higher for categories where generics are available and clinically appropriate.

Specialty drug trend management. Track specialty drug costs as a percentage of total pharmacy spend, with programs aimed at controlling growth rather than total elimination.

Clinical Quality Metrics

Medication adherence rates. Monitor adherence for key chronic disease medications, with programs aimed at achieving 80% adherence rates or higher.

Therapeutic outcomes. Track clinical indicators like blood pressure control, diabetes management, and cholesterol levels to ensure cost containment doesn't compromise care quality.

Adverse event monitoring. Monitor emergency room visits and hospitalizations related to medication issues to ensure that cost management programs aren't creating safety risks.

Employee Satisfaction Measures

Benefits satisfaction surveys. Include prescription benefit questions in your annual benefits surveys to ensure that cost management efforts aren't negatively impacting employee satisfaction.

Pharmacy access metrics. Monitor employee complaints about pharmacy access, medication availability, and prior authorization delays to identify and address program issues.

Cost-sharing burden analysis. Track out-of-pocket prescription costs for employees to ensure that cost management efforts provide benefits to both employer and employees.

Learn how Roundstone achieved eight years without a premium increase.

Your Next Steps to Lower Prescription Drug Prices

Lowering prescription costs requires a systematic approach that goes far beyond choosing the right PBM. The biggest savings come from building comprehensive programs that address every aspect of pharmacy spend.

Employers can follow three practical steps:

Step 1: Assess Your Current Spend

The first step is building a clear picture of where your money is going. A thorough baseline analysis helps you see which areas to target first.

Key actions include:

Review prescription claims. Identify your highest-cost drugs to understand where the most savings potential exists.

Measure generic utilization rates. Compare current usage against benchmarks to see if your plan is underperforming.

Evaluate plan incentives. Determine whether your benefit design steers employees toward affordable prescription options.

Step 2: Focus on High-Impact Opportunities

Once you know your starting point, the next move is to zero in on the strategies that drive the greatest savings.

Here’s how to get results:

Increase generic adoption. Drive utilization to reduce overall prescription costs by 20–30 percent.

Implement smarter plan design. Use tiered formularies and mail-order options to encourage cost-effective choices.

Add employee education. Ensure workers understand savings opportunities and how to access them.

Adopt clinical management programs. Put measures in place to guarantee the appropriate use of high-cost medications.

Step 3: Build a Sustainable Program

The final step is making prescription cost control part of an ongoing process. A program that evolves with market changes and employee needs will deliver lasting results.

An effective process includes:

Ongoing monitoring. Track prescription trends to identify and address changes quickly.

Continuous refinement. Adjust incentives and clinical programs as employee needs and drug markets shift.

Regular use of claims data. Analyze data to guide smarter decisions and strengthen cost control over time.

Why Roundstone

Roundstone helps employers put this roadmap into action. With our group captive model, you gain:

Transparent PBM partnerships. Savings and rebates are returned directly to you, not kept by intermediaries.

Flexible plan design. Your health plan adapts to the needs of your workforce instead of forcing a one-size-fits-all approach.

Actionable claims data. Roundstone Reporting gives you the visibility to make smarter decisions throughout the year.

Return of unused premiums. To date, Roundstone has returned $91.8 million to employers in our captive.

The Roundstone Guarantee. We guarantee that you will save money over five years, or we will make up the difference.

Your employees need affordable access to essential medications. Your business needs predictable, sustainable costs. With Roundstone, you can achieve both, while building a lasting competitive advantage.

Ready to take control of your prescription costs? Contact Roundstone today to find out how easy it is to get started and why employers who self-fund with us consistently outperform the fully insured market.

For advanced strategies on managing high-cost specialty medications, see our Guide to Specialty Prescription Drugs. These prescription cost management approaches integrate with your broader Cost Containment Hub strategies and work alongside Pharmacy Benefit Manager selection for complete pharmacy cost control.

FAQ

Self-funded employers often combine strategic plan design, generic-first copays, mail order incentives, and clinical management programs to reduce prescription drug costs by 20–35%, all while maintaining or improving care quality. This integrated approach ensures each element reinforces the others for maximum savings.

Employers can optimize generic use through measures like $0-5 copays for generics, automatic substitution policies, and targeted provider and employee education. These actions can boost generic utilization from typical 65–70% to 85% or higher, yielding substantial savings.

Even the most thoughtfully designed benefit plan fails without employee understanding. Ongoing communication, tools for cost comparison, and real-world savings examples help employees make cost-effective decisions and support adherence to treatment plans.

Clinical programs—like prior authorization, step therapy, and pharmacist-led reviews—ensure cost-effective medication use and prevent issues like drug interactions or unnecessary therapies. These interventions improve outcomes and avoid costly downstream medical claims.

Access to claims data enables employers to spot high-cost drug trends, measure program ROI, and align prescription strategies within the broader total cost of care framework. It’s the backbone for proactive, targeted cost-control initiatives.

Integrating prescription trend data and specialty drug tracking with stop-loss coverage enhances forecasting and budgeting accuracy. This coordination helps prevent high-cost medication episodes from triggering catastrophic claims and stabilizes premium forecasting.

Some employers are exploring alternative models like 340B hospital pharmacy networks, which offer steep discounts passed directly to plan members. These arrangements can significantly trim drug spending—sometimes by 20–30%—while avoiding typical rebate structures.

Traditional PBMs—like CVS Caremark, Express Scripts, and Optum Rx—are facing regulatory pressure over concerns about transparency and pricing practices. As a result, 34% of employers are considering alternative PBMs, and 40% are exploring outcome- or acquisition-based drug pricing models.

*Methodology

Comprehensive pricing data was verified from multiple sources for 3 of the 10 medications (atorvastatin, metformin, levothyroxine). Pricing for the remaining 7 medications represents estimates based on drug class averages and limited available data, as pharmaceutical pricing information is not consistently published across all medications.

**Data Sources and Limitations

The prescription cost management ROI data presented in this analysis is compiled from multiple sources with varying levels of evidential support, including peer-reviewed studies (such as the Fairview Health Services 10-year MTM study with 9,068 patients and UPMC Health Plan analysis with 10,747 patients), government reports, industry analyses, and health plan case studies.

While some figures represent well-documented outcomes from controlled studies—particularly MTM program results and generic substitution savings—many ROI ratios and cost estimates are derived from industry benchmarks, physician surveys, consulting firm projections, and modeled cost-avoidance calculations rather than randomized controlled trials.

Sample sizes range from 246 to 166,000 participants, methodology varies between actual measured savings and projected benefits, and cost-per-intervention figures often reflect industry estimates rather than comprehensive cost accounting.

This data should be used for directional insights and comparative analysis rather than precise financial projections, and organizations should conduct their own pilot studies and cost-benefit analyses specific to their population and operational context before implementing these programs.

- Association for Accessible Medicines. “Generic Drug Prices vs. Brand Drug Prices.” Accessed September 6, 2025.

- Centers for Disease Control and Prevention. “FastStats – Therapeutic Drug Use.” Last modified March 6, 2025.

- ClinCalc. “The Top 300 of 2023.” Accessed September 6, 2025.

- Congressional Budget Office. “Prescription Drugs: Spending, Use, and Prices.” October 2022.

- GoodRx. “Atorvastatin 2025 Prices, Coupons & Savings Tips.” Last updated February 29, 2024.

- GoodRx. “How Much Does Atorvastatin Cost Without Insurance?” Last updated March 2, 2025.

- GoodRx. “How Much Is Levothyroxine Without Insurance?” Last updated September 2, 2024.

- GoodRx. “How Much Is Metformin Without Insurance?” Last updated April 15, 2024.

- GoodRx. “Metformin 2025 Prices, Coupons & Savings Tips.” Last updated February 29, 2024.

- GoodRx. “Synthroid 2025 Prices, Coupons & Savings Tips.” Last updated February 29, 2024.

- Healthgrades. “The Top 50 Drugs Prescribed in the United States.” September 28, 2022.

- Mark Cuban Cost Plus Drug Company.

- Medical News Today. “Atorvastatin cost 2025: Coupons and more.” Last updated May 20, 2024.

- Medical News Today. “Levothyroxine cost 2025: Coupons and more.” Last updated June 29, 2025.

- Medical News Today. “Lipitor cost 2025.” Last updated September 16, 2024.

- Medical News Today. “Metformin cost 2025: Saving tips and more.” Last updated April 20, 2025.

- National Institutes of Health/National Library of Medicine. “Medication Adherence: The Elephant in the Room.”

- Noom. “Metformin Cost in 2025: With and Without Insurance Coverage.” Last updated March 18, 2025.

- RAND Corporation. “Prescription Drug Prices in the United States Are 2.78 Times Higher Than in Other Developed Countries.” February 1, 2024.

- Reuters. “Many U.S. Employers Plan to Pare Health Benefits as Weight Loss Spending Soars.” July 16, 2025.

- U.S. Department of Health and Human Services, ASPE. “More than 4,200 Drug Products Had Price Increases, With 46% Exceeding Inflation Rates.” 2024.

- U.S. Food and Drug Administration. Office of Generic Drugs. “Generic Competition and Drug Prices; Generic Drug Facts; Generic Drug Information and Pricing Guidelines.”

- Wall Street Journal. “Some Employers Use 340B Hospital Pharmacy Networks for Steep Drug Discounts.” 2025.

ABOUT THE AUTHOR

Roundstone Team

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025