- Employers

- Advisors

ADVISORS

Roundstone recognizes and appreciates the important role benefits advisors play — that’s why we only operate through our network of trusted advisors.

- Resources

THE LATEST AND THE GREATEST

- Blog

BLOG

Stay up-to-date with the latest trends and learn about how small to midsize businesses can enjoy the benefits of self funded health insurance.

LATEST POST

FEATURED FAVORITES

- About Us

ABOUT US

We are a health benefits captive providing self-funded solutions to small and mid-sized employers. Our self-funded medical group captive bands employers together to fund their benefits the way much larger Fortune 500 companies do.

- Our TPA

TOPIC

How Self-Funded health Insurance and Direct Primary Care Reduce Employer Healthcare Costs

- Jamie Debenham

- 5 Minute Read

- Cost Containment

Find this article helpful? Share it with others.

When employees skip care due to high deductibles, employers pay the price—literally. Direct Primary Care, paired with self-funded group captive insurance, offers a smarter way to cut healthcare costs while keeping your workforce healthy and covered.

A familiar scenario unfolds in businesses every day. An employee skips an annual physical because the deductible feels too high. Six months later, a routine checkup that would cost $150 turns into a $40,000 hospital admission. These hidden, preventable costs hit employers hardest.

For years, companies have controlled rising healthcare costs by shifting the financial burden onto employees, higher deductibles, copays, and health savings accounts. But when people can’t afford care, they put it off until they have no choice.

By then, costs explode and employers lose control.

Roundstone sees it differently. Employers who remove barriers to primary and preventive care spend less overall and build healthier, more engaged workforces. Decades of real-world experience and data proves that investing wisely beats shifting costs every time.

Direct Primary Care FAQs

Direct Primary Care or DPC is a healthcare model where patients pay a flat monthly fee to their primary care physician rather than relying on traditional insurance billing for primary care.

Monthly membership fees for Direct Primary Care are typically $50 – $150. This covers a range of primary care services.

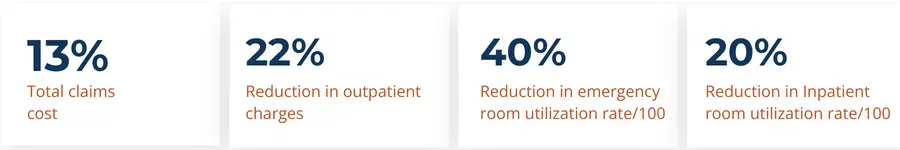

Yes, DPC allows for incrreased access to a primary care physician and sees decreased patient costs including:

- 22% reduction in outpatient charges

- 40% reduction in Emergency Room utilization

- 20% reduction in hospital utilization

Join Our Newsletter

Sign up for fresh insights straight to your inbox.

The High Cost of Avoided Care

High-deductible plans entered the market as a tool for healthcare cost containment. The idea seemed logical: Give people more financial responsibility and they’ll compare prices and avoid waste. But the reality for employees has played out very differently.

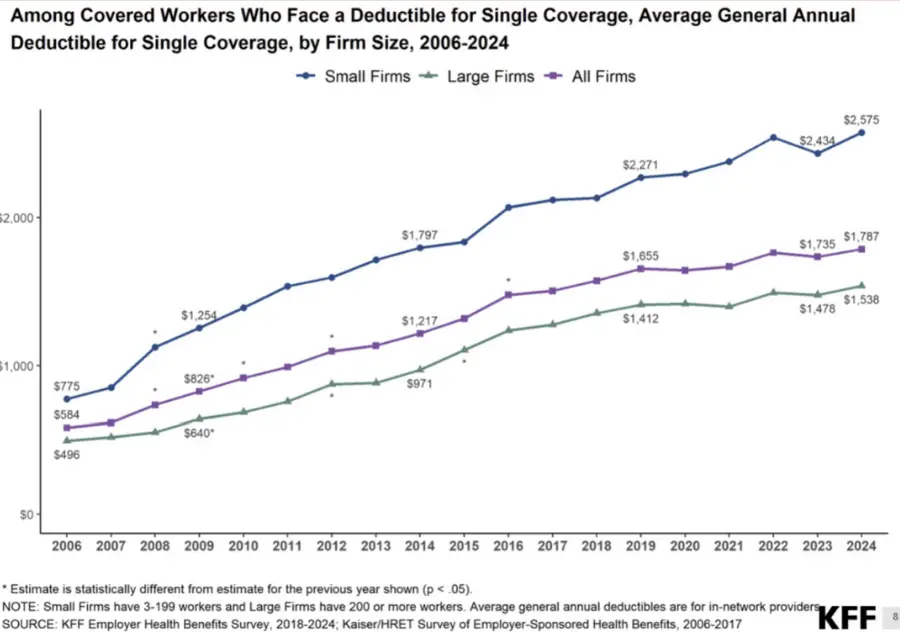

According to the Kaiser Family Foundation, the average annual deductible for single coverage now exceeds $1,700, and it’s even higher for families. Many households lack the cash to cover routine medical expenses upfront. Health savings accounts often sit underfunded or unused. So employees skip screenings, delay checkups, and hope nothing goes wrong.

Small issues escalate when people avoid early care. Chronic conditions go unmanaged. Minor infections turn into inpatient stays. National data shows how often people who skip primary care end up with more severe, more expensive conditions.

Accessible primary care can flip this pattern. Increasing primary care spending by 10% can lower catastrophic care costs by up to 30%. It’s practical math, not theory.

Delayed Care Creates Costly Claims

Every employer that uses self-funded health insurance sees the impact firsthand. A condition missed during a simple checkup can grow into a claim that drains plan reserves. Employers locked into fully insured plans feel it too, through ever-higher renewals they can’t control.

Barriers to care never save money. They push costs into the future, guaranteeing that when problems surface, they’re more costly to fix.

Direct Primary Care: A Smarter Way to Spend

Direct Primary Care (DPC) helps employers tackle this challenge head-on. The model is clear: For a predictable monthly fee, employees gain unlimited access to a trusted primary care provider. They don’t pay per visit, face surprise bills, or worry about deductibles.

A DPC plan removes the fear of seeing a doctor. Employees book same-day or next-day appointments, speak with their provider by phone, video, or text, and handle preventive screenings and chronic care without hesitation. Employers see fewer urgent care trips, lower emergency room use, and fewer inpatient stays.

Hint Connect, a national DPC network that Roundstone works with, calls it “primary care reimagined.” DPC clinicians handle routine care, guide employees through referrals, and help them find transparent rates for labs or imaging. They focus on prevention and personalized care that keeps small issues from turning costly.

Real-World Cost Reductions

One national real estate firm combined DPC with its traditional Gold PPO plan. Supported by trusted advisors and the Hint Connect network, the company expanded DPC to 24 states. The results speak volumes.

Employees who used DPC cut total claims costs by over 50% compared to non-DPC peers. The company saved more than $360,000 in just one year. The DPC group reduced outpatient charges by 22%, inpatient use by 40%, and emergency room visits by 20%.

Based on the statistical evaluation of differences in risk-adjusted health care claim costs and utilization for over 2,000 employees

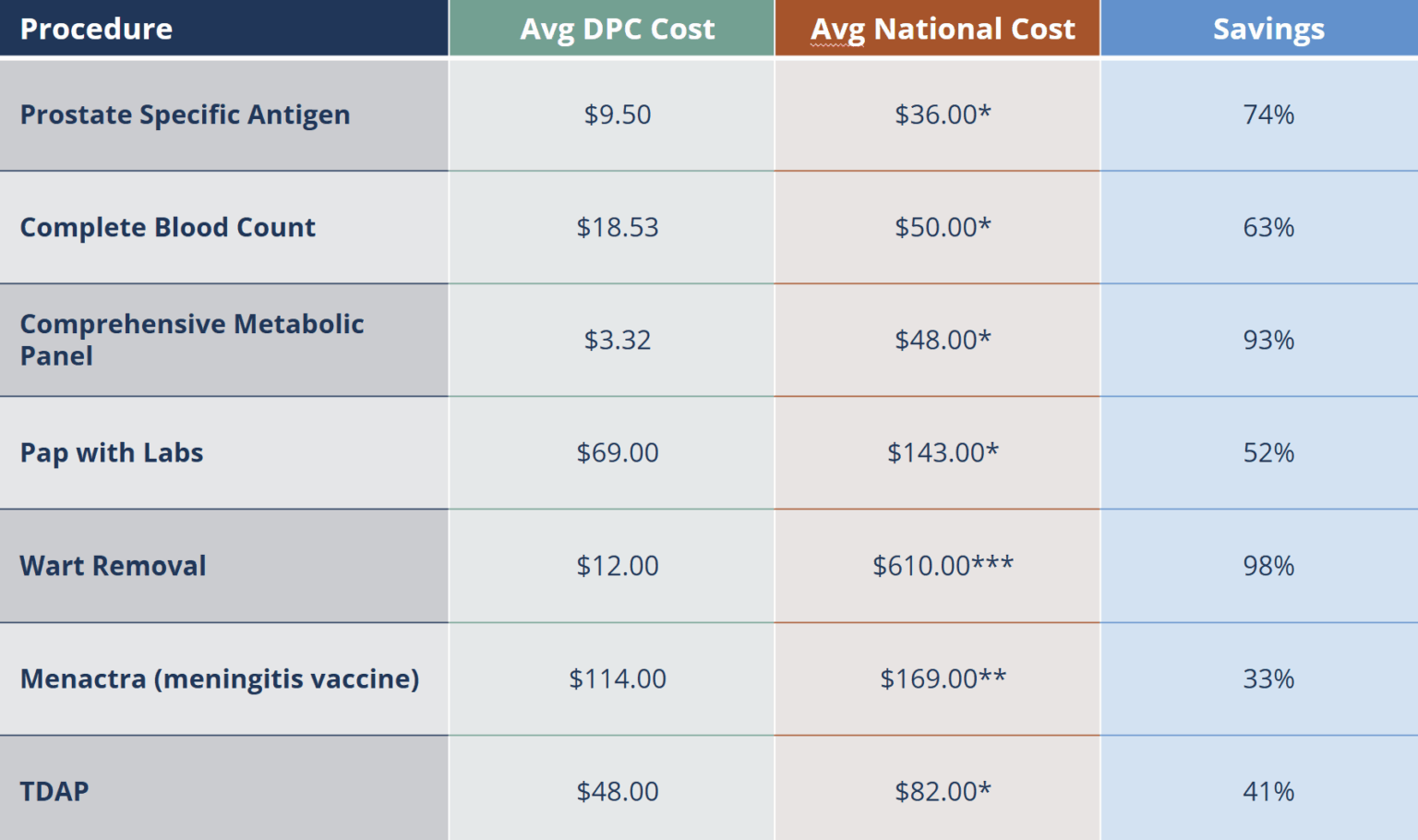

Routine services cost less under DPC, too. For example, wart removal averaged $12 through the DPC network, compared to more than $600 through standard insurance. Routine lab work costs a fraction of what big carriers typically pay.

For companies that want each dollar to stretch further, this level of control makes a clear difference.

Group Captive Insurance Keeps Control with Employers

Adding DPC to a well-managed self-funded health insurance plan delivers real results. Pairing it with group captive insurance multiplies the impact. In a traditional fully insured plan, carriers set rates, keep underwriting profits, and raise premiums without clear justification. Employers see little transparency and lose control over how to contain costs.

Roundstone’s group captive insurance model changes this dynamic. Employers join forces with like-minded businesses, share large claims risk, and keep ownership of plan design.

Transparent claims data shows exactly where money goes and where improvements make sense. When claims come in under expectations, employers keep the savings. Roundstone’s captive members have collected more than $91.8 million in returned unused premiums.

Combining a captive with Direct Primary Care removes barriers to early care while containing large claims risk with a stop-loss captive strategy. Savings don’t disappear into a carrier’s profit margin—they stay with the company and its employees.

Totem Solutions: A Real Example of Smart Design

Roundstone member Totem Solutions put this combined strategy to work. Totem moved from a traditional PEO plan to a self-funded captive through Roundstone. They redesigned their plan, removed deductibles, and added Direct Primary Care access for every employee.

The plan’s performance improved immediately. Employees had no financial reason to avoid routine care, so preventive visits increased and costly claims dropped. Totem’s plan delivered a 12% refund of unused premium in the first year alone. The company reinvested those savings where they mattered most.

Totem’s commitment to a smarter self-funded health insurance strategy earned it a spot on Inc. Magazine’s Best Workplaces list.

A Better Approach for Advisors

Benefits advisors also see advantages. Guiding clients toward a captive plus Direct Primary Care solution means offering more than another renewal. Advisors who move beyond quoting fully insured plans deliver a proactive cost containment model that reduces total spend, protects budgets, and improves the employee experience.

When advisors lead with real savings, they strengthen client relationships and stand out from the competition. They build trust that lasts year after year.

Steps Employers Can Take Now

Employers ready to regain control over healthcare costs should start by looking at the numbers. Review claims data. How many high-dollar claims could earlier primary care have prevented? Which conditions drive the biggest costs?

Next, examine your plan design. Are deductibles and copays so high that they push people away from care? Does the plan make it easy to see a trusted doctor before problems escalate?

Connect with an experienced captive partner. Roundstone’s Regional Practice Leaders and Partner Solutions team help employers compare plan designs, implement Direct Primary Care, and build a self-funded health insurance strategy that keeps savings in the business instead of the carrier’s pocket.

A Smarter Path Forward

Simply shifting costs to employees no longer works. Companies that want true cost control remove barriers, protect access to care, and share risk through group captive insurance. Direct Primary Care strengthens the plan, keeps people healthier, and prevents small claims from becoming big ones.

Roundstone’s approach pairs self-funded health insurance with proven cost containment tools that deliver measurable savings and healthier outcomes. This strategy puts employers in control—and keeps employees covered when they need care the most.

Contact Roundstone today to see how smarter plan design, group captive insurance, and Direct Primary Care can reduce your risk, protect your people, and return savings to your business.

ABOUT THE AUTHOR

Jamie Debenham

Enjoy Reading?

Check out these similar posts.

Roundstone Insurance © 2025