Highlights

- PEPY refers to your per-employee-per-year cost, an important employee health benefits plan metric.

- Your PEPY presents the cost per employee of your health benefits plan.

- Reducing your PEPY with cost-containment strategies lowers overall health insurance costs and saves you money.

- With a group medical captive plan from Roundstone, you have transparent access to your claims data, which allows you to analyze your PEPY and make changes to your benefits plan.

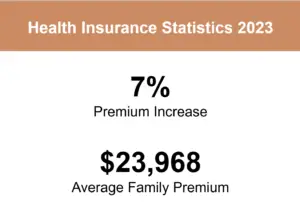

If you’re struggling with rising health insurance premiums in your employee benefits plan and looking for a way to save on your healthcare costs, you’re not alone. In 2023, the average family premium rose 7% in 2023, reaching a staggering $23,968, leaving many small to midsize business owners searching for solutions. If you’re feeling the pinch, it’s time to consider a new approach.

If you’re struggling with rising health insurance premiums in your employee benefits plan and looking for a way to save on your healthcare costs, you’re not alone. In 2023, the average family premium rose 7% in 2023, reaching a staggering $23,968, leaving many small to midsize business owners searching for solutions. If you’re feeling the pinch, it’s time to consider a new approach.

Understanding and optimizing your per-employee-per-year (PEPY) cost can be a game-changer to lowering the cost of your company’s health benefits. Using PEPY as a benchmark and implementing cost-containment strategies through Roundstone’s group medical captive plan will allow you to take control of your healthcare expenses and start saving money.

What Is PEPY and Why Is It Important to Company Health Plans?

Per-employee-per-year is a metric that represents the total annual cost of health insurance for each employee covered under your healthcare plan within your company. This includes premiums, administrative fees, and other related expenses.

PEPY helps you track spending trends over time and compare these figures to claims data and industry benchmarks. Use PEPY to uncover specific patterns and areas of potential overspending on health insurance costs.

For example, you might find that your company’s prescription drug costs are consistently higher than the industry average, indicating a need to review your pharmacy benefits plan to lower the cost of your company’s health benefits.

Understanding PEPY and Its Impact on Your Business

PEPY directly impacts the cost of providing healthcare benefits to your employees. High PEPY expenses can strain your business finances, making it challenging to stay competitive. Lowering your PEPY can lower the cost of your employee health plan and boost your bottom line, helping your business to thrive.

Understanding PEPY is crucial because of the 80/20 rule of healthcare, which states that roughly 80% of healthcare expenses are incurred by only 20% of the members. A Medical Expenditure Panel survey reported that the top 1% of people account for 21% of healthcare expenditures in the U.S., while the bottom 50% accrued just 3% of the total healthcare expenses.

Knowing your company’s PEPY helps you determine your per-employee spend each year and identify trends like the 80/20 rule among your members. With this insight, you can work with your advisor to implement cost containment strategies in your company health plan as part of a self-funded insurance solution to ensure a more efficient and sustainable approach to reducing employee healthcare costs.

How to Calculate Your PEPY and Compare It to Industry Benchmarks

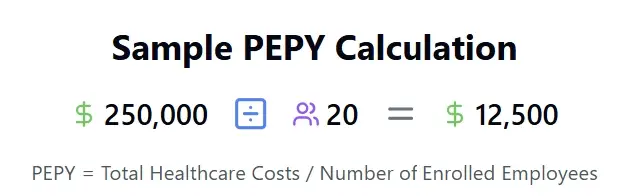

To calculate your PEPY, divide your health insurance expenses for one year by your total number of covered employees. For example, if your employee benefits plan healthcare costs were $250,000 last year and you had 20 enrolled employees, your PEPY is $12,500.

You can then compare this cost to national industry benchmarks to discover if you are paying at or below average in your company’s health benefits. You can also use this number to set a PEPY goal and implement strategies to lower costs. Comparing this number to your claim experience will also let you know whether you are overpaying for employee health insurance.

Strategies to Reduce PEPY With Roundstone Group Captive Insurance

Gaining control over PEPY is essential to remain competitive by lowering your health insurance expenses. Roundstone’s transparent approach to claims data gives you access to every aspect of your self-funded plan’s costs through our CSI Dashboard. This data can be proactively used to drive down the cost of your employee health benefits.

The CSI Dashboard allows you to analyze your claims data throughout the year to calculate your total expenses and identify your company’s trends against national benchmarks. Armed with actionable insights from your claims data, you can begin investigating and implementing possible cost-containment strategies like the following:

Prescription Services

Monitoring your plan’s pharmaceutical spending can significantly reduce your PEPY. Brand-name prescription drug costs accounted for up to 72% of drug spending in 2021, so reducing this expense impacts your overall insurance costs.

When you switch to group captive insurance as part of a self-funded arrangement, you can change to a transparent or pass-through Pharmacy Benefits Manager (PBM). PBMs are responsible for negotiating prescription drug prices for your company’s health plan.

Traditional PBMs work for fully insured insurance carriers, who typically keep the savings they negotiate for themselves. With a pass-through or transparent PBM, those savings will go directly to you. The services of your PBM will be based on a predictable fee structure.

Inpatient Services, Outpatient Services, and Office Visits

With a fully insured plan, your employees must use whatever network providers and vendors the plan approves. With a group captive plan, you can contain costs by using high-quality, low-cost services at Centers of Excellence or implementing a direct primary care program.

These interventions keep costs down and improve the health of your employees by making visits more accessible and treatment more effective.

Employee Well-Being Programs

Building an employee wellness program into your group captive plan lowers your PEPY by improving the health of every employee on your team. Well-being programs encourage employees to be proactive about maintaining their health, which can significantly lower the costs of your company’s health plan over time.

They also provide educational resources regarding conditions like diabetes, nutrition, weight management, and other issues that can affect your employees’ overall health and your bottom line.

Health Management Programs

Health management programs provide specific education and resources for employees with chronic conditions like diabetes or dialysis. Giving your workers access to this program, along with specialized vendors or health services, gets them better care and helps them manage their conditions, significantly improving overall employee health. Health management programs cut down on costly emergency department visits and other medical expenses, proactively lowering the cost of your employee health benefits.

Medical Plan Benchmarks: Is Your Current Employee Healthcare Plan Competitively Priced?

When compared to the national averages for employer-covered healthcare plans, how does your current plan stack up? If you’re at or above the national benchmark, your plan is not competitively priced and will likely cost you thousands of extra dollars annually.

If your PEPY is at or above the national benchmark, it may be time to consider switching to group medical captive insurance that allows you to implement cost-containment strategies,reduce your PEPY, and drive down the cost of your employee health plan.

Without insight into your claims data, knowing where that extra money is going is impossible. With a self-funded group captive plan from Roundstone, you can access your claims data and measure your plan against national benchmarks. This enables you to make changes to your plan and start saving.

Want to know more? For answers to the questions we hear most often about PEPY, please see our FAQ below.

Reduce Your PEPY and Save Thousands on Your Employee Health Benefits

Ready to lower your health insurance expenses and improve your employee benefits plan? Contact Roundstone today to learn how our self-funded group captive insurance can help you achieve your financial goals.

Roundstone is an innovative employee health benefits company. We help small and midsize businesses offer competitive benefits at a lower cost by self-funding health insurance through our group medical captive. The Roundstone Captive enables companies to self-insure safely by pooling hundreds of employers together to share risk and save money.

With easy onboarding and personalized support every step of the way, the Captive offers control, flexibility, and transparency and returns all savings back to employers where they belong. We believe in always aligning with the employers’ best interests and remain committed to our mission — quality, affordable healthcare and a better life for all.

Reach out to our team of experts and start saving.

PEPY FAQs

Q: What are the benefits of using PEPY as a benchmark?

A: Using PEPY as a benchmark lets businesses accurately track and control their health insurance costs. It helps you identify trends in healthcare spending, compare your expenses to industry standards, and learn where you might be overspending. By focusing on PEPY, you can develop targeted strategies to reduce costs, improve your employee benefits plan, and save money in the long run.

Q: How does Roundstone’s group captive insurance help lower PEPY?

A: Roundstone’s group captive insurance helps lower PEPY by giving you transparent access to claims data through the CSI Dashboard. This real-time access allows you to analyze all aspects of your health insurance costs and spot opportunities for savings. Plus, Roundstone’s Cost Savings Investigators offer support to help you implement effective, tailored cost-containment strategies, which can lead to lower health insurance expenses.

Q: What cost-containment strategies can be implemented to reduce PEPY?

A: To reduce PEPY, you can do the following:

- Partner with a transparent PBM. These PBMs pass savings from negotiated drug prices that benefit your business directly. This helps you spend less on prescription drugs, especially for high-cost medications.

- Choose high-quality, cost-effective healthcare providers. Work with Centers of Excellence or direct primary care programs that provide low-cost, high-level care.

- Launch employee well-being programs. Promote well-being programs to encourage proactive health management to lower long-term healthcare costs.

- Introduce health management programs. These teams educate and provide resources for managing chronic conditions effectively, reducing emergency visits and costly treatments.

Q: How can I determine if my current health insurance plan is overpriced?

A: To see if your health insurance plan is overpriced, compare your PEPY cost to national benchmarks. Use detailed claims data for an accurate analysis. Roundstone’s CSI Dashboard can help you review your expenses and identify areas of overspending. This information lets you decide if your current plan is cost-effective or if switching to a different insurance solution would benefit your business.

Q: What are the potential cost savings of switching to a self-funded group captive insurance plan?

A: A self-funded group captive insurance plan can save money by giving you more control over your health insurance expenses. You can implement cost-savings strategies, like using a transparent or pass-through PBM and choosing high-quality, low-cost healthcare providers, to reduce your PEPY costs.

Q: How does Roundstone’s group captive insurance improve employee health and reduce costs?

A: Roundstone’s group captive insurance improves employee health by providing access to high-quality care and preventative health programs. Initiatives like employee well-being and health management programs offer better care and education. Programs like these help manage chronic conditions and reduce costly emergency visits to lower your PEPY.

Q: What level of transparency and control will I have over my health insurance expenses with Roundstone?

A: With Roundstone’s self-funded group captive insurance, you get full transparency and control over your health insurance expenses. The CSI Dashboard offers detailed insights into your claims data, helping you monitor costs, spot trends, and implement effective cost containment strategies. This transparency lets you make data-driven decisions to optimize your employee benefits plan and reduce expenses.