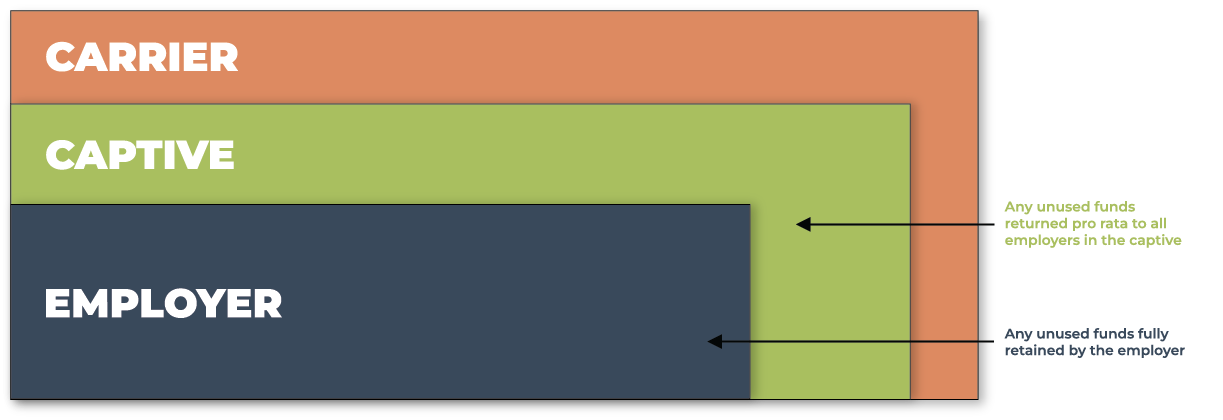

CARRIER

Shift Healthcare Costs to a Stop-Loss Carrier

The employer purchases stop-loss reinsurance to cover large claims above $500,000.

CAPTIVE

Share Healthcare Costs with Other Employers

The employer shares a portion of total costs with a pool of hundreds of other employers in the Roundstone Captive.

EMPLOYER

Pay Healthcare Costs

The employer pays for employees’ and families’ care up to a custom deductible.

CARRIER

Shift Healthcare Costs to a Stop-Loss Carrier

The employer purchases stop-loss reinsurance to cover large claims above $500,000.

CAPTIVE

Share Healthcare Costs with Other Employers

The employer shares a portion of total costs with a pool of hundreds of other employers in the Roundstone Captive.

EMPLOYER

Pay Healthcare Costs

The employer pays for employees’ and families’ care up to a custom deductible.