Learn how group captive health insurance plans can help participating mid-market companies save enough for an entire year of coverage within their first four years.

Employer health plan costs are continuing to rise, easily outpacing inflation and challenging businesses’ bottom lines. Mid-market companies can feel powerless when tasked with fighting spiraling healthcare costs, but a solution may be as simple as rethinking how you insure employees.

A group captive health insurance plan is a pool formed by companies joining together to reduce the cost of their medical benefit spend. This type of self-funded health plan helps control costs because it gives employers more control and returns unused premiums to the companies that use them.

In fact, most participating companies save enough, on average, in the first four years of a captive plan to fully pay for their fifth year of coverage.

How Group Captive Health Insurance Works

Group captive health insurance allows companies to set up what are effectively in-house insurance companies. If that sounds like it requires a lot of expertise, relax. Working with an experienced partner ensures that the licensed insurance company not only adheres to all applicable laws and regulations but also truly works for you and your employees. This can benefit companies in almost any industry and is especially compelling for small- to mid-sized companies, which can benefit from risk sharing and the other tailored offerings of captive plans.

A provider like Roundstone can work with you and your advisor to set goals and identify risks. Then we’ll develop, implement and operate a captive insurance plan. We offer turnkey management and have the talent and experience to build a custom healthcare solution that perfectly matches your needs.

Here are some of the reasons why a group captive health insurance plan works like your current plan, only better:

- – Risk taking: Each employer participating in a captive plan will self-insure at least $30,000 of claims per member, per policy period.

- – Risk sharing: For claims between $30,000 and $500,000, employers pool stop-loss premiums and claims.

- – Risk shifting: For claims above $500,000 and 125% of expected, reinsurance is purchased by the employer, and is paid for as part of their premium.

How Group Captive Health Insurance Plans Allocate Risk and Keep More Money in the Hands of Employers and Employees

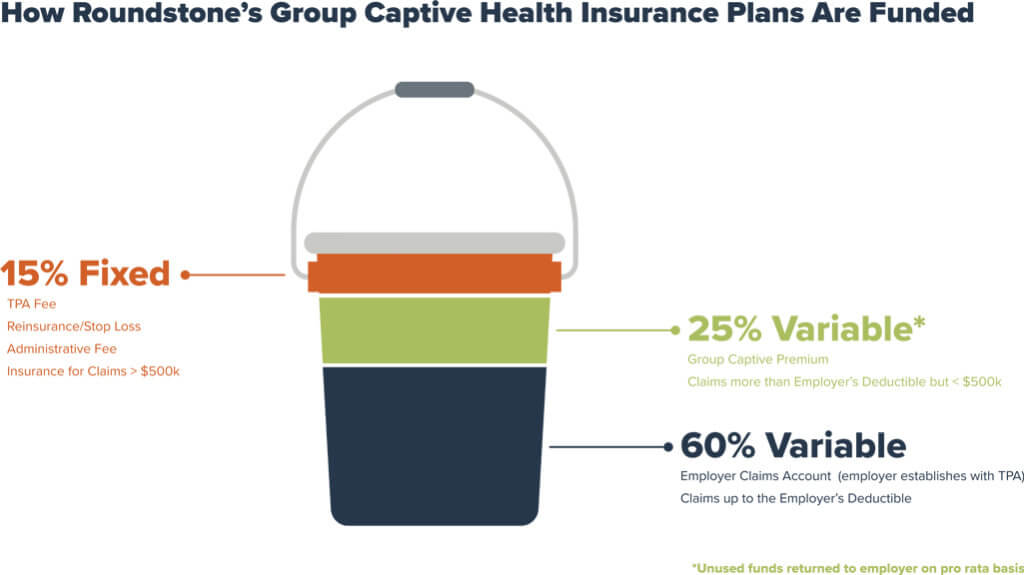

Each captive plan’s “secret sauce” is its ability to convert the majority—typically at least two-thirds—of traditional fixed costs (i.e., stop-loss premiums) to a variable cost.

And with a high variable spend, more money stays with the employer and reduces year-over-year claim volatility.

With traditional insurance, employers pay a fixed premium and the insurance company assumes the risk of paying employee medical claims. With group captive health insurance, employers assume a portion of a claim’s cost by paying for a share of each claim as it’s incurred. This allows employers to improve cash flow, which ultimately results in reduced insurance costs for employees.

Small- to mid-sized firms are increasingly turning to captive plans due to the skyrocketing costs of conventional plans. Group captive health insurance plans outperform traditional fully insured plans over the long term by allowing the employer to retain funds year-over-year instead of forfeiting them over to an insurance company. If your claims are lower than expected, up to 85% of the benefit cost savings is subject to return, allowing your company to pocket the savings.

While reducing health benefit costs is the main reason companies turn to group captive plans, they are delighted to find many additional perks, such as:

- – Transparency: Group captive plans allow you to see exactly what is driving healthcare costs because you have full access to data and reporting. You can make choices in the best interest of your company and employees.

- – Control: Once you know where the money is going, you can address expenses and boost employee wellness. You can also choose the networks, pharmacy options, wellness incentives, claims management and other factors that go into the costs and benefits of a plan.

- – Simplicity: Working with the right partner takes the worry out of medical insurance and lets you focus on growing your business.

Take Control Today

Self-funding doesn’t mean you’re alone. An experienced insurance partner can efficiently deliver your captive health insurance solution. Work with an insurance professional with deep captive plan experience to ensure your plan delivers optimal benefits and savings. An effective captive health plan will be tailored to your needs and will help your company’s bottom line—all while making employees healthier and happier.

Contact us to learn more about captive plans and how they can help you save on employer health plan costs.