Is Self-Funded Health Insurance Right for You?

The growth of self funded health insurance and stop-loss captive programs has been significant over the past several years providing the perfect example of self-insurance and captive insurance working together for the benefit of smaller and mid-sized employers.

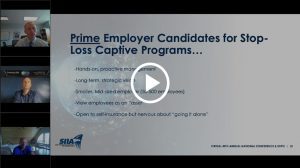

Our founder and president, Mike Schroeder, spoke at the Self-Insurance Institute of America’s recent virtual 40th annual expo on understanding stop-loss captives in a self funded health insurance strategy. His session provides a detailed overview of how these programs are structured, the pros and cons, and which types of employers are the best fit to participate.

What is the key difference between a “standard” market insurance program and a captive insurance program for self funded health insurance? In the standard market, all risk is assumed by and all profits are retained by the insurance carrier. A captive program allows the captive participant to share in the risk for a potential reward of underwriting profits and investment income.

The evolving healthcare industry has brought opportunities for benefit plan stakeholders to come together and develop plans for self funded health insurance that not only address cost containment, but also enhance their employee value proposition through more robust benefit offerings.

Direct provider network solutions, alternative funding strategies and Centers of Excellence are just some of the innovative concepts that are available to employers today. Roundstone recognizes that companies, and their advisors, need a trusted partner to offer solutions best able to help solve specific challenges, and that’s exactly what we do.

Watch the video now to learn more about medical captives and the advantages of self funded health insurance.

Learn 5 Ways to Save

For more information, download this paper on 5 ways to save on health benefits for self funded health insurance without compromising on the quality of care for your employees – critical in today’s competitive job market.